Duke Energy 2011 Annual Report Download - page 185

Download and view the complete annual report

Please find page 185 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

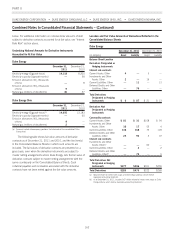

The following table shows information with respect to derivative

contracts that are in a net liability position and contain objective

credit-risk related payment provisions. The amounts disclosed in the

table below represents the aggregate fair value amounts of such

derivative instruments at the end of the reporting period, the

aggregate fair value of assets that are already posted as collateral

under such derivative instruments at the end of the reporting period,

and the aggregate fair value of additional assets that would be

required to be transferred in the event that credit-risk-related

contingent features were triggered at December 31, 2011.

Information Regarding Derivative Instruments that Contain Credit-

risk Related Contingent Features

Duke Energy

(in millions)

December 31,

2011

December 31,

2010

Aggregate Fair Value Amounts of

Derivative Instruments in a Net

Liability Position $96 $148

Collateral Already Posted 36 2

Additional Cash Collateral or Letters of

Credit in the Event Credit-risk-

related Contingent Features were

Triggered at the End of the

Reporting Period 514

Duke Energy Ohio

(in millions)

December 31,

2011

December 31,

2010

Aggregate Fair Value Amounts of

Derivative Instruments in a Net

Liability Position $94 $147

Collateral Already Posted 35 2

Additional Cash Collateral or Letters of

Credit in the Event Credit-risk-

related Contingent Features were

Triggered at the End of the

Reporting Period 514

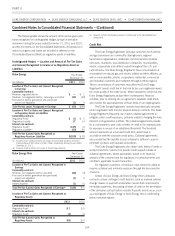

Netting of Cash Collateral and Derivative Assets and Liabilities

Under Master Netting Arrangements.

In accordance with applicable accounting rules, Duke Energy

and Duke Energy Ohio have elected to offset fair value amounts (or

amounts that approximate fair value) recognized on their

Consolidated Balance Sheets related to cash collateral amounts

receivable or payable against fair value amounts recognized for

derivative instruments executed with the same counterparty under the

same master netting agreement. The amounts disclosed in the table

below represent the receivables related to the right to reclaim cash

collateral and payables related to the obligation to return cash

collateral under master netting arrangements as of December 31,

2011 and December 31, 2010. See Note 15 for additional

information on fair value disclosures related to derivatives.

Information Regarding Cash Collateral under Master Netting Arrangements

Duke Energy

December 31, 2011 December 31, 2010

(in millions) Receivables Payables Receivables Payables

Amounts offset against net derivative positions on the Consolidated Balance Sheets $10 — $2 —

Amounts not offset against net derivative positions on the Consolidated Balance Sheets(a) 30 — 23

Duke Energy Ohio

December 31, 2011 December 31, 2010

(in millions) Receivables Payables Receivables Payables

Amounts offset against net derivative positions on the Consolidated Balance Sheets $9 — $2 —

Amounts not offset against net derivative positions on the Consolidated Balance Sheets(a) 28 $— —3

(a) Amounts primarily represent margin deposits related to futures contracts.

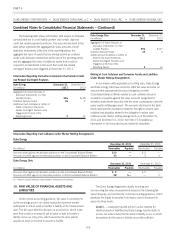

15. FAIR VALUE OF FINANCIAL ASSETS AND

LIABILITIES

Under current accounting guidance, fair value is considered to

be the exchange price in an orderly transaction between market

participants to sell an asset or transfer a liability at the measurement

date. The fair value definition focuses on an exit price, which is the

price that would be received to sell an asset or paid to transfer a

liability versus an entry price, which would be the price paid to

acquire an asset or received to assume a liability.

The Duke Energy Registrants classify recurring and

non-recurring fair value measurements based on the following fair

value hierarchy, as prescribed by current accounting guidance, which

prioritizes the inputs to valuation techniques used to measure fair

value into three levels:

Level 1 — unadjusted quoted prices in active markets for

identical assets or liabilities that Duke Energy has the ability to

access. An active market for the asset or liability is one in which

transactions for the asset or liability occur with sufficient

165