Duke Energy 2011 Annual Report Download - page 204

Download and view the complete annual report

Please find page 204 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

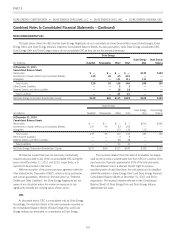

Combined Notes to Consolidated Financial Statements – (Continued)

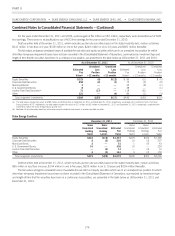

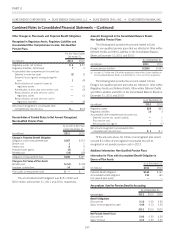

The following table illustrates Duke Energy’s basic and diluted EPS calculations and reconciles the weighted-average number of common

shares outstanding to the diluted weighted-average number of common shares outstanding for the years ended December 31, 2011, 2010,

and 2009.

(in millions, except per share amounts) Income

Average

Shares EPS

2011

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating

securities — basic $1,702 1,332 $1.28

Effect of dilutive securities:

Stock options, performance and restricted stock 1

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating

securities — diluted $1,702 1,333 $1.28

2010

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating

securities — basic $1,315 1,318 $1.00

Effect of dilutive securities:

Stock options, performance and restricted stock 1

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating

securities — diluted $1,315 1,319 $1.00

2009

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating

securities — basic $1,061 1,293 $0.82

Effect of dilutive securities:

Stock options, performance and restricted stock 1

Income from continuing operations attributable to Duke Energy common shareholders, as adjusted for participating

securities — diluted $1,061 1,294 $0.82

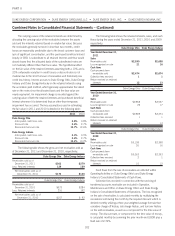

As of December 31, 2011, 2010 and 2009, 7 million,

13 million and 20 million, respectively, of stock options, unvested

stock and performance awards were not included in the “effect of

dilutive securities” in the above table because either the option

exercise prices were greater than the average market price of the

common shares during those periods, or performance measures

related to the awards had not yet been met.

Beginning in the fourth quarter of 2008, Duke Energy began

issuing authorized but previously unissued shares of common stock

to fulfill obligations under its Dividend Reinvestment Plan (DRIP) and

other internal plans, including 401(k) plans. During the years ended

December 31, 2010 and 2009, Duke Energy received proceeds of

$288 million and $494 million, respectively, from the sale of

common stock associated with these plans. Proceeds from the sale of

common stock associated with these plans were not significant in

2011. Duke Energy has discontinued issuing new shares of common

stock under the DRIP.

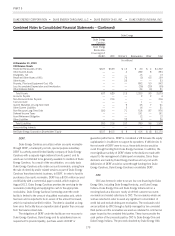

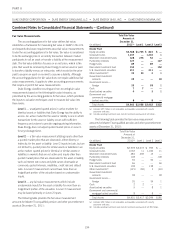

19. SEVERANCE

2011 Severance Plans.

In conjunction with the proposed merger with Progress Energy, in

August 2011, Duke Energy announced plans to offer a voluntary

severance plan to approximately 4,850 eligible employees. As this is a

voluntary plan, all severance benefits offered under this plan are

considered special termination benefits under GAAP. Special

termination benefits are measured upon employee acceptance and

recorded immediately absent a significant retention period. If a

significant retention period exists, the cost of the special termination

benefits are recorded ratably over the remaining service periods of the

affected employees. Approximately 500 employees accepted the

termination benefits during the voluntary window period, which closed

on November 30, 2011. Duke Energy reserves the right to reject any

request to volunteer based on business needs and/or excessive

participation. The estimated amount of severance payments associated

with this voluntary plan, contingent upon a successful close of the

proposed merger with Progress Energy, are expected to be

approximately $80 million.

2010 Severance Plans.

During 2010, the majority of severance charges were related to

a voluntary severance plan whereby eligible employees were provided

a window during which to accept termination benefits. As this was a

voluntary plan, all severance benefits offered under this plan were

considered special termination benefits under GAAP. Special

termination benefits are measured upon employee acceptance and

recorded immediately absent a significant retention period. If a

significant retention period exists, the cost of the special termination

benefits are recorded ratably over the remaining service periods of the

affected employees. Approximately 900 employees accepted the

termination benefits during the voluntary window period, which

closed March 31, 2010. Future severance costs under Duke

Energy’s ongoing severance plan, if any, are currently not estimable.

184