MetLife 2006 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

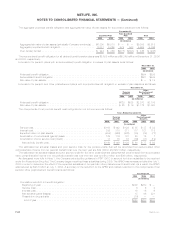

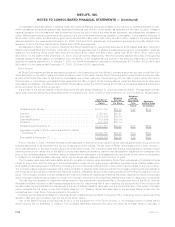

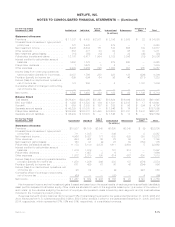

Compensation expense related to awards under the Incentive Plans is recognized based on the number of awards expected to vest,

which represents the awards granted less expected forfeitures over the life of the award, as estimated at the date of grant. Unless a

material deviation from the assumed rate is observed during the term in which the awards are expensed, any adjustment necessary to

reflect differences in actual experience is recognized in the period the award becomes payable or exercisable. Compensation expense of

$144 million, $120 million and $89 million, and income tax benefits of $50 million, $42 million and $31 million, related to the Incentive Plans

was recognized for the years ended December 31, 2006, 2005 and 2004, respectively. Compensation expense is principally related to the

issuance of Stock Options, Performance Shares and LTPCP arrangements.

As described in Note 1, the Company changed its policy prospectively for recognizing expense for stock-based awards to retirement

eligible employees. Had the Company continued to recognize expense over the stated requisite service period, compensation expense

related to the Incentive Plans would have been $116 million, $120 million and $89 million, rather than $144 million, $120 million and

$89 million, for the years ended December 31, 2006, 2005 and 2004, respectively. Had the Company applied the policy of recognizing

expense related to stock-based compensation over the shorter of the requisite service period or the period to attainment of retirement

eligibility for awards granted prior to January 1, 2006, pro forma compensation expense would have been $120 million, $122 million and

$94 million for the years ended December 31, 2006, 2005 and 2004, respectively.

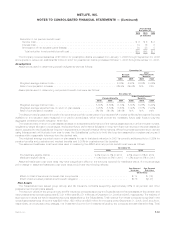

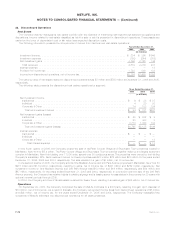

Stock Options

All Stock Options granted had an exercise price equal to the closing price of the Holding Company’s stock as reported on the New York

Stock Exchange on the date of grant, and have a maximum term of ten years. Certain Stock Options granted under the Stock Incentive Plan

and the 2005 Stock Plan have or will become exercisable over a three year period commencing with the date of grant, while other Stock

Options have or will become exercisable three years after the date of grant. Stock Options issued under the Directors Stock Plan were

exercisable immediately. The date at which a Stock Option issued under the 2005 Directors Stock Plan becomes exercisable is determined

at the time such Stock Option is granted.

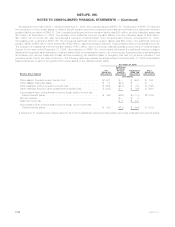

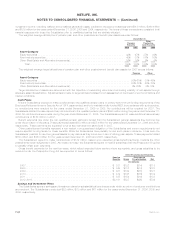

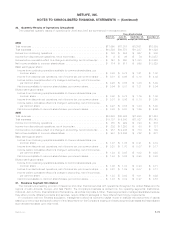

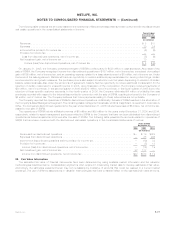

A summary of the activity related to Stock Options for the year ended December 31, 2006 is presented below. The aggregate intrinsic

value was computed using the closing share price on December 29, 2006 of $59.01 and December 30, 2005 of $49.00, as applicable.

Number of

Shares Under

Option

Weighted

Average

Exercise Price

Per Share

Weighted

Average

Remaining

Contractual

Term Aggregate

Intrinsic Value

(Years) (In millions)

Outstanding at January 1, . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,381,783 $31.83 6.92 $419

Granted . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3,758,955 $50.21

Exercised . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,754,390) $30.00

Cancelled/Expired . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (153,494) $32.04

Forfeited. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (341,403) $37.14

Outstanding at December 31, . . . . . . . . . . . . . . . . . . . . . . . . . . 24,891,451 $34.68 6.58 $606

Aggregate number of stock options expected to vest at

December 31, . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 24,390,157 $34.48 6.54 $598

Exercisable at December 31, . . . . . . . . . . . . . . . . . . . . . . . . . . 17,034,788 $30.66 5.72 $483

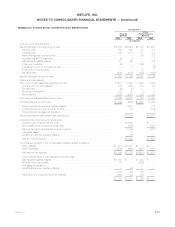

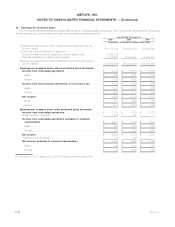

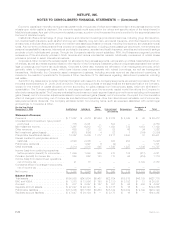

Prior to January 1, 2005, the Black-Scholes model was used to determine the fair value of Stock Options granted and recognized in the

financial statements or as reported in the pro forma disclosure which follows. The fair value of Stock Options issued on or after January 1,

2005 was estimated on the date of grant using a binomial lattice model. The Company made this change because lattice models produce

more accurate option values due to the ability to incorporate assumptions about grantee exercise behavior resulting from changes in the

price of the underlying shares. In addition, lattice models allow for changes in critical assumptions over the life of the option in comparison

to closed-form models like Black-Scholes, which require single-value assumptions at the time of grant.

The Company used daily historical volatility since the inception of trading when calculating Stock Option values using the Black-Scholes

model. In conjunction with the change to the binomial lattice model, the Company began estimating expected future volatility based upon

an analysis of historical prices of the Holding Company’s common stock and call options on that common stock traded on the open market.

The Company uses a weighted-average of the implied volatility for publicly traded call options with the longest remaining maturity nearest to

the money as of each valuation date and the historical volatility, calculated using monthly closing prices of the Holding Company’s common

stock. The Company chose a monthly measurement interval for historical volatility as it believes this better depicts the nature of employee

option exercise decisions being based on longer-term trends in the price of the underlying shares rather than on daily price movements.

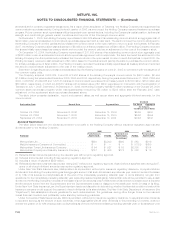

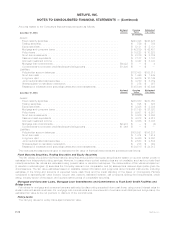

The risk-free rate is based on observed interest rates for instruments with maturities similar to the expected term of the Stock Options.

Whereas the Black-Scholes model requires a single spot rate for instruments with a term matching the expected life of the option at the

valuation date, the binomial lattice model allows for the use of different rates for each year over the contractual term of the option. The table

below presents the full range of imputed forward rates for U.S. Treasury Strips that was used in the binomial lattice model over the

contractual term of all Stock Options granted in the period.

Dividend yield is determined based on historical dividend distributions compared to the price of the underlying common stock as of the

valuation date and held constant over the life of the Stock Option.

Use of the Black-Scholes model requires an input of the expected life of the Stock Options, or the average number of years before

Stock Options will be exercised or expired. The Company estimated expected life using the historical average years to exercise or

F-68 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)