MetLife 2006 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

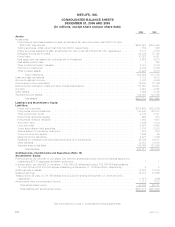

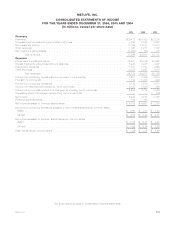

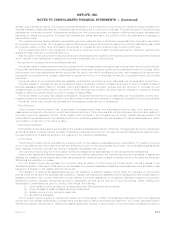

METLIFE, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE YEARS ENDED DECEMBER 31, 2006, 2005 AND 2004

(In millions)

2006 2005 2004

Cash flows from operating activities

Netincome......................................................... $ 6,293 $ 4,714 $ 2,758

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciationandamortizationexpenses ................................... 394 352 444

Amortization of premiums and accretion of discounts associated with investments, net . . . . . (618) (201) (110)

(Gains)lossesfromsalesofinvestmentsandbusinesses,net ..................... (3,492) (2,271) (302)

Equity earnings of real estate joint ventures

andotherlimitedpartnershipinterests ................................... (459) (416) (153)

Interestcreditedtopolicyholderaccountbalances............................. 5,246 3,925 2,997

Interestcreditedtobankdeposits........................................ 193 106 38

Universallifeandinvestment-typeproductpolicyfees .......................... (4,780) (3,828) (2,867)

Changeinaccruedinvestmentincome .................................... (315) (157) (142)

Changeinpremiumsandotherreceivables ................................. (2,655) (37) 78

Changeindeferredpolicyacquisitioncosts,net .............................. (1,317) (1,043) (1,331)

Changeininsurance-relatedliabilities..................................... 5,031 5,709 5,346

Changeintradingsecurities ........................................... (432) (244) —

Changeinincometaxpayable.......................................... 2,039 528 (135)

Changeinotherassets .............................................. 1,712 347 (492)

Changeinotherliabilities............................................. (202) 506 351

Other,net....................................................... (38) 29 30

Netcashprovidedbyoperatingactivities...................................... 6,600 8,019 6,510

Cash flows from investing activities

Sales, maturities and repayments of:

Fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 113,321 155,709 87,451

Equitysecurities................................................... 1,313 1,062 1,686

Mortgageandconsumerloans.......................................... 8,348 8,462 3,954

Realestateandrealestatejointventures................................... 6,211 3,668 1,268

Otherlimitedpartnershipinterests ....................................... 1,768 1,132 799

Purchases of:

Fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (129,644) (169,111) (94,275)

Equitysecurities................................................... (1,052) (1,509) (2,178)

Mortgageandconsumerloans.......................................... (13,472) (10,902) (9,931)

Realestateandrealestatejointventures................................... (1,523) (1,451) (872)

Otherlimitedpartnershipinterests ....................................... (1,915) (1,105) (894)

Netchangeinshort-terminvestments ...................................... 595 2,267 (740)

Additionalconsiderationrelatedtopurchasesofbusinesses........................ (115) — —

Purchases of businesses, net of cash received of $0, $852 and $0, respectively . . . . . . . . . . — (10,160) (7)

Proceeds from sales of businesses, net of cash disposed of $0, $43 and $103, respectively. . . 48 260 29

Netchangeinotherinvestedassets ....................................... (2,411) (450) (566)

Other,net ........................................................ (358) (489) (134)

Netcashusedininvestingactivities......................................... $ (18,886) $ (22,617) $(14,410)

See accompanying notes to consolidated financial statements.

F-5MetLife, Inc.