MetLife 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

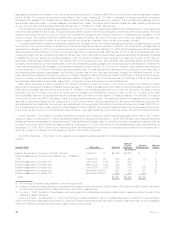

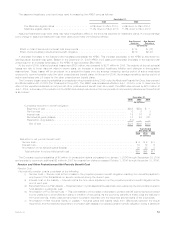

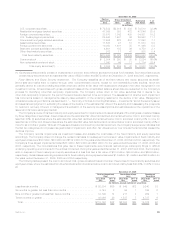

The following table summarizes the actual and target weighted-average allocations of other postretirement benefit plan assets within the

separate accounts:

2006 2005 2007

Weighted

Average

Actual

Allocation

Weighted

Average

Target

Allocation

December 31,

Asset Category

Equitysecurities ....................................................... 37% 42% 30%-45%

Fixedmaturities........................................................ 57% 53% 45%-70%

Other .............................................................. 6% 5% 0%-10%

Total ............................................................. 100% 100%

Target allocations of assets are determined with the objective of maximizing returns and minimizing volatility of net assets through

adequate asset diversification. Adjustments are made to target allocations based on an assessment of the impact of economic factors and

market conditions.

Funding and Cash Flows of Pension and Other Postretirement Benefit Plan Obligations

Pension Plan Obligations

It is the Subsidiaries’ practice to make contributions to the qualified pension plans to comply with minimum funding requirements of the

ERISA, as amended, and/or to maintain a fully funded ABO. In accordance with such practice, no contributions were required for the years

ended December 31, 2006 or 2005. No contributions will be required for 2007. The Subsidiaries elected to make discretionary

contributions to the qualified pension plans of $350 million for the year ended December 31, 2006. No contributions were made during

the year ended December 31, 2005. The Subsidiaries expect to make additional discretionary contributions of $150 million in 2007.

Benefit payments due under the non-qualified pension plans are funded from the Subsidiaries’ general assets as they become due

under the provision of the plans. These payments totaled $38 million and $35 million for the years ended December 31, 2006 and 2005,

respectively. These benefit payments are expected to be at approximately the same level in 2007.

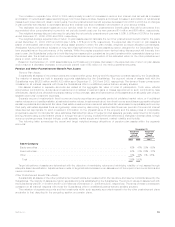

Gross pension benefit payments for the next ten years, which reflect expected future service as appropriate, are expected to be as

follows:

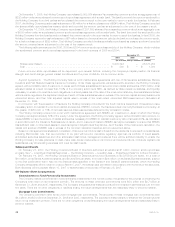

Pension

Benefits

(In millions)

2007................................................................... $ 337

2008................................................................... $ 349

2009................................................................... $ 367

2010................................................................... $ 372

2011................................................................... $ 385

2012-2016............................................................... $2,141

Other Postretirement Benefit Plan Obligations

Other postretirement benefits represent a non-vested, non-guaranteed obligation of the Subsidiaries and current regulations do not

require specific funding levels for these benefits. While the Subsidiaries have funded such plans in advance, it has been the Subsidiaries’

practice to use their general assets to pay claims as they come due in lieu of utilizing plan assets. These payments totaled $152 million and

$160 million for the years ended December 31, 2006 and 2005, respectively.

The Subsidiaries’ expect to make contributions of $132 million, based upon expected gross benefit payments, towards the other

postretirement plan obligations in 2007. As noted previously, the Subsidiaries expect to receive subsidies under the Prescription Drug Act

to partially offset such payments.

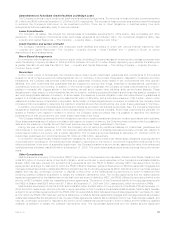

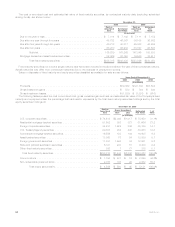

Gross other postretirement benefit payments for the next ten years, which reflect expected future service where appropriate, and gross

subsidies to be received under the Prescription Drug Act are expected to be as follows:

Gross

Benefits Prescription

Drug Subsidies Net

Benefits

(In millions)

2007................................................... $132 $(14) $118

2008................................................... $137 $(14) $123

2009................................................... $142 $(15) $127

2010................................................... $148 $(16) $132

2011................................................... $154 $(16) $138

2012-2016 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $837 $(98) $739

Insolvency Assessments

Most of the jurisdictions in which the Company is admitted to transact business require life insurers doing business within the

jurisdiction to participate in guaranty associations, which are organized to pay contractual benefits owed pursuant to insurance policies

issued by impaired, insolvent or failed life insurers. These associations levy assessments, up to prescribed limits, on all member insurers in

a particular state on the basis of the proportionate share of the premiums written by member insurers in the lines of business in which the

56 MetLife, Inc.