Duke Energy 2011 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

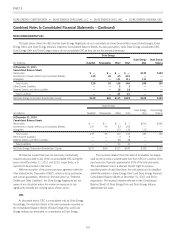

Combined Notes to Consolidated Financial Statements – (Continued)

For the years ended December 31, 2011 and 2009, a pre-tax gain of $6 million and $7 million, respectively were reclassified out of AOCI

into earnings. There were no reclassifications out of AOCI into earnings for the year ended December 31, 2010.

Debt securities held at December 31, 2011, which excludes auction rate securities based on the stated maturity date, mature as follows:

$141 million in less than one year, $318 million in one to five years, $240 million in six to 10 years and $381 million thereafter.

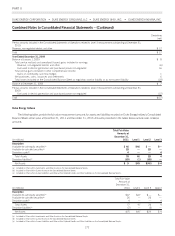

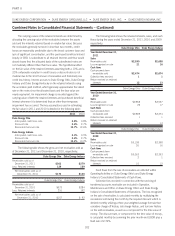

The fair values and gross unrealized losses of available-for-sale debt and equity securities which are in an unrealized loss position for which

other-than-temporary impairment losses have not been recorded in the Consolidated Statement of Operations, summarized by investment type and

length of time that the securities have been in a continuous loss position, are presented in the table below as of December 31, 2011 and 2010.

As of December 31, 2011 As of December 31, 2010

Estimated

Fair

Value(a)

Unrealized

Loss

Position

>12 months

Unrealized

Loss

Position

<12 months

Estimated

Fair

Value(a)

Unrealized

Loss

Position

>12 months

Unrealized

Loss

Position

<12 months

Equity Securities $123 (6) $(12) $ 85 (11) $ (5)

Corporate Debt Securities 258 (2) (1) 73 (2) (2)

Municipal Bonds 3——42 (8) (1)

U.S. Government Bonds 8——38 — (1)

Auction Rate Debt Securities(b) 71 (17) — 118 (31) —

Other 121 — (4) 84 (1) (3)

Total long-term investments $584 $(25) $(17) $440 $(53) $(12)

(a) The table above includes fair values of $289 million and $226 million at December 31, 2011 and December 31, 2010, respectively, associated with investments held in the Duke

Energy Carolinas NDTF. Additionally, the table above includes fair values of $11 million and $5 million at December 31, 2011 and December 31, 2010, respectively, associated with

investments held in the Duke Energy Indiana grantor trust.

(b) See Note 15 for information about fair value measurements related to investments in auction rate debt securities.

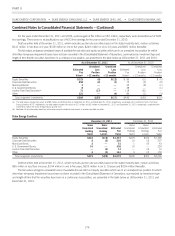

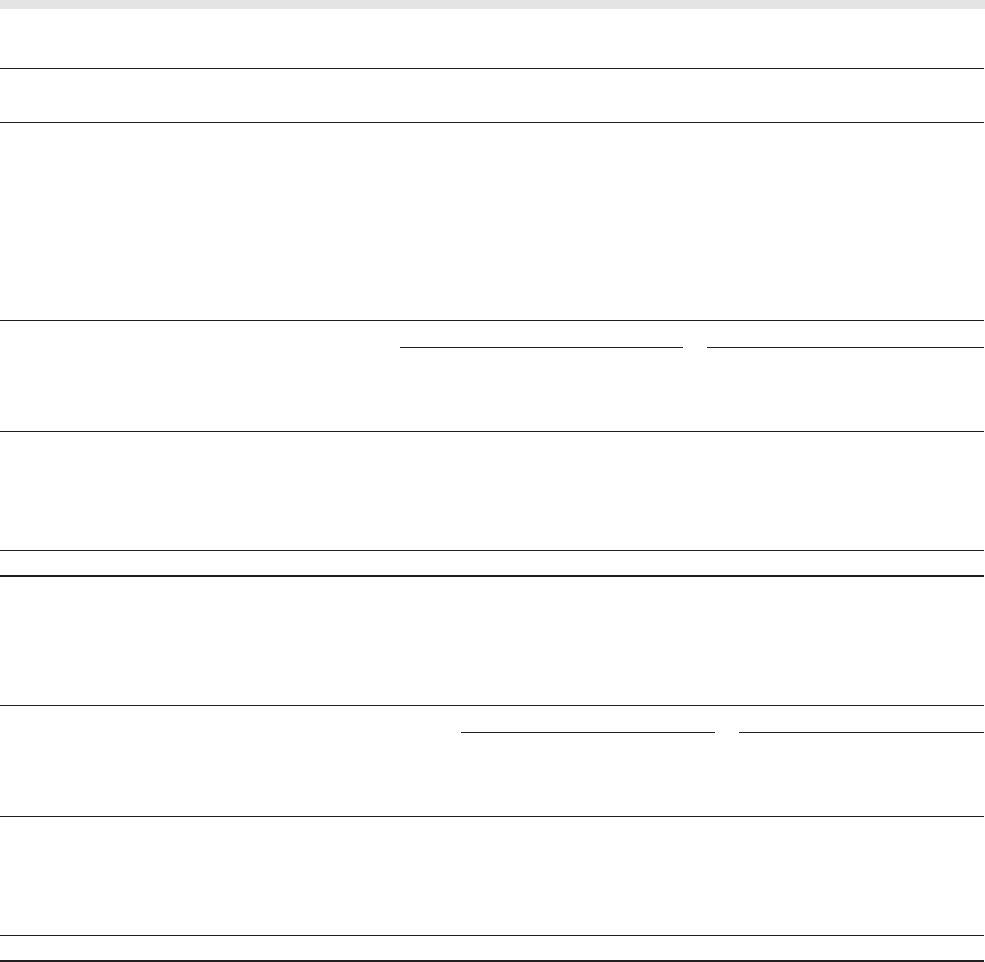

Duke Energy Carolinas

December 31, 2011 December 31, 2010

Gross

Unrealized

Holding

Gains

Gross

Unrealized

Holding

Losses

Estimated

Fair

Value

Gross

Unrealized

Holding

Gains

Gross

Unrealized

Holding

Losses

Estimated

Fair

Value

Equity Securities $443 $(16) $1,337 $475 $(16) $1,365

Corporate Debt Securities 8(2)20510 (3) 227

Municipal Bonds 2—51 1 (9) 43

U.S. Government Bonds 16 — 306 10 — 224

Auction Rate Debt Securities — (3) 12 — (3) 12

Other 4(4)161 9 (4) 155

Total long-term investments $473 $(25) $2,072 $505 $(35) $2,026

Debt securities held at December 31, 2011, which excludes auction rate securities based on the stated maturity date, mature as follows:

$65 million in less than one year, $144 million in one to five years, $205 million in six to 10 years and $309 million thereafter.

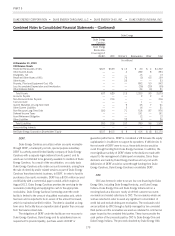

The fair values and gross unrealized losses of available-for-sale debt and equity securities which are in an unrealized loss position for which

other-than-temporary impairment losses have not been recorded in the Consolidated Statement of Operations, summarized by investment type

and length of time that the securities have been in a continuous loss position, are presented in the table below as of December 31, 2011 and

December 31, 2010.

176