Duke Energy 2011 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

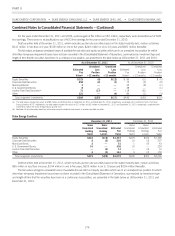

Combined Notes to Consolidated Financial Statements – (Continued)

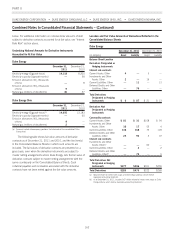

frequency and volume to provide ongoing pricing information.

Duke Energy does not adjust quoted market prices on Level 1

for any blockage factor.

Level 2 — a fair value measurement utilizing inputs other than

a quoted market price that are observable, either directly or

indirectly, for the asset or liability. Level 2 inputs include, but are

not limited to, quoted prices for similar assets or liabilities in an

active market, quoted prices for identical or similar assets or

liabilities in markets that are not active and inputs other than

quoted market prices that are observable for the asset or liability,

such as interest rate curves and yield curves observable at

commonly quoted intervals, volatilities, credit risk and default

rates. A Level 2 measurement cannot have more than an

insignificant portion of the valuation based on unobservable

inputs.

Level 3 — any fair value measurements which include

unobservable inputs for the asset or liability for more than an

insignificant portion of the valuation. A Level 3 measurement

may be based primarily on Level 2 inputs.

The fair value accounting guidance for financial instruments

permits entities to elect to measure many financial instruments and

certain other items at fair value that are not required to be accounted

for at fair value under other GAAP. There are no financial assets or

financial liabilities that are not required to be accounted for at fair

value under GAAP for which the option to record at fair value has

been elected. However, in the future, the Duke Energy Registrants

may elect to measure certain financial instruments at fair value in

accordance with this accounting guidance.

Valuation methods of the primary fair value measurements

disclosed below are as follows:

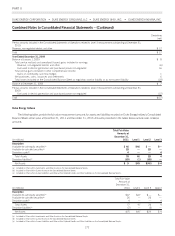

Investments in equity securities.

Investments in equity securities are typically valued at the

closing price in the principal active market as of the last business day

of the period. Principal active markets for equity prices include

published exchanges such as NASDAQ and NYSE. Foreign equity

prices are translated from their trading currency using the currency

exchange rate in effect at the close of the principal active market.

Prices have not been adjusted to reflect for after-hours market activity.

The majority of investments in equity securities are valued using

Level 1 measurements.

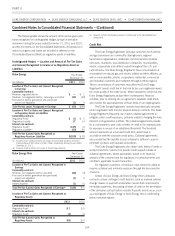

Investments in available-for-sale auction rate securities.

Duke Energy held $89 million par value ($71 million carrying

value) and $149 million par value ($118 million carrying value) as

of December 31, 2011, and December 31, 2010, respectively of

auction rate securities for which an active market does not currently

exist. During the year ended December 31, 2011, $59 million of

these investments in auction rate securities were redeemed at full par

value plus accrued interest. Duke Energy Carolinas held $16 million

par value ($12 million carrying value) of auction rate securities at

both December 31, 2011, and December 31, 2010. All of these

auction rate securities are student loan securities for which

substantially all the values are ultimately backed by the U.S.

government, and the majority of these securities are AAA rated. As of

December 31, 2011 all of these auction rate securities are classified

as long-term investments and are valued using Level 3

measurements. The methods and significant assumptions used to

determine the fair values of the investment in auction rate debt

securities represent estimations of fair value using internal discounted

cash flow models which incorporate primarily management’s own

assumptions as to the term over which such investments will be

recovered at par, the current level of interest rates, and the

appropriate risk-adjusted discount rates when relevant observable

inputs are not available to determine the present value of such cash

flows. In preparing the valuations, all significant value drivers were

considered, including the underlying collateral. Auction rate securities

which are classified as Short-term investments are valued using

Level 2 measurements, as they are valued at par based on a

commitment by the issuer to redeem at par value. There were no

auction rate securities classified as Short-term investments as of

December 31, 2011 or December 31, 2010.

There were no other-than-temporary impairments associated

with investments in auction rate debt securities during the years

ended December 31, 2011, 2010, or 2009.

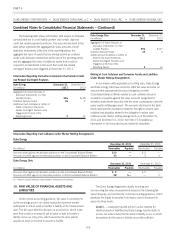

Investments in debt securities.

Most debt investments (including those held in the NDTF) are

valued based on a calculation using interest rate curves and credit

spreads applied to the terms of the debt instrument (maturity and

coupon interest rate) and consider the counterparty credit rating. Most

debt valuations are Level 2 measurements. If the market for a

particular fixed income security is relatively inactive or illiquid, the

valuation is a Level 3 measurement. U.S. Treasury debt is typically a

Level 1 measurement.

Commodity derivatives.

The pricing for commodity derivatives is primarily a calculated

value which incorporates the forward price and is adjusted for

liquidity (bid-ask spread), credit or non-performance risk (after

reflecting credit enhancements such as collateral) and discounted to

present value. The primary difference between a Level 2 and a Level

3 measurement has to do with the level of activity in forward markets

for the commodity. If the market is relatively inactive, the

measurement is deemed to be a Level 3 measurement. Some

commodity derivatives are NYMEX contracts, which are classified as

Level 1 measurements.

Goodwill and Long-Lived Assets.

See Note 12 for a discussion of the valuation for goodwill and

long-lived assets.

166