Duke Energy 2011 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART I

Fuel Supply

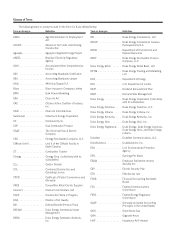

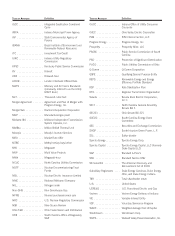

USFE&G relies principally on coal and nuclear fuel for its generation of electric energy. The following table lists USFE&G’s sources of power

and fuel costs for the three years ended December 31, 2011.

Generation by Source

(Percent)

Cost of Delivered Fuel per Net

Kilowatt-hour Generated (Cents)

2011(d) 2010(d) 2009 2011(d) 2010(d) 2009

Coal(a) 60.0 61.5 59.6 3.17 3.04 2.88

Nuclear 37.6 36.3 38.5 0.55 0.52 0.48

Oil and gas(b) 1.4 0.9 0.4 5.89 6.77 7.71

All fuels (cost-based on weighted average)(a) 99.0 98.7 98.5 2.21 2.15 1.96

Hydroelectric(c) 1.0 1.3 1.5

100.0 100.0 100.0

(a) Statistics related to coal generation and all fuels reflect USFE&G’s 69% ownership interest in the East Bend Steam Station and 50.05% ownership interest in Unit 5 of the Gibson Steam

Station.

(b) Cost statistics include amounts for light-off fuel at USFE&G’s coal-fired stations and combined cycle (gas only).

(c) Generating figures are net of output required to replenish pumped storage facilities during off-peak periods.

(d) In addition, Duke Energy Carolinas produced approximately 6,000 megawatt-hours (MWh) in solar generation for 2011 and 2010; no fuel costs are attributed to this generation.

Coal.

USFE&G meets its coal demand in the Carolinas and Midwest

through a portfolio of long-term purchase contracts and short-term

spot market purchase agreements. Large amounts of coal are

purchased under long-term contracts with mining operators who

mine both underground and at the surface. USFE&G uses spot-

market purchases to meet coal requirements not met by long-term

contracts. Expiration dates for its long-term contracts, which have

various price adjustment provisions and market re-openers, range

from 2012 to 2014 for the Carolinas and 2012 to 2016 for the

Midwest. USFE&G expects to renew these contracts or enter into

similar contracts with other suppliers for the quantities and quality of

coal required as existing contracts expire, though prices will fluctuate

over time as coal markets change. The coal purchased for the

Carolinas is primarily produced from mines in eastern Kentucky,

West Virginia and southwestern Virginia. The coal purchased for the

regulated Midwest entities is primarily produced in Indiana, Illinois,

and Kentucky. USFE&G has an adequate supply of coal under

contract to fuel its projected 2012 operations and a significant portion

of supply to fuel its projected 2013 operations. Coal inventory levels

have increased during the past year due to the impact of mild

weather and the economy on retail load and low natural gas prices

which are resulting in higher combined cycle gas-fired generation. If

these factors continue for an extended period of time, USFE&G could

have excess levels of coal inventory or incur incremental purchased

powerorothercosts.

The current average sulfur content of coal purchased by

USFE&G for the Carolinas is between 1% and 2%; while the

Midwest is between 2% and 3%. USFE&G’s scrubbers, in

combination with the use of sulfur dioxide (SO2) emission

allowances, enable USFE&G to satisfy current SO2emission

limitations for existing facilities in the Carolinas and Midwest.

Gas.

USFE&Gisresponsibleforthepurchaseandthesubsequent

delivery of natural gas to native load customers in its Ohio and

Kentucky service territories. USFE&G’s natural gas procurement

strategy is to buy firm natural gas supplies (natural gas intended to be

available at all times) and firm interstate pipeline transportation

capacity during the winter season (November through March) and

during the non-heating season (April through October) through a

combination of firm supply and transportation capacity along with

spot supply and interruptible transportation capacity. This strategy

allows USFE&G to assure reliable natural gas supply for its high

priority (non-curtailable) firm customers during peak winter conditions

and provides USFE&G the flexibility to reduce its contract

commitments if firm customers choose alternate gas suppliers under

USFE&G customer choice/gas transportation programs. In 2011, firm

supply purchase commitment agreements provided approximately

100% of the natural gas supply. These firm supply agreements

feature two levels of gas supply, specifically (i.) base load, which is a

continuous supply to meet normal demand requirements, and (ii.)

swing load, which is gas available on a daily basis to accommodate

changes in demand due primarily to changing weather conditions.

USFE&G also owns two underground caverns with a total

storage capacity of 16 million gallons of liquid propane. In addition,

USFE&G has access to 5.5 million gallons of liquid propane storage

and product loan through a commercial services agreement with a

third party. This liquid propane is used in the three propane/air peak

shaving plants located in Ohio and Kentucky. Propane/air peak

shaving plants vaporize the propane and mix it with natural gas to

supplement the natural gas supply during peak demand periods.

USFE&G maintains natural gas procurement-price volatility

mitigation programs for Duke Energy Ohio and Duke Energy

Kentucky. These programs pre-arrange percentages of seasonal gas

requirements for Duke Energy Ohio and Duke Energy

Kentucky. Duke Energy Ohio and Duke Energy Kentucky use

primarily fixed-price forward contracts and contracts with a ceiling

and floor on the price. As of December 31, 2011, Duke Energy Ohio

and Duke Energy Kentucky, combined, had locked in pricing for

19% of their winter 2012/2013 system load requirements.

USFE&G is also responsible for the purchase and the

subsequent delivery of natural gas to the gas turbine generators to

serve native electric load customers in the Duke Energy Carolinas,

Duke Energy Indiana and Duke Energy Kentucky service territories.

11