Duke Energy 2011 Annual Report Download - page 211

Download and view the complete annual report

Please find page 211 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

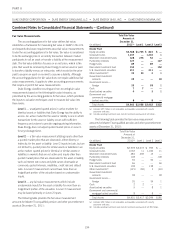

The discount rate used to determine the current year pension

obligation and following year’s pension expense is based on a bond

selection-settlement portfolio approach. This approach develops a

discount rate by selecting a portfolio of high quality corporate bonds

that generate sufficient cash flow to provide for the projected benefit

payments of the plan. The selected bond portfolio is derived from a

universe of non-callable corporate bonds rated Aa quality or higher.

After the bond portfolio is selected, a single interest rate is determined

that equates the present value of the plan’s projected benefit

payments discounted at this rate with the market value of the bonds

selected.

Other Post-Retirement Benefit Plans

Duke Energy and most of its subsidiaries provide some health

care and life insurance benefits for retired employees on a

contributory and non-contributory basis. Employees are eligible for

these benefits if they have met age and service requirements at

retirement, as defined in the plans.

Duke Energy did not make any pre-funding contributions to its

other post-retirement benefit plans during the years ended

December 31, 2011, 2010 or 2009.

These benefit costs are accrued over an employee’s active

service period to the date of full benefits eligibility. The net

unrecognized transition obligation is amortized over 20 years.

Actuarial gains and losses are amortized over the average remaining

service period of the active employees. The average remaining service

period of the active employees covered by the plan is 11 years.

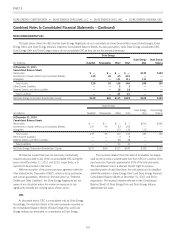

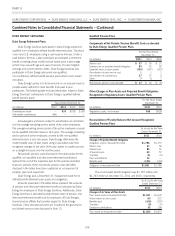

Components of Net Periodic Other Post-Retirement Benefit Costs

For the Years Ended

December 31,

(in millions) 2011(a) 2010(a) 2009(a)

Service cost $7 $7 $7

Interest cost on accumulated post-

retirement benefit obligation 35 38 46

Expected return on plan assets (15) (15) (16)

Amortization of prior service credit (8) (8) (8)

Amortization of net transition liability 10 11 10

Amortization of actuarial gain (3) (5) (5)

Net periodic other post-retirement benefit

costs $26 $28 $34

(a) These amounts exclude $8 million, $9 million and $9 million for the years ended

December 31, 2011, 2010 and 2009, respectively, of regulatory asset amortization

resulting from purchase accounting adjustments associated with Duke Energy’s merger

with Cinergy in April 2006.

The Medicare Prescription Drug, Improvement and

Modernization Act of 2003 (Modernization Act) introduced a

prescription drug benefit under Medicare (Medicare Part D) as well as

a federal subsidy to sponsors of retiree health care benefit plans.

Accounting guidance issued and adopted by Duke Energy in 2004

prescribes the appropriate accounting for the federal subsidy. The

after-tax effect on net periodic post-retirement benefit cost was a

decrease of $3 million in 2011, $4 million in 2010 and $3 million

in 2009. Duke Energy recognized a $1 million subsidy receivable as

of December 31, 2011 and 2010, which is included in Receivables

on the Consolidated Balance Sheets.

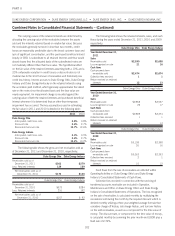

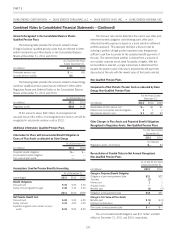

Other Changes in Plan Assets and Projected Benefit Obligations

Recognized in Accumulated Other Comprehensive Income,

Regulatory Assets and Regulatory Liabilities: Other Post-

Retirement Benefit Plans

For the Years Ended

December 31,

(in millions) 2011 2010

Regulatory assets, net decrease $(22) $(14)

Regulatory liabilities, net increase (decrease) 21 (5)

Accumulated other comprehensive (income) loss

Deferred income tax liability 11

Actuarial (gain) loss arising during the year —(3)

Amortization of prior year actuarial gains 11

Reclassification of actuarial losses to regulatory

liabilities —(8)

Amortization of prior year prior service credit —2

Reclassification of prior service credit to

regulatory liabilities —9

Amortization of prior year net transition liability —(2)

Reclassification of net transition liability to

regulatory liabilities —(2)

Net amount recognized in accumulated other

comprehensive (income) loss $2 $(2)

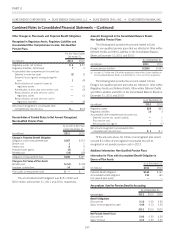

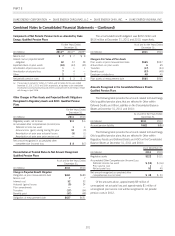

Reconciliation of Funded Status to Accrued Other Post-Retirement

Benefit Costs

As of and for the Years

Ended

December 31,

(in millions) 2011 2010

Change in Benefit Obligation

Accumulated post-retirement benefit obligation at

prior measurement date $723 $728

Service cost 77

Interest cost 35 38

Plan participants’ contributions 32 35

Actuarial gain (55) (12)

Benefits paid (83) (79)

Early retiree reinsurance program subsidy 3—

Accrued retiree drug subsidy 56

Accumulated post-retirement benefit obligation at

measurement date $667 $723

Change in Fair Value of Plan Assets

Plan assets at prior measurement date $186 $169

Actualreturnonplanassets 419

Benefits paid (83) (79)

Employer contributions 42 42

Plan participants’ contributions 32 35

Plan assets at measurement date $181 $186

191