MetLife 2006 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

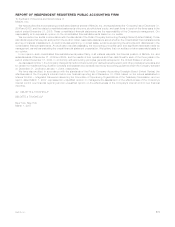

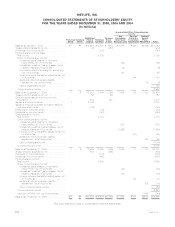

METLIFE, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

FOR THE YEARS ENDED DECEMBER 31, 2006, 2005 AND 2004

(In millions)

Preferred

Stock Common

Stock

Additional

Paid-in

Capital Retained

Earnings

Treasury

Stock

at Cost

Net

Unrealized

Investment

Gains (Losses)

Foreign

Currency

Translation

Adjustment

Defined

Benefit

Plans

Adjustment Total

Accumulated Other Comprehensive

Income

BalanceatJanuary1,2004 .............. $— $8 $14,991 $ 4,193 $ (835) $2,972 $(52) $(128) $21,149

Treasurystocktransactions,net ........... 46 (950) (904)

Dividendsoncommonstock.............. (343) (343)

Comprehensive income (loss):

Netincome....................... 2,758 2,758

Other comprehensive income:

Unrealized gains (losses) on derivative

instruments,netofincometax ........ (62) (62)

Unrealized investment gains (losses), net of

relatedoffsetsandincometax ........ (6) (6)

Cumulative effect of a change in accounting,

netofincometax................. 90 90

Foreign currency translation adjustments, net

ofincometax................... 144 144

Additional minimum pension liability

adjustment,netofincometax......... (2) (2)

Othercomprehensiveincome............. 164

Comprehensive income . . . ............ 2,922

Balance at December 31, 2004 ............ — 8 15,037 6,608 (1,785) 2,994 92 (130) 22,824

Treasurystocktransactions,net ........... 58 99 157

Common stock issued in connection with

acquisition........................ 283 727 1,010

Issuanceofpreferredstock .............. 1 2,042 2,043

Issuance of stock purchase contracts related to

commonequityunits ................. (146) (146)

Dividendsonpreferredstock ............. (63) (63)

Dividendsoncommonstock.............. (394) (394)

Comprehensive income:

Netincome....................... 4,714 4,714

Other comprehensive income:

Unrealized gains (losses) on derivative

instruments,netofincometax ........ 233 233

Unrealized investment gains (losses), net of

relatedoffsetsandincometax ........ (1,285) (1,285)

Foreign currency translation adjustments, net

ofincometax................... (81) (81)

Additional minimum pension liability

adjustment,netofincometax......... 89 89

Othercomprehensiveincome............. (1,044)

Comprehensive income . . . ............ 3,670

Balance at December 31, 2005 ............ 1 8 17,274 10,865 (959) 1,942 11 (41) 29,101

Treasurystocktransactions,net ........... 180 (398) (218)

Dividendsonpreferredstock ............. (134) (134)

Dividendsoncommonstock.............. (450) (450)

Comprehensive income:

Netincome....................... 6,293 6,293

Other comprehensive income:

Unrealized gains (losses) on derivative

instruments,netofincometax ........ (43) (43)

Unrealized investment gains (losses), net of

relatedoffsetsandincometax ........ (35) (35)

Foreign currency translation adjustments, net

ofincometax................... 46 46

Additional minimum pension liability

adjustment,netofincometax......... (18) (18)

Other comprehensive income .......... (50)

Comprehensive income . . . ............ 6,243

Adoption of SFAS 158, net of income tax . . . . (744) (744)

Balance at December 31, 2006 ............ $1 $8 $17,454 $16,574$(1,357) $1,864 $ 57 $(803) $33,798

See accompanying notes to consolidated financial statements.

F-4 MetLife, Inc.