Duke Energy 2011 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

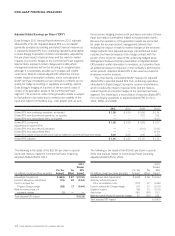

The following is a reconciliation of adjusted segment EBIT for the year ended December 31, 2011, to the most directly comparable

GAAP measure:

For the Year Ended December 31, 2011

Economic

Adjusted Emission Hedges Reported

Segment Edwardsport Allowances (Mark-to- Segment

(In millions) EBIT Impairment Impairment Market) EBIT

U.S. Franchised Electric & Gas $ 2,826 $ (222) $ — $ — $ 2,604

Commercial Power 305 — (79) (1) 225

International Energy 679 — — — 679

Total 2011 reportable segment EBIT $ 3,810 $ (222) $ (79) $ (1) $ 3,508

Effective with the first quarter of 2012, Duke Energy will

no longer report EBIT for its business segments. Instead,

Duke Energy will begin evaluating the performance of its

segments on a net income basis. This new reporting measure

will involve an allocation of interest and taxes as well as

previously unallocated corporate costs to each of the segments.

Other will primarily include captive insurance results and interest

expense on the direct debt of the Duke Energy holding company.

When used for future periods, segment and Other net income

may also include amounts that are ultimately reported as

discontinued operations. Due to the forward-looking nature of this

non-GAAP financial measure for 2012, information to reconcile it

to the most directly comparable GAAP financial measure is not

available at this time, as management is unable to project special

items or mark-to-market adjustments for future periods.

Dividend Payout Ratio

Duke Energy’s 2011 Annual Report includes a discussion

of Duke Energy’s anticipated long-term dividend payout ratio

of 65-70% based upon adjusted diluted EPS. This payout

ratio is a non-GAAP financial measure as it is based upon

forecasted diluted EPS from continuing operations attributable

to Duke Energy Corporation shareholders, adjusted for the

per-share impact of special items and the mark-to-market

impacts of economic hedges in the Commercial Power segment,

as discussed above under “Adjusted Diluted Earnings Per Share

(“EPS”)”. The most directly comparable GAAP measure for

adjusted diluted EPS is reported diluted EPS from continuing

operations attributable to Duke Energy Corporation common

shareholders, which includes the impact of special items and the

mark-to-market impacts of economic hedges in the Commercial

Power segment. Due to the forward-looking nature of this

non-GAAP financial measure for future periods, information to

reconcile it to the most directly comparable GAAP financial

measure is not available at this time, as management is unable

to project special items or mark-to-market adjustments for

future periods.

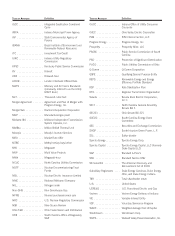

Total Available Liquidity

Duke Energy’s 2011 Annual Report includes a discussion of

total available liquidity. Total available liquidity is a non-GAAP

financial measure as it represents cash and cash equivalents

and short-term investments (excluding amounts held in foreign

jurisdictions) and remaining availability under the master credit

and regional bank credit facilities. The most directly comparable

GAAP financial measure for available liquidity is cash and cash

equivalents. The following is a reconciliation of total available

liquidity as of December 31, 2011 and December 31, 2010, to

the most directly comparable GAAP measure:

As of As of

December 31, December 31,

(In millions) 2011 2010

Cash and cash equivalents $ 2,110 $ 1,670

Short-term investments 190 —

Less: Amounts held in

foreign jurisdictions (1,037) (724)

1,263 946

Plus: Remaining availability

under master credit and

regional bank credit facilities 3,255 2,482

Total available liquidity $ 4,518 $ 3,428

16 DUKE ENERGY CORPORATION 2011 ANNUAL REPORT