Duke Energy 2011 Annual Report Download - page 167

Download and view the complete annual report

Please find page 167 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

retirement of specific assets and are recognized in the period in which

the liability is incurred, if a reasonable estimate of fair value can be

made. The present value of the liability is added to the carrying

amount of the associated asset in the period the liability is incurred

and this additional carrying amount is depreciated over the remaining

life of the asset. Subsequent to the initial recognition, the liability is

adjusted for any revisions to the estimated future cash flows

associated with the asset retirement obligation (with corresponding

adjustments to property, plant, and equipment), which can occur

due to a number of factors including, but not limited to, cost

escalation, changes in technology applicable to the assets to be

retired and changes in federal, state or local regulations, as well as for

accretion of the liability due to the passage of time until the obligation

is settled. Depreciation expense is adjusted prospectively for any

increases or decreases to the carrying amount of the associated asset.

The recognition of asset retirement obligations has no impact on the

earnings of Duke Energy’s regulated electric operations as the effects

of the recognition and subsequent accounting for an asset retirement

obligation are offset by the establishment of regulatory assets and

liabilities pursuant to regulatory accounting.

Asset retirement obligations recognized by Duke Energy relate

primarily to the decommissioning of nuclear power facilities, asbestos

removal, closure of landfills and removal of wind generation assets.

Asset retirement obligations recognized by Duke Energy Carolinas

relate primarily to the decommissioning of nuclear power facilities,

asbestos removal and closure of landfills at fossil generation facilities.

Asset retirement obligations at Duke Energy Ohio relate primarily to

the retirement of gas mains, asbestos abatement at certain generating

stations and closure and post-closure activities of landfills. Asset

retirement obligations at Duke Energy Indiana relate primarily to

obligations associated with future asbestos abatement at certain

generating stations. Certain of the Duke Energy Registrants’ assets

have an indeterminate life, such as transmission and distribution

facilities and thus the fair value of the retirement obligation is not

reasonably estimable. A liability for these asset retirement obligations

will be recorded when a fair value is determinable.

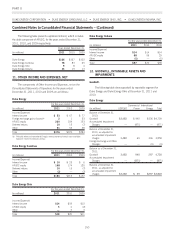

The following tables present the changes to the liability associated with asset retirement obligations for the Duke Energy Registrants during

the years ended December 31, 2011 and 2010:

December 31, 2011

(in millions) Duke Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

Balance as of January 1, $1,816 $1,728 $27 $46

Accretion expense(a) 111 105 2 2

Liabilities settled (3) (1) (2) —

Revisions in estimates of cash flows 19—(9)

Liabilities incurred in the current year 11 5 — 4

Balance as of December 31, $1,936 $1,846 $27 $43

(a) Substantially all of the accretion expense for the years ended December 31, 2011 relate to Duke Energy’s regulated electric operations and has been deferred in accordance with

regulatory accounting treatment, as discussed above.

December 31, 2010

(in millions) Duke Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

Balance as of January 1, $ 3,185 $3,098 $36 $42

Accretion expense(a) 97 9312

Correction of prior year error(b) (1,465) (1,465) — —

Liabilities settled (10) (7) — (3)

Revisions in estimates of cash flows (8) (1) (10) 4

Liabilities incurred in the current year 12 5— 1

Other 55——

Balance as of December 31, $ 1,816 $1,728 $27 $46

(a) Substantially all of the accretion expense for the years ended December 31, 2010 relate to Duke Energy’s regulated electric operations and has been deferred in accordance with

regulatory accounting treatment, as discussed above.

(b) In the second quarter of 2010, Duke Energy Carolinas recorded a $1.5 billion correction of an error to reduce the nuclear decommissioning asset retirement obligation liability, with

offsetting impacts to regulatory assets and property, plant and equipment. This correction had no impact on Duke Energy Carolinas’ equity, results of operations or cash flows.

Duke Energy’s regulated electric and regulated natural gas

operations accrue costs of removal for property that does not have an

associated legal retirement obligation based on regulatory orders from

the various state commissions. These costs of removal are recorded

as a regulatory liability in accordance with regulatory treatment. Duke

Energy does not accrue the estimated cost of removal for any

non-regulated assets (including Duke Energy Ohio’s generation

assets). See Note 4 for the estimated cost of removal for assets

147