Duke Energy 2011 Annual Report Download - page 228

Download and view the complete annual report

Please find page 228 of the 2011 Duke Energy annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PART II

DUKE ENERGY CORPORATION •DUKE ENERGY CAROLINAS, LLC •DUKE ENERGY OHIO, INC. •DUKE ENERGY INDIANA, INC.

Combined Notes to Consolidated Financial Statements – (Continued)

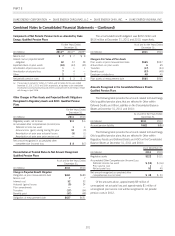

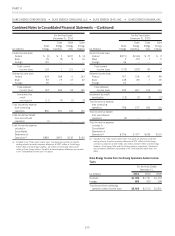

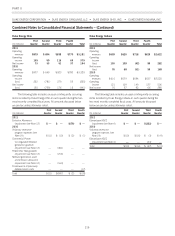

Reconciliation of Funded Status to Accrued Other Post-Retirement

Benefit Costs

As of and for the Years

Ended December 31,

(in millions) 2011 2010

Change in Benefit Obligation

Accumulated post-retirement benefit obligation

at prior measurement date $152 $154

Service cost 11

Interest cost 78

Plan participants’ contributions 43

Actuarial (gain) loss (17) 1

Benefits paid (14) (15)

Transfers —(1)

Early retiree reinsurance program subsidy 1—

Accrued retiree drug subsidy 11

Accumulated post-retirement benefit obligation

at measurement date $135 $152

Change in Fair Value of Plan Assets

Plan assets at prior measurement date $14 $13

Actual return on plan assets —2

Benefits paid (14) (15)

Employer contributions 10 11

Plan participants’ contributions 43

Plan assets at measurement date $14 $14

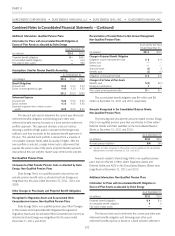

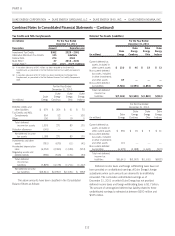

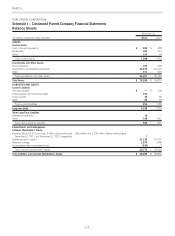

Amounts Recognized in the Consolidated Balance Sheets: Other

Post-Retirement Benefit Plans

The following table provides the amounts related to Duke Energy

Indiana’s other post-retirement benefit plans that are reflected in

Other within Deferred Credits and Other Liabilities on the

Consolidated Balance Sheets at December 31, 2011 and 2010:

As of December 31,

(in millions) 2011 2010

Accrued other post-retirement liability(a) $(121) $(138)

(a) Includes an insignificant amount recognized in Other within Current Liabilities on the

Consolidated Balance Sheets as of both December 31, 2011 and 2010.

The following table provides the amounts related to Duke Energy

Indiana’s other post-retirement benefit plans that are reflected in

Other within Regulatory Assets and Deferred Debits and within Other

within Deferred Credits and Other Liabilities on the Consolidated

Balance Sheets at December 31, 2011 and 2010:

As of December 31,

2011 2010

(in millions)

Regulatory assets $83 $90

Regulatory liabilities 70 58

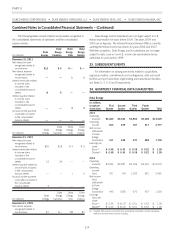

Assumptions Used for Other Post-retirement Benefits Accounting

As of December 31,

(percentages) 2011 2010 2009

Benefit Obligations

Discount rate 5.10 5.00 5.50

Net Periodic Benefit Cost

Discount rate 5.00 5.50 6.50

Expected long-term rate of return on plan

assets 8.25 8.50 8.50

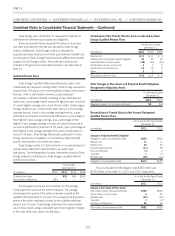

The discount rate used to determine the current year other post-

retirement benefits obligation and following year’s other post-

retirement benefits expense is based on a bond selection-settlement

portfolio approach. This approach develops a discount rate by

selecting a portfolio of high quality corporate bonds that generate

sufficient cash flow to provide for the projected benefit payments of

the plan. The selected bond portfolio is derived from a universe of

non-callable corporate bonds rated Aa quality or higher. After the

bond portfolio is selected, a single interest rate is determined that

equates the present value of the plan’s projected benefit payments

discounted at this rate with the market value of the bonds selected.

Assumed Health Care Cost Trend Rate

2011 2010

Health care cost trend rate assumed for next year 8.75% 8.50%

Rate to which the cost trend is assumed to decline (the

ultimate trend rate) 5.00% 5.00%

Year that the rate reaches the ultimate trend rate 2020 2020

Sensitivity to Changes in Assumed Health Care Cost Trend

Rates

(in millions)

1-Percentage-

Point Increase

1-Percentage-

Point Decrease

Effect on total service and interest

costs $ 1 $ (1)

Effect on post-retirement benefit

obligation 18 (16)

208