Duke Energy 2011 Annual Report Download - page 224

Download and view the complete annual report

Please find page 224 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

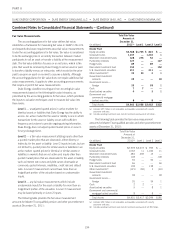

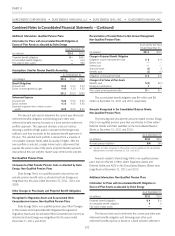

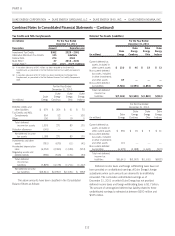

Amounts Recognized in the Consolidated Balance Sheets: Other

Post-Retirement Benefit Plans

The following table provides the amounts related to Duke Energy

Ohio’s other post-retirement benefit plans that are reflected in Other

within Deferred Credits and Other Liabilities on the Consolidated

Balance Sheets at December 31, 2011 and 2010:

As of December 31,

(in millions) 2011 2010

Accrued other post-retirement liability(a) $(52) $(58)

(a) Includes $2 million recognized in Other within Current Liabilities on the Consolidated

Balance Sheets as of both December 31, 2011 and 2010.

The following table provides the amounts related to Duke Energy

Ohio’s other post-retirement benefit plans that are reflected in Other

within Deferred Credits and Other Liabilities and AOCI on the

Consolidated Balance Sheets at December 31, 2011 and 2010:

As of December 31,

(in millions) 2011 2010

Regulatory liabilities $19 $20

Accumulated other comprehensive income

Deferred income tax liability $4 $5

Prior service credit (1) (1)

Net actuarial loss gain (9) (12)

Net amount recognized in accumulated other

comprehensive (income)/loss $(6) $(8)

Of the amounts above, $2 million of unrecognized gains and $1

million of unrecognized prior service credit (which will reduce pension

expense) will be recognized in net periodic pension costs in 2012.

Assumptions Used for Other Post-retirement Benefits

Accounting

(percentages) 2011 2010 2009

Benefit Obligations

Discount rate 5.10 5.00 5.50

Net Periodic Benefit Cost

Discount rate 5.00 5.50 6.50

Expected long-term rate of return on plan

assets 8.25 8.50 8.50

Assumed Health Care Cost Trend Rate

2011 2010

Health care cost trend rate assumed for next year 8.75% 8.50%

Rate to which the cost trend is assumed to decline (the

ultimate trend rate) 5.00% 5.00%

Year that the rate reaches the ultimate trend rate 2020 2020

Sensitivity to Changes in Assumed Health Care Cost Trend Rates

(in millions)

1-Percentage-

Point Increase

1-Percentage-

Point Decrease

Effect on total service and interest

costs $ 1 $ (1)

Effect on post-retirement benefit

obligation 18 (16)

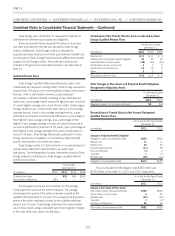

Expected Benefit Payments

The following table presents Duke Energy’s expected benefit

payments made on behalf of Duke Energy Ohio to participants in its

qualified, non-qualified and other post-retirement benefit plans over

the next 10 years, which are primarily paid out of the assets of the

various trusts. These benefit payments reflect expected future service,

as appropriate.

(in millions)

Qualified

Plans

Non-Qualified

Plans

Other Post-

Retirement

Plans Total

Years Ended December 31,

2012 $ 46 $1 $ 5 $ 52

2013 45 1 5 51

2014 44 1 6 51

2015 43 1 6 50

2016 44 1 6 51

2017 – 2021 241 3 27 271

Employee Savings Plans

Duke Energy sponsors, and Duke Energy Ohio participates in,

an employee savings plan that covers substantially all U.S.

employees. Duke Energy contributes a matching contribution equal to

100% of employee before-tax and Roth 401(k) employee

contributions, of up to 6% of eligible pay per period. Duke Energy

Ohio expensed pre-tax plan contributions, as allocated by Duke

Energy, of $4 million in 2011, $4 million in 2010 and $4 million in

2009.

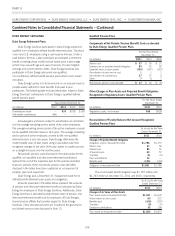

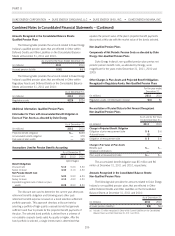

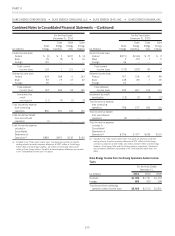

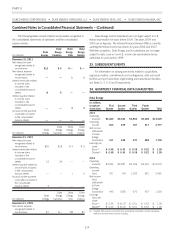

DUKE ENERGY INDIANA

Duke Energy Retirement Plans.

Duke Energy Indiana participates in qualified and non-qualified

defined benefit pension plans and other post-retirement benefit plans

sponsored by Duke Energy. Duke Energy allocates pension and other

post-retirement obligations and costs related to these plans to Duke

Energy Indiana.

Net periodic benefit cost disclosed below for the qualified,

non-qualified and other post-retirement benefit plans represent the

cost of the respective plan for the periods presented. However,

portions of the net periodic costs disclosed have been capitalized as a

component of property, plant and equipment.

204