Duke Energy 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

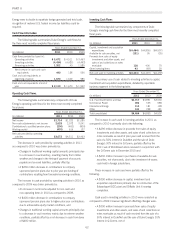

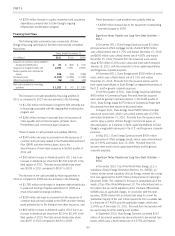

Duke Energy’s projected capital and investment expenditures for

the next three fiscal years are included in the table below.

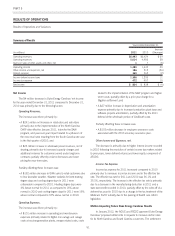

(in millions) 2012 2013 2014

U.S. Franchised Electric and Gas $3,400 $3,200 $3,525

Commercial Power, International

Energy and Other 900 350 325

Total committed expenditures 4,300 3,550 3,850

Discretionary expenditures 200 400 650

Total projected capital and investment

expenditures $4,500 $3,950 $4,500

Duke Energy continues to focus on reducing risk and positioning

its business for future success and will invest principally in its

strongest business sectors. Based on this goal, the majority of Duke

Energy’s total projected capital expenditures are allocated to the U.S.

Franchised Electric and Gas segment. The table below includes the

components of projected capital expenditures for U.S. Franchised

Electric and Gas for the next three fiscal years.

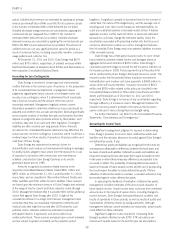

2012 2013 2014

System growth 30% 21% 26%

Maintenance and upgrades of existing

facilities 55% 54% 47%

Nuclear fuel 9% 12% 11%

Environmental 6% 13% 16%

Total projected U.S. Franchised Electric and

Gas capital expenditures 100% 100% 100%

With respect to the 2012 capital expenditure plan, Duke Energy

has flexibility within its $4.5 billion budget to defer or eliminate

certain spending should economic or financing conditions deteriorate.

Of the $4.5 billion budget, $1.6 billion relates to projects for which

management has committed capital, including, but not limited to, the

continued construction of Cliffside Unit 6, the Edwardsport IGCC

plant and the Dan River combined cycle gas-fired facilities, and

management intends to spend those capital dollars in 2012

irrespective of broader economic factors. $2.7 billion of projected

2012 capital expenditures are expected to be used primarily for

overall system maintenance and upgrades, customer connections,

compliance with new environmental requirements and corporate

capital expenditures. Although these expenditures are ultimately

necessary to ensure overall system maintenance and reliability, the

timing of the expenditures may be influenced by broad economic

conditions and customer growth, thus management has more

flexibility in terms of when these dollars are actually spent. The

remaining planned 2012 capital expenditures of $0.2 billion are of a

discretionary nature and relate to growth opportunities in which Duke

Energy may invest, provided there are opportunities that meet return

expectations.

As a result of Duke Energy’s significant commitment to

modernize its generating fleet through the construction of new units,

the ability to cost effectively manage the construction phase of current

and future projects is critical to ensuring full and timely recovery of

costs of construction. Should Duke Energy encounter significant cost

overruns above amounts approved by the various state commissions,

and those amounts are disallowed for recovery in rates, or if

construction cost of renewable generation exceed amounts provided

through power sales agreements, future cash flows and results of

operations could be adversely impacted.

Many of Duke Energy’s current capital expenditure projects,

including system modernization and renewable investments, qualify

for bonus depreciation. Duke Energy estimates that over time it could

generate cumulative cash benefits of approximately $2.3 billion for

projects expected to be placed in service by the end of 2012. Even

though bonus depreciation related to Duke Energy’s regulated projects

reduces rate base eligible for inclusion in future rates, the cash

benefits will decrease Duke Energy’s need for financings over time

and help to mitigate future customer rate increases.

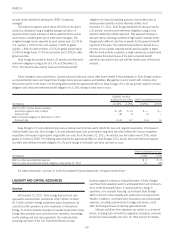

Duke Energy’s capitalization is balanced between debt and

equity as shown in the table below.

Projected

2012 2011 2010

Equity 52% 52% 55%

Debt 48% 48% 45%

Duke Energy’s fixed charges coverage ratio, calculated using

SEC guidelines, was 3.2 times for 2011, 3.0 times for 2010, and

3.0 times for 2009.

In 2012, Duke Energy currently anticipates issuing additional

net debt of $400 million, primarily for the purpose of funding capital

expenditures. Due to the flexibility in the timing of projected 2012

capital expenditures, the timing and amount of debt issuances

throughout 2012 could be influenced by changes in capital

spending.

In November 2011, Duke Energy entered into a new $6 billion,

five-year master credit facility with $4.0 billion available at closing

and the remaining $2.0 billion available following successful

completion of the proposed merger with Progress Energy, Inc. This

facility is not restricted upon general market conditions. Additionally,

Duke Energy has access to $0.2 billion in a credit facility from

smaller regional banks. At December 31, 2011, Duke Energy has

available borrowing capacity of $3.3 billion under these facilities.

Management currently believes that amounts available under its

revolving credit facilities are accessible should there be a need to

generate additional short-term financing in 2012. Management

expects that cash flows from operations and issuances of debt will be

sufficient to cover the 2012 funding requirements related to capital

and investments expenditures, dividend payments and debt

maturities. See “Credit Facilities” section below for additional

information regarding Duke Energy’s credit facilities.

Duke Energy monitors compliance with all debt covenants and

restrictions and does not currently believe it will be in violation or

breach of its significant debt covenants during 2012. However,

circumstances could arise that may alter that view. If and when

management had a belief that such potential breach could exist,

appropriate action would be taken to mitigate any such issue. Duke

Energy also maintains an active dialogue with the credit rating

agencies.

Duke Energy periodically evaluates the impact of repatriation of

cash generated and held in foreign countries. Duke Energy’s current

intent is to indefinitely reinvest foreign earnings. However,

circumstances could arise that may alter that view, including a future

change in tax law governing U.S. taxation of foreign earnings. If Duke

61