Duke Energy 2011 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

VIEs. Restricted cash balances are reflected within both Other within

Current Assets and Other within Investments and Other Assets on the

Consolidated Balance Sheets.

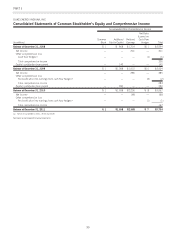

December 31,

(in millions) 2011 2010

Duke Energy $104 $126

Duke Energy Carolinas —2

Duke Energy Ohio 30 4

Duke Energy Indiana —6

Inventory. Inventory is comprised of amounts presented in the

tables below and is recorded primarily using the average cost

method. Inventory related to the Duke Energy Registrants’ regulated

operations is valued at historical cost consistent with ratemaking

treatment. Materials and supplies are recorded as inventory when

purchased and subsequently charged to expense or capitalized to

plant when installed. Inventory related to the Duke Energy

Registrants’ non-regulated operations is valued at the lower of cost or

market.

Components of Inventory

December 31, 2011

(in millions)

Duke

Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

Materials and supplies $ 873 $505 $150 $134

Coal held for electric

generation 712 412 90 196

Natural gas 3— 3—

Total Inventory $1,588 $917 $243 $330

December 31, 2010

(in millions)

Duke

Energy

Duke Energy

Carolinas

Duke Energy

Ohio

Duke Energy

Indiana

Materials and supplies $ 734 $476 $106 $ 78

Coal held for electric

generation 528 240 92 189

Natural gas 56 — 56 —

Total Inventory $1,318 $716 $254 $267

Effective November 1, 2011, Duke Energy Ohio executed an

agreement with a third party to transfer title of natural gas inventory

purchased by Duke Energy Ohio to the third party. Under the

agreements, the gas inventory was stored and managed for Duke

Energy Ohio and was delivered on demand. As a result of the

agreements, the combined natural gas inventory of approximately

$50 million being held by a third party as of December 31, 2011,

was classified as Other within Current Assets on the Consolidated

Balance Sheets.

Investments in Debt and Equity Securities.

The Duke Energy Registrants classify investments into two

categories — trading and available-for-sale. Trading securities are

reported at fair value in the Consolidated Balance Sheets with net

realized and unrealized gains and losses included in earnings each

period. Available-for-sale securities are also reported at fair value on

the Consolidated Balance Sheets with unrealized gains and losses

included in Accumulated Other Comprehensive Income (AOCI) or a

regulatory asset or liability, unless it is determined that the carrying

value of an investment is other-than-temporarily impaired. Other-

than-temporary impairments related to equity securities and the credit

loss portion of debt securities are included in earnings, unless

deferred in accordance with regulatory accounting treatment.

Investments in debt and equity securities are classified as either short-

term investments or long-term investments based on management’s

intent and ability to sell these securities, taking into consideration

illiquidity factors in the current markets with respect to certain

investments that have historically provided for a high degree of

liquidity, such as investments in auction rate debt securities.

See Note 16 for further information on the investments in debt

and equity securities, including investments held in the Nuclear

Decommissioning Trust Fund (NDTF).

Goodwill.

Duke Energy and Duke Energy Ohio perform an annual goodwill

impairment test as of August 31 each year and updates the test

between annual tests if events or circumstances occur that would

more likely than not reduce the fair value of a reporting unit below its

carrying value. Duke Energy and Duke Energy Ohio perform the

annual review for goodwill impairment at the reporting unit level,

which Duke Energy has determined to be an operating segment or

one level below and Duke Energy Ohio has determined to be an

operating segment.

The annual goodwill impairment test has historically required a

two step process. However in 2011 Duke Energy and Duke Energy

Ohio adopted revised accounting guidance, which allows an entity to

first assess qualitative factors to determine whether it is necessary to

perform the two step goodwill impairment test. As discussed in “New

Accounting Standards” below, Duke Energy and Duke Energy Ohio

utilized the qualitative factors for the annual goodwill impairment test

in 2011, and concluded that it was more likely than not the fair value

of each reporting unit exceeded its carrying value. Thus, the two step

goodwill impairment test was not necessary in 2011.

For 2010 and 2009, Duke Energy and Duke Energy Ohio

tested goodwill for potential impairment utilizing the two step process.

Step one of the impairment test involves comparing the estimated fair

values of reporting units with their aggregate carrying values,

including goodwill. If the carrying amount of a reporting unit exceeds

the reporting unit’s fair value, step two must be performed to

determine the amount, if any, of the goodwill impairment loss. If the

carrying amount is less than fair value, further testing of goodwill

impairment is not performed. For purposes of the step one analyses,

determination of a reporting unit’s fair value is typically based on a

combination of the income approach, which estimates the fair value

102