Duke Energy 2011 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

Year Ended December 31, 2010 as Compared to

December 31, 2009. Consolidated interest expense increased

$89 million in 2010 as compared to 2009. This increase is primarily

attributable to higher debt balances, partially offset by a higher debt

component of AFUDC due to increased spending on capital projects

and lower interest expense related to income taxes.

Consolidated Income Tax Expense from Continuing Operations

Year Ended December 31, 2011 as Compared to

December 31, 2010. For 2011, consolidated income tax expense

from continuing operations decreased $138 million compared to

2010, primarily due to a decrease in the effective tax rate. The

effective tax rate for the year ended December 31, 2011 was 30.5%

compared to 40.3% for the year ended December 31, 2010. The

change in the effective tax rate is primarily due to a $500 million

impairment of non-deductible goodwill in 2010

Year Ended December 31, 2010 as Compared to

December 31, 2009. For 2010, consolidated income tax expense

from continuing operations increased $132 million compared to

2009, primarily due to the increase in pre-tax income. The effective

tax rate for the year ended December 31, 2010 was 40% compared

to 41% for the year ended December 31, 2009. The effective tax

rates for both 2010 and 2009 reflect the effect of goodwill

impairments, which are non-deductible for tax purposes.

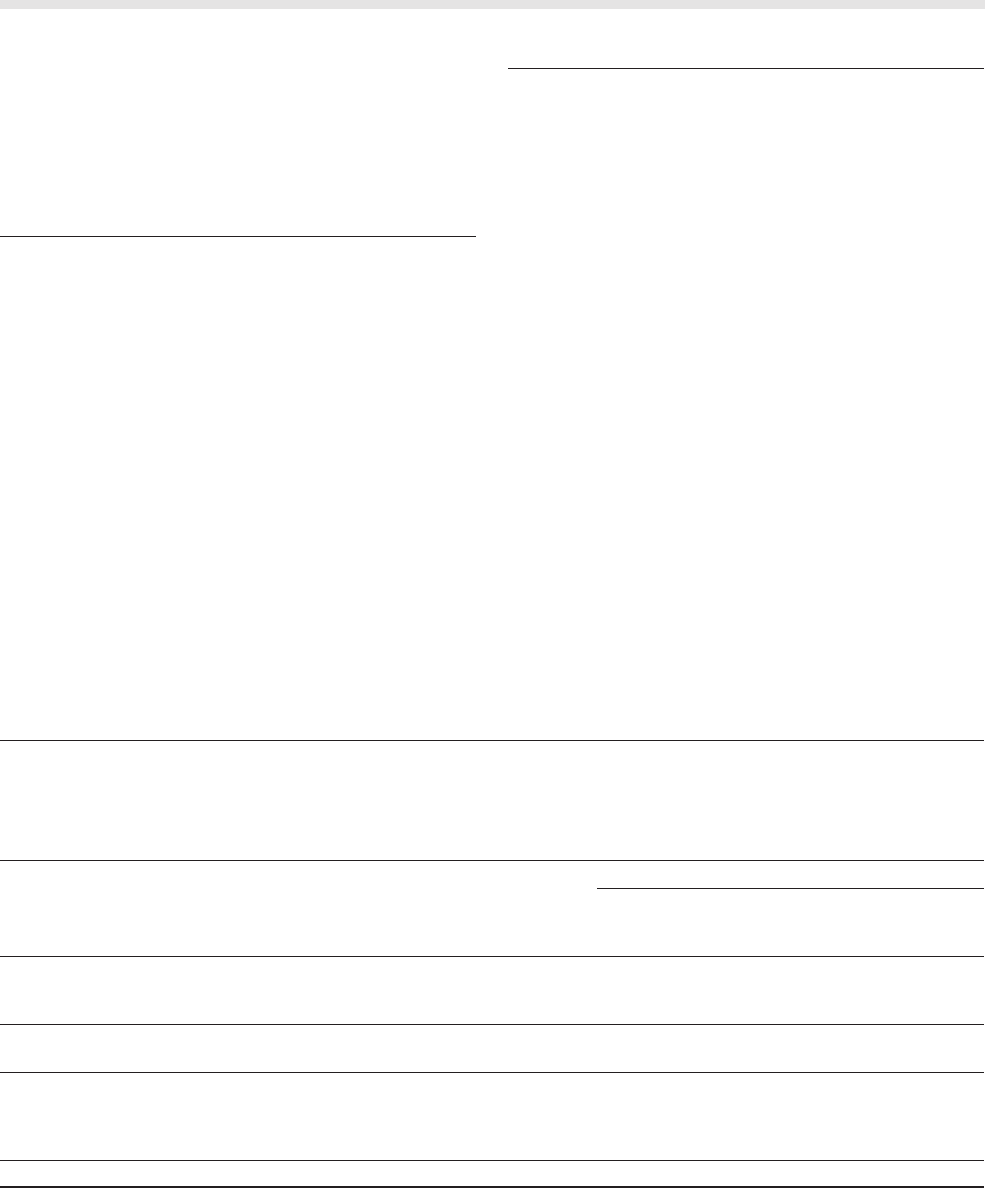

Segment Results

Management evaluates segment performance based on

earnings before interest and taxes from continuing operations

(excluding certain allocated corporate governance costs), after

deducting amounts attributable to noncontrolling interests related to

those profits (EBIT). On a segment basis, EBIT excludes discontinued

operations, represents all profits from continuing operations (both

operating and non-operating) before deducting interest and taxes, and

is net of the amounts attributable to noncontrolling interests related to

those profits. Cash, cash equivalents and short-term investments are

managed centrally by Duke Energy, so interest and dividend income

on those balances, as well as gains and losses on remeasurement of

foreign currency denominated balances, are excluded from the

segments’ EBIT. Management considers segment EBIT to be a good

indicator of each segment’s operating performance from its continuing

operations, as it represents the results of Duke Energy’s ownership

interest in operations without regard to financing methods or capital

structures.

See Note 3 to the Consolidated Financial Statements, “Business

Segments,” for a discussion of Duke Energy’s segment structure.

Duke Energy’s operating earnings may not be comparable to a

similarly titled measure of another company because other entities

may not calculate operating earnings in the same manner. Beginning

in 2012, the chief operating decision maker began evaluating

segment financial performance and allocation of resources on a net

income basis. Therefore, previously unallocated corporate costs will

be reflected in each segment.

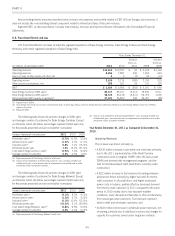

Segment EBIT is summarized in the following table, and detailed discussions follow.

EBIT by Business Segment

Years Ended December 31,

(in millions) 2011 2010

Variance

2011 vs.

2010 2009

Variance

2010 vs.

2009

U.S. Franchised Electric and Gas $2,604 $2,966 $(362) $2,321 $ 645

Commercial Power 225 (229) 454 27 (256)

International Energy 679 486 193 365 121

Total reportable segment EBIT 3,508 3,223 285 2,713 510

Other (261) (255) (6) (251) (4)

Total reportable segment EBIT and other 3,247 2,968 279 2,462 506

Interest expense (859) (840) (19) (751) (89)

Interest income and other(a) 56 64 (8) 102 (38)

Add back of noncontrolling interest component of reportable segment and Other EBIT 21 18 3 18 —

Consolidated earnings from continuing operations before income taxes $2,465 $2,210 $ 255 $1,831 $ 379

(a) Other within Interest income and other includes foreign currency transaction gains and losses and additional noncontrolling interest amounts not allocated to reportable segment and

Other EBIT.

43