Duke Energy 2011 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

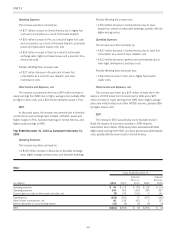

Operating Expenses.

The decrease was primarily driven by:

• A $584 million decrease in impairment charges primarily

related to a $660 million charge related to goodwill and

non-regulated coal-fired generation asset impairments in the

Midwest in 2010, as compared to a $79 million impairment

in 2011 to write down the carrying value of excess emission

allowances held to fair value as a result of the EPA’s issuance

of the Cross-State Air Pollution Rule (CSAPR) and a $9 million

impairment of the Vermillion generation station in 2011. See

Note 12 to the Consolidated Financial Statements, “Goodwill,

Intangible Assets and Impairments,” for additional information;

and

• A $65 million decrease in retail fuel and purchased power

expenses due to lower generation volumes net of higher

purchased power volumes in 2011 as compared to 2010.

Partially offsetting these decreases were:

• A $156 million increase in wholesale fuel expenses due to

higher generation volumes, partially offset by favorable hedge

realizations in 2011 as compared to 2010;

• A $68 million increase in operating expenses resulting

primarily from the recognition of Midwest ISO exit fees, higher

maintenance expenses and higher transmission costs in 2011

compared to 2010; and

• A $30 million increase in mark-to-market fuel expense on

non-qualifying fuel hedge contracts, consisting of

mark-to-market losses of $3 million in 2011 compared to

gains of $27 million in 2010.

Gains on Sales of Other Assets and Other, net.

The increase in 2011 as compared to 2010 is attributable to

2011 gains on sales of certain assets resulting from a contract

termination.

Other Income and Expenses, net.

The decrease in 2011 as compared to 2010 is primarily due to

distributions from South Houston Green Power received in 2010

which did not recur in 2011.

EBIT.

The increase is primarily attributable to lower goodwill,

generation and other asset impairment charges, higher wholesale

margins due to increased generation volumes, and an increase in

renewables generation revenues. These factors were partially offset by

lower retail margins driven by customer switching and unfavorable

weather, higher operating expenses resulting from the recognition of

Midwest ISO exit fees and increased maintenance expenses, and net

mark-to-market losses on non-qualifying commodity hedge contracts

in 2011 compared to gains in 2010.

Matters Impacting Future Commercial Power Results

Commercial Power’s coal-fired generation assets were dedicated

under Duke Energy Ohio’s ESP through December 31, 2011. The

PUCO approved Duke Energy Ohio’s new ESP in November 2011.

The new ESP effectively separates the generation of electricity from

Duke Energy Ohio’s retail load obligation as of January 1, 2012. As a

result, Commercial Power’s coal-fired generation assets no longer

serve retail load customers or receive negotiated pricing under the

ESP. The coal-fired generation assets began dispatching all of their

electricity into unregulated markets in January 2012 and going

forward will receive wholesale energy margins and capacity revenues

from PJM at rates currently below those previously collected under

the prior ESP. The impact of these lower energy margins and capacity

revenues are expected to be partially offset by a non-bypassable

stability charge collected from Duke Energy Ohio’s retail customers

through 2014. As a result, Commercial Power’s operating revenues

and EBIT will be negatively impacted.

Commercial Power’s gas-fired non-regulated generation assets

earn capacity revenues from PJM. PJM capacity prices are

determined through an auction process for planning years from June

through May of the following year and are conducted approximately

three years in advance of the capacity delivery period. Capacity

prices, for periods beginning June 2011 and continuing through May

2014 will be significantly lower than current and historical capacity

prices. As a result, Commercial Power’s operating revenues and EBIT

will be negatively impacted through 2014.

Commercial Power is focused on growing its non-regulated

renewable energy portfolio. Results for Commercial Power are

dependent upon completion of renewable energy construction

projects and tax credits from renewable energy production and project

investments. Failure of current construction projects to reach

commercial operation before the expiration of certain tax credits at the

end of 2011 could have a significant impact on Commercial Power’s

results of operations.

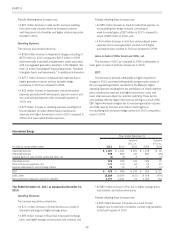

Year Ended December 31, 2010 as compared to December 31,

2009

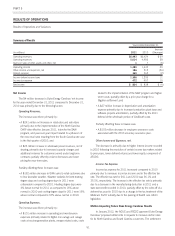

Operating Revenues.

The increase was primarily driven by:

• A $294 million increase in wholesale electric revenues due to

higher generation volumes and pricing net of lower margin

earned from participation in wholesale auctions;

• A $54 million increase in PJM capacity revenues due to

additional megawatts participating in the auction and higher

cleared auction pricing in 2010 compared to 2009;

• A $51 million increase in renewable generation revenues due

to additional wind generation facilities placed in service in

2010 and a full year of operations for wind generation

facilities placed in service throughout 2009; and

• An $8 million increase in net mark-to-market revenues on

non-qualifying power and capacity hedge contracts, consisting

of mark-to-market gains of $6 million in 2010 compared to

losses of $2 million in 2009.

47