Duke Energy 2011 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

restricted net assets of wholly-owned subsidiaries of Duke Energy that

may not be distributed to Duke Energy in the form of a loan or

dividend is $8.6 billion. However, Duke Energy does not have any

legal or other restrictions on paying common stock dividends to

shareholders out of its consolidated Retained Earnings account.

Although these restrictions cap the amount of funding the various

operating subsidiaries can provide to Duke Energy, management

does not believe these restrictions will have any significant impact on

Duke Energy’s ability to access cash to meet its payment of dividends

on common stock and other future funding obligations.

Off-Balance Sheet Arrangements

Duke Energy and certain of its subsidiaries enter into guarantee

arrangements in the normal course of business to facilitate

commercial transactions with third parties. These arrangements

include performance guarantees, stand-by letters of credit, debt

guarantees, surety bonds and indemnifications.

Most of the guarantee arrangements entered into by Duke

Energy enhance the credit standing of certain subsidiaries,

non-consolidated entities or less than wholly-owned entities, enabling

them to conduct business. As such, these guarantee arrangements

involve elements of performance and credit risk, which are not

included on the Consolidated Balance Sheets. The possibility of Duke

Energy, either on its own or on behalf of Spectra Energy Capital, LLC

(Spectra Capital) through indemnification agreements entered into as

part of the spin-off of Spectra Energy Corp (Spectra Energy), having to

honor its contingencies is largely dependent upon the future

operations of the subsidiaries, investees and other third parties, or the

occurrence of certain future events.

Duke Energy performs ongoing assessments of its guarantee

obligations to determine whether any liabilities have been triggered as

a result of potential increased non-performance risk by parties for

which Duke Energy has issued guarantees.

See Note 7 to the Consolidated Financial Statements,

“Guarantees and Indemnifications,” for further details of the

guarantee arrangements.

Issuance of these guarantee arrangements is not required for the

majority of Duke Energy’s operations. Thus, if Duke Energy

discontinued issuing these guarantees, there would not be a material

impact to the consolidated results of operations, cash flows or

financial position.

Other than the guarantee arrangements discussed above and

normal operating lease arrangements, Duke Energy does not have

any material off-balance sheet financing entities or structures. For

additional information on these commitments, see Note 5 to the

Consolidated Financial Statements, “Commitments and

Contingencies.”

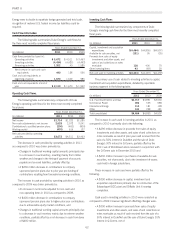

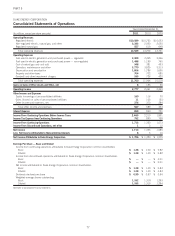

Contractual Obligations

Duke Energy enters into contracts that require payment of cash

at certain specified periods, based on certain specified minimum

quantities and prices. The following table summarizes Duke Energy’s

contractual cash obligations for each of the periods presented.

Contractual Obligations as of December 31, 2011

Payments Due By Period

(in millions) Total

Less than 1

year

(2012)

2-3 Years

(2013 &

2014)

4-5 Years

(2015 &

2016)

More than

5Years

(2017 &

Thereafter)

Long-term debt(a) $32,144 $2,853 $ 5,040 $4,244 $20,007

Capital leases(b) 670 60 90 81 439

Operating leases(b) 481 81 125 73 202

Purchase Obligations:(h)

Firm capacity and transportation payments(c) 274 76 107 26 65

Commodity contracts(d) 12,900 3,873 4,730 2,285 2,012

Other purchase, maintenance and service obligations(e) 3,250 2,042 876 64 268

Other funding obligations(f) 480 48 96 96 240

Total contractual cash obligations(g) $50,199 $9,033 $11,064 $6,869 $23,233

(a) See Note 6 to the Consolidated Financial Statements, “Debt and Credit Facilities.” Amount includes interest payments over the life of the debt. Interest payments on variable rate debt

instruments were calculated using interest rates derived from the interpolation of the forecast interest rate curve. In addition, a spread was placed on top of the interest rates to aid in

capturing the volatility inherent in projecting future interest rates.

(b) See Note 5 to the Consolidated Financial Statements, “Commitments and Contingencies.” Amounts in the table above include the interest component of capital leases based on the

interest rates explicitly stated in the lease agreements.

(c) Includes firm capacity payments that provide Duke Energy with uninterrupted firm access to electricity transmission capacity, and natural gas transportation contracts.

(d) Includes contractual obligations to purchase physical quantities of electricity, coal, nuclear fuel and limestone. Also, includes contracts that Duke Energy has designated as hedges,

undesignated contracts and contracts that qualify as normal purchase/normal sale (NPNS). For contracts where the price paid is based on an index, the amount is based on forward

market prices at December 31, 2011. For certain of these amounts, Duke Energy may settle on a net cash basis since Duke Energy has entered into payment netting agreements with

counterparties that permit Duke Energy to offset receivables and payables with such counterparties.

(e) Includes contracts for software, telephone, data and consulting or advisory services. Amount also includes contractual obligations for engineering, procurement and construction costs for

new generation plants and nuclear plant refurbishments, environmental projects on fossil facilities, major maintenance of certain non-regulated plants, maintenance and day to day

contract work at certain wind facilities and commitments to buy wind and combustion turbines (CT). Amount excludes certain open purchase orders for services that are provided on

demand, for which the timing of the purchase cannot be determined.

(f) Relates to future annual funding obligations to the nuclear decommissioning trust fund (NDTF) (see Note 9 to the Consolidated Financial Statements,“AssetRetirementObligations”).

67