Duke Energy 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

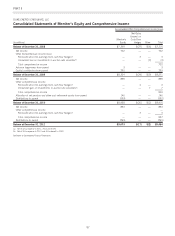

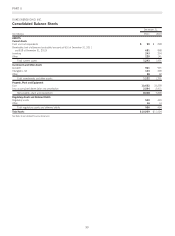

PART II

DUKE ENERGY CORPORATION

Consolidated Statements of Equity and Comprehensive Income

Duke Energy Corporation Shareholders

Accumulated Other Comprehensive Income (Loss)

(In millions)

Common

Stock

Shares

Common

Stock

Additional

Paid-in

Capital

Retained

Earnings

Foreign

Currency

Adjustments

Net Gains

(Losses) on

Cash Flow

Hedges Other

Pension and

OPEB Related

Adjustments

to AOCI

Common

Stockholders’

Equity

Noncontrolling

Interests

Total

Equity

Balance at December 31, 2008 1,272 $ 1 $ 20,106 $ 1,607 $ (306) $ (41) $ (28) $ (351) $ 20,988 $ 163 $ 21,151

Net income 1,075 1,075 10 1,085

Other Comprehensive income (loss)

Foreign currency translation adjustments — — — — 323 — — — 323 18 341

Net unrealized gain on cash flow hedges(a) —— —— — 1— — 1 — 1

Reclassification into earnings from cash

flow hedges(b) —— —— — 18— — 18 — 18

Pension and OPEB related adjustments to

AOCI(g) —— —— — —— 36 36 — 36

Net actuarial loss(c) — — — — — — — (21) (21) — (21)

Unrealized loss on investments in auction

rate securities(d) — — — — — — (6) — (6) — (6)

Reclassification of gains on investments in

available-for-sale securities into

earnings(e) — — — — — — (5) — (5) — (5)

Unrealized gain on investments in

available-for-sale securities(f) —— —— — —8 — 8 — 8

Total comprehensive income 1,429 28 1,457

Common stock issuances, including dividend

reinvestment and employee benefits 37 — 546 — — — — — 546 — 546

Purchases and other changes in

noncontrolling interest in subsidiaries(h) — — 14 — — — — — 14 (55) (41)

Common stock dividends — — — (1,222) — — — — (1,222) — (1,222)

Other — — (5) — — — — — (5) — (5)

Balance at December 31, 2009 1,309 $ 1 $20,661 $ 1,460 $ 17 $(22) $(31) $(336) $21,750 $136 $21,886

Net income — — — 1,320 — — — — 1,320 3 1,323

Other comprehensive income ——

Foreign currency translation adjustments — — — — 80 — — — 80 (1) 79

Pension and OPEB related adjustments to

AOCI(g) — — — — — — — 276 276 — 276

Net unrealized gain on cash flow hedges(a) —— —— — 1— — 1 — 1

Reclassification into earnings from cash

flow hedges(b) —— —— — 3— — 3 — 3

Unrealized gain on investments in auction

rate securities(d) —— —— — 14 — 14 — 14

Total comprehensive income 1,694 2 1,696

Common stock issuances, including dividend

reinvestment and employee benefits 20 — 362 — — — — — 362 — 362

Common stock dividends — — — (1,284) — — — — (1,284) — (1,284)

Changes in noncontrolling interest in

subsidiaries(h) —— —— — —— — — (7) (7)

Balance at December 31, 2010 1,329 $ 1 $21,023 $ 1,496 $ 97 $(18) $(17) $ (60) $22,522 $131 $22,653

Net income — — — 1,706 — — — — 1,706 8 1,714

Other comprehensive (loss) income ——

Foreign currency translation adjustments — — — — (142) — — — (142) (7) (149)

Pension and OPEB related adjustments to

AOCI(g) — — — — — — — (49) (49) — (49)

Net unrealized loss on cash flow hedges(a) — — — — — (57) — — (57) — (57)

Reclassification into earnings from cash

flow hedges(b) —— —— — 4— — 4 — 4

Unrealized gain on investments in auction

rate securities(d) —— —— — 8 8 — 8

Reclassification of gains on investments in

available-for-sale securities into

earnings(e) — — — — — — (4) — (4) — (4)

Unrealized gain on investments in

available-for-sale securities(f) —— —— — —4 — 4 — 4

Total comprehensive income 1,470 1 1,471

Common stock issuances, including dividend

reinvestment and employee benefits 7 — 109 — — — — — 109 — 109

Common stock dividends — — — (1,329) — — — — (1,329) — (1,329)

Changes in noncontrolling interest in

subsidiaries(h) — — — — — — — — — (39) (39)

Balance at December 31, 2011 1,336 $ 1 $21,132 $ 1,873 $ (45) $(71) $ (9) $(109) $22,772 $ 93 $22,865

(a) Net of $31 tax benefit in 2011, $1 tax expense in 2010, and $1 tax expense in 2009.

(b) Net of $1 tax expense in 2011, insignificant tax expense in 2010 and $10 tax expense in 2009.

(c) Net of $12 tax benefit in 2009.

(d) Net of $4 tax expense in 2011, $8 tax expense in 2010 and $4 tax benefit in 2009.

(e) Net of $2 tax benefit in 2011 and $2 tax expense in 2009.

(f) Net of $3 tax expense in 2011 and $4 tax expense in 2009.

(g) Net of $23 tax benefit in 2011, $150 tax expense in 2010 and $16 tax expense in 2009.

(h) Includes $26, $10, and $37 in cash distributions to noncontrolling interests in 2011, 2010, and 2009 respectively.

See Notes to Consolidated Financial Statements

81