MetLife 2006 Annual Report Download - page 10

Download and view the complete annual report

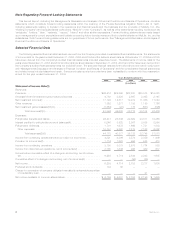

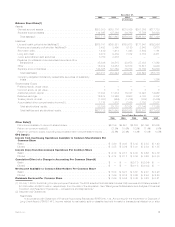

Please find page 10 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On September 1, 2005, the Company completed the acquisition of CitiStreet Associates, a division of CitiStreet LLC, which is primarily

involved in the distribution of annuity products and retirement plans to the education, healthcare, and not-for-profit markets, for $56 million,

of which $2 million was allocated to goodwill and $54 million to other identifiable intangibles, specifically the value of customer relationships

acquired, which has a weighted average amortization period of 16 years. CitiStreet Associates was integrated with MetLife Resources, a

focused distribution channel of MetLife, which is dedicated to provide retirement plans and financial services to the same markets.

On July 1, 2005, the Holding Company completed the acquisition of The Travelers Insurance Company, excluding certain assets, most

significantly, Primerica, from Citigroup Inc. (“Citigroup”), and substantially all of Citigroup’s international insurance businesses (collectively,

“Travelers”) for $12.1 billion. The results of Travelers’ operations were included in the Company’s financial statements beginning July 1,

2005. As a result of the acquisition, management of the Company increased significantly the size and scale of the Company’s core

insurance and annuity products and expanded the Company’s presence in both the retirement & savings’ domestic and international

markets. The distribution agreements executed with Citigroup as part of the acquisition provide the Company with one of the broadest

distribution networks in the industry. The initial consideration paid by the Holding Company for the acquisition consisted of $10.9 billion in

cash and 22,436,617 shares of the Holding Company’s common stock with a market value of $1.0 billion to Citigroup and $100 million in

other transaction costs. Additional consideration of $115 million was paid by the Holding Company to Citigroup in 2006 as a result of the

finalization by both parties of their review of the June 30, 2005 financial statements and final resolution as to the interpretation of the

provisions of the acquisition agreement. In addition to cash on-hand, the purchase price was financed through the issuance of common

stock, debt securities, common equity units and preferred stock. See “— Liquidity and Capital Resources — The Holding Company —

Liquidity Sources.”

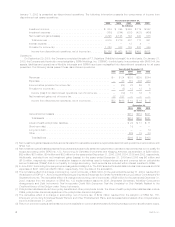

On January 31, 2005, the Company completed the sale of SSRM to a third party for $328 million in cash and stock. As a result of the

sale of SSRM, the Company recognized income from discontinued operations of $157 million, net of income tax, comprised of a realized

gain of $165 million, net of income tax, and an operating expense related to a lease abandonment of $8 million, net of income tax. Under

the terms of the sale agreement, MetLife will have an opportunity to receive additional payments based on, among other things, certain

revenue retention and growth measures. The purchase price is also subject to reduction over five years, depending on retention of certain

MetLife-related business. Also under the terms of such agreement, MetLife had the opportunity to receive additional consideration for the

retention of certain customers for a specific period in 2005. Upon finalization of the computation, the Company received payments of

$30 million, net of income tax, in the second quarter of 2006 and $12 million, net of income tax, in the fourth quarter of 2005 due to the

retention of these specific customer accounts. In the fourth quarter of 2006, the Company eliminated $4 million of a liability that was

previously recorded with respect to the indemnities provided in connection with the sale of SSRM, resulting in a benefit to the Company of

$2 million, net of income tax. The Company believes that future payments relating to these indemnities are not probable. The Company

reported the operations of SSRM in discontinued operations. Additionally, the sale of SSRM resulted in the elimination of the Company’s

Asset Management segment. The remaining asset management business, which is insignificant, is reported in Corporate & Other. The

Company’s discontinued operations for the year ended December 31, 2005 included expenses of $6 million, net of income tax, related to

thesaleofSSRM.

Industry Trends

The Company’s segments continue to be influenced by a variety of trends that affect the industry.

Financial Environment. The level of long-term interest rates and the shape of the yield curve can have a negative impact on the

demand for and the profitability of spread-based products such as fixed annuities, guaranteed interest contracts (“GICs”) and universal life

insurance. A flat or inverted yield curve and low long-term interest rates will be a concern until new money rates on corporate bonds are

higher than overall life insurer investment portfolio yields. Equity market performance can also impact the profitability of life insurers, as

product demand and fee revenue from variable annuities and fee revenue from pension products tied to separate account balances often

reflect equity market performance.

Steady Economy. A steady economy provides improving demand for group insurance and retirement & savings-type products. Group

insurance premium growth, with respect to life and disability products, for example, is closely tied to employers’ total payroll growth.

Additionally, the potential market for these products is expanded by new business creation. Bond portfolio credit losses continue close to

low historical levels due to the steady economy.

Demographics. In the coming decade, a key driver shaping the actions of the life insurance industry will be the rising income

protection, wealth accumulation and needs of the retiring Baby Boomers. As a result of increasing longevity, retirees will need to

accumulate sufficient savings to finance retirements that may span 30 or more years. Helping the Baby Boomers to accumulate assets for

retirement and subsequently to convert these assets into retirement income represents an opportunity for the life insurance industry.

Life insurers are well positioned to address the Baby Boomers’ rapidly increasing need for savings tools and for income protection. The

Company believes that, among life insurers, those with strong brands, high financial strength ratings and broad distribution, are best

positioned to capitalize on the opportunity to offer income protection products to Baby Boomers.

Moreover, the life insurance industry’s products and the needs they are designed to address are complex. The Company believes that

individuals approaching retirement age will need to seek information to plan for and manage their retirements and that, in the workplace, as

employees take greater responsibility for their benefit options and retirement planning, they will need information about their possible

individual needs. One of the challenges for the life insurance industry will be the delivery of this information in a cost effective manner.

Competitive Pressures. The life insurance industry remains highly competitive. The product development and product life-cycles have

shortened in many product segments, leading to more intense competition with respect to product features. Larger companies have the

ability to invest in brand equity, product development, technology and risk management, which are among the fundamentals for sustained

profitable growth in the life insurance industry. In addition, several of the industry’s products can be quite homogeneous and subject to

intense price competition. Sufficient scale, financial strength and financial flexibility are becoming prerequisites for sustainable growth in

7MetLife, Inc.