Duke Energy 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Energy were to decide to repatriate foreign generated and held cash,

recognition of material U.S. federal income tax liabilities could be

required.

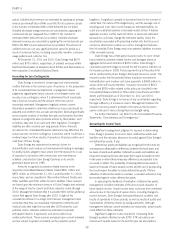

Cash Flow Information

The following table summarizes Duke Energy’s cash flows for

the three most recently completed fiscal years:

Years Ended December 31,

(in millions) 2011 2010 2009

Cash flows provided by (used in):

Operating activities $3,672 $ 4,511 $ 3,463

Investing activities (4,434) (4,423) (4,492)

Financing activities 1,202 40 1,585

Net increase in cash and cash

equivalents 440 128 556

Cash and cash equivalents at

beginning of period 1,670 1,542 986

Cash and cash equivalents at end of

year $2,110 $ 1,670 $ 1,542

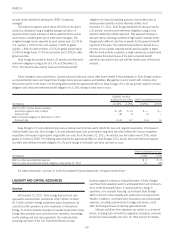

Operating Cash Flows.

The following table summarizes key components of Duke

Energy’s operating cash flows for the three most recently completed

fiscal years:

Years Ended December 31,

(in millions) 2011 2010 2009

Net income $1,714 $1,323 $1,085

Non-cash adjustments to net income 2,628 2,972 3,041

Contributions to qualified pension plans (200) (400) (800)

Working capital (470) 616 137

Net cash provided by operating

activities $3,672 $4,511 $3,463

The decrease in cash provided by operating activities in 2011

as compared to 2010 was driven primarily by:

• Changes in traditional working capital amounts principally due

to a increase in coal inventory, resulting mainly from milder

weather and changes in the timing of payment of accounts

payable and accrued liabilities, partially offset by;

• A $200 million decrease in contributions to company

sponsored pension plans due to prior year pre-funding of

contributions resulting from favorable borrowing conditions.

The increase in cash provided by operating activities in 2010 as

compared to 2009 was driven primarily by:

• An increase in net income adjusted for non-cash and

non-operating items in 2010 as compared to 2009,

• A $400 million decrease in contributions to company

sponsored pension plans due to higher prior year contributions

due to unfavorable equity market conditions, and

• Changes in traditional working capital amounts principally due

to a decrease in coal inventory mainly due to extreme weather

conditions, partially offset by a net decrease in cash from taxes

of $480 million.

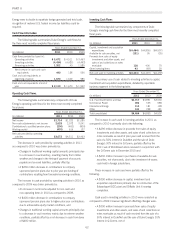

Investing Cash Flows

The following table summarizes key components of Duke

Energy’s investing cash flows for the three most recently completed

fiscal years:

Years Ended December 31,

(in millions) 2011 2010 2009

Capital, investment and acquisition

expenditures $(4,464) $(4,855) $(4,557)

Available for sale securities, net (131) 95 (25)

Proceeds from sales of equity

investments and other assets, and

sales of and collections on notes

receivable 118 406 70

Other investing items 43 (69) 20

Net cash used in investing activities $(4,434) $(4,423) $(4,492)

The primary use of cash related to investing activities is capital,

investment and acquisition expenditures, detailed by reportable

business segment in the following table.

Years Ended December 31,

(in millions) 2011 2010 2009

U.S. Franchised Electric and Gas $3,717 $3,891 $3,560

Commercial Power 492 525 688

International Energy 114 181 128

Other 141 258 181

Total consolidated $4,464 $4,855 $4,557

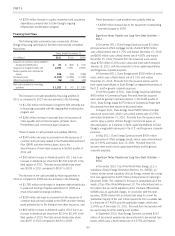

The increase in cash used in investing activities in 2011 as

compared to 2010 is primarily due to the following:

• A $290 million decrease in proceeds from sales of equity

investments and other assets, and sales of and collections on

notes receivable as result of prior year cash received from the

sale of a 50% interest in DukeNet and the sale of Duke

Energy’s 30% interest in Q-Comm, partially offset by the

2011 sale of Windstream stock received in conjunction with

the Q-Comm sale in December 2010 and

• A $230 million increase in purchases of available-for-sale

securities, net of proceeds, due to the investment of excess

cash held in foreign jurisdictions.

These increases in cash used were partially offset by the

following:

• A $390 million decrease in capital, investment and

acquisition expenditures primarily due to construction of the

Edwardsport IGCC plant and Cliffside Unit 6 nearing

completion.

Cash used in investing activities in 2010 were consistent as

compared to 2009. However significant offsetting changes were:

• A $300 million increase in proceeds from sales of equity

investments and other assets, and sales of and collections on

notes receivable as result of cash received from the sale of a

50% interest in DukeNet and the sale of Duke Energy’s 30%

interest in Q-Comm, net of

62