Duke Energy 2011 Annual Report Download - page 206

Download and view the complete annual report

Please find page 206 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

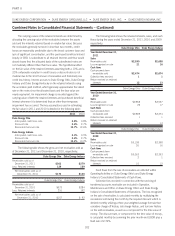

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

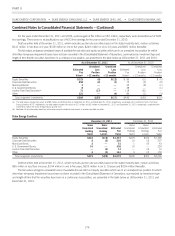

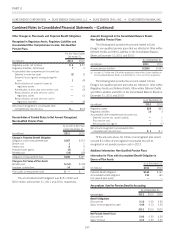

Stock Option Activity

Options

(in thousands)

Weighted-

Average

Exercise

Price

Weighted-

Average

Remaining

Life

(in years)

Aggregate

Intrinsic

Value

(in millions)

Outstanding at

December

31, 2010 13,881 $17

Granted 1,074 18

Exercised (4,734) 15

Forfeited or

expired (3,954) 22

Outstanding at

December 31,

2011 6,267 $15 4.6 $41

Exercisable at

December 31,

2011 4,256 $15 2.7 $31

Options

Expected to

Vest 2,011 $17 8.6 $10

On December 31, 2010 and 2009, Duke Energy had

12 million and 17 million exercisable options, respectively with a

weighted-average exercise price of $17 and $18, respectively. The

options granted in 2011 were expensed immediately, therefore, there

is no future compensation cost associated with these options. The

following table includes information related to Duke Energy’s stock

options.

For the Years Ended

December 31,

(in millions) 2011 2010 2009

Intrinsic value of options exercised $26$8$6

Tax benefit related to options exercised 10 32

Cash received from options exercised 74 14 24

(in thousands of shares)

Stock options granted(a) 1,074 1,103 603

(a) The options granted in 2011 were expensed immediately, therefore, there is no future

compensation cost associated with these options.

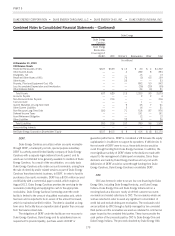

These assumptions were used to determine the grant date fair

value of the stock options granted during 2011:

Weighted-Average Assumptions for Option Pricing

Risk-free interest rate(a) 2.5%

Expected dividend yield(b) 5.7%

Expected life(c) 6.0 years

Expected volatility(d) 18.8%

(a) The risk free rate is based upon the U.S. Treasury Constant Maturity rates as of the

grant date.

(b) The expected dividend yield is based upon annualized dividends and the 1-year

average closing stock price.

(c) The expected life of options is derived from the simplified method approach.

(d) Volatility is based upon 50% historical and 50% implied volatility. Historic volatility is

based on Duke Energy’s historical volatility over the expected life using daily stock

prices. Implied volatility is the average for all option contracts with a term greater than

six months using the strike price closest to the stock price on the valuation date.

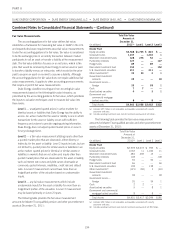

Phantom Stock Awards

Phantom stock awards issued and outstanding under the 2010

Plan and the 2006 Plan generally vest over periods from immediate

to three years. The following table includes information related to

Duke Energy’s phantom stock awards.

Shares awarded

(in thousands)

Fair value(a)

(in millions)

Years ended December 31,

2011 1,907 $34

2010 1,047 17

2009 1,096 16

(a) Based on the market price of Duke Energy’s common stock at the grant date.

The following table summarizes information about phantom

stock awards outstanding at December 31, 2011:

Shares

(in thousands)

Weighted Average

Per Share Grant

Date Fair Value

Number of Phantom Stock

Awards:

Outstanding at December 31,

2010 1,763 $17

Granted 1,907 18

Vested (1,057) 18

Forfeited (46) 18

Outstanding at December 31,

2011 2,567 $17

Phantom Stock Awards Expected

to Vest 2,503 $17

The total grant date fair value of the shares vested during the

years ended December 31, 2011, 2010 and 2009 was $19

million, $29 million and $23 million, respectively. At December 31,

2011, Duke Energy had $19 million of unrecognized compensation

cost which is expected to be recognized over a weighted-average

period of 2.6 years.

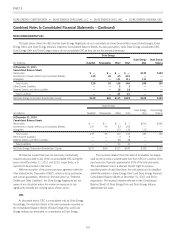

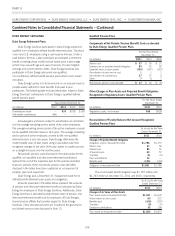

Performance Awards

Stock-based awards issued and outstanding under the 2010

Plan and the 2006 Plan generally vest over three years if

performance targets are met. Vesting for certain stock-based

performance awards can occur in three years, at the earliest, if

performance is met. Certain performance awards granted in 2011,

2010 and 2009 contain market conditions based on the total

shareholder return (TSR) of Duke Energy stock relative to a

pre-defined peer group (relative TSR). These awards are valued using

a path-dependent model that incorporates expected relative TSR into

the fair value determination of Duke Energy’s performance-based

share awards. The model uses three year historical volatilities and

correlations for all companies in the pre-defined peer group, including

186