Duke Energy 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

counterparties that permit the Duke Energy Registrants to offset

receivables and payables with such counterparties. The Duke Energy

Registrants attempt to further reduce credit risk with certain

counterparties by entering into agreements that enable the Duke

Energy Registrants to obtain collateral or to terminate or reset the

terms of transactions after specified time periods or upon the

occurrence of credit-related events.

European Exposures.

Duke Energy owns a 25% ownership interest in Attiki, a natural

gas distributor located in Athens, Greece. The carrying value of Duke

Energy’s investment in Attiki was $64 million at December 31,

2011, and is recorded in Other within Investments and other assets

in the Consolidated Balance Sheets. Duke Energy also has a $64

million debt obligation associated with its investment in Attiki. Duke

Energy has an agreement to sell its ownership interest in Attiki. If all

conditions of this agreement are met, Duke Energy expects the

transaction to close in March 2012. At December 31, 2011, Duke

Energy held $285 million of money market funds and short term

investments in investment-grade debt securities of issued by financial

and nonfinancial institutions that are domiciled in Europe or have

exposures to European sovereign debt. This amount is recorded at fair

value and included in Cash and cash equivalents and Short-term

investment in the Consolidated Balance Sheets. A disorderly default

by the Greek government or withdrawal of Greece from the euro zone

and financial stress in other European countries could require Duke

Energy to recognize an impairment of some or all of these securities.

Interest Rate Risk

The Duke Energy Registrants are exposed to risk resulting from

changes in interest rates as a result of their issuance of variable and

fixed rate debt and commercial paper. The Duke Energy Registrants

manage interest rate exposure by limiting variable-rate exposures to a

percentage of total capitalization and by monitoring the effects of

market changes in interest rates. The Duke Energy Registrants also

enter into financial derivative instruments, which may include

instruments such as, but not limited to, interest rate swaps,

swaptions and U.S. Treasury lock agreements to manage and

mitigate interest rate risk exposure. See Notes 1, 6, 14, and 15 to the

Consolidated Financial Statements, “Summary of Significant

Accounting Policies,” “Debt and Credit Facilities,” “Risk Management,

Derivative Instruments and Hedging Activities,” and “Fair Value of

Financial Assets and Liabilities.”

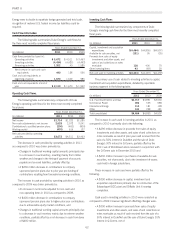

The table below summarizes the potential effect of interest rate

changes on the Duke Energy Registrants’ pre-tax net income, based

on a sensitivity analysis performed as of December 31, 2011 and

December 31, 2010.

Summary of Sensitivity Analysis for Interest Rate Risks

($ in millions)

Potential Increase (+)

or Decrease (-) in

Interest

Expense(a):

Assuming market

interest rates average

1% higher (+) or

lower (-) in 2012

than in 2011 As of

December 31, 2011

Assuming market

interest rates average

1% higher (+) or

lower (-) in 2011

than in 2010 As of

December 31, 2010

Duke Energy +/- $4 +/- $8

Duke Energy Carolinas +/- $5 +/- $2

Duke Energy Ohio +/- $4 +/- $1

Duke Energy Indiana +/- $9 +/- $5

(a) Amounts presented net of offsetting impacts in interest income.

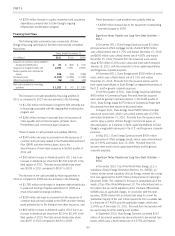

These amounts were estimated by considering the impact of the

hypothetical interest rates on variable-rate securities outstanding,

adjusted for interest rate hedges, short-term and long-term

investments, cash and cash equivalents outstanding as of

December 31, 2011 and 2010. The change in interest rate

sensitivity for the Duke Energy Registrants’ is primarily due to

changes in short-term debt balances and cash balances. If interest

rates changed significantly, management would likely take actions to

manage its exposure to the change. However, due to the uncertainty

of the specific actions that would be taken and their possible effects,

the sensitivity analysis assumes no changes in the Duke Energy

Registrants’ financial structure.

Marketable Securities Price Risk

Duke Energy

As described further in Note 16 to the Consolidated Financial

Statements, “Investments in Debt and Equity Securities,” Duke

Energy invests in debt and equity securities as part of various

investment portfolios to fund certain obligations of the business. The

vast majority of the investments in equity securities are within the

NDTF and assets of the various pension and other post-retirement

benefit plans.

71