MetLife 2006 Annual Report Download - page 159

Download and view the complete annual report

Please find page 159 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

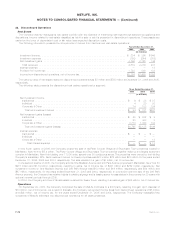

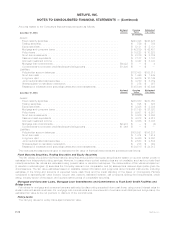

22. Discontinued Operations

Real Estate

The Company actively manages its real estate portfolio with the objective of maximizing earnings through selective acquisitions and

dispositions. Income related to real estate classified as held-for-sale or sold is presented in discontinued operations. These assets are

carried at the lower of depreciated cost or fair value less expected disposition costs.

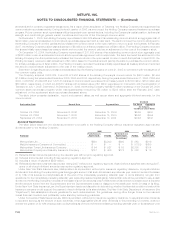

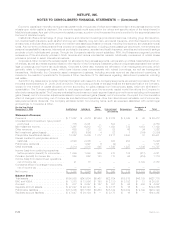

The following information presents the components of income from discontinued real estate operations:

2006 2005 2004

Years Ended December 31,

(In millions)

Investmentincome..................................................... $ 234 $ 395 $649

Investmentexpense.................................................... (150) (244) (388)

Netinvestmentgains ................................................... 4,795 2,125 146

Totalrevenues ...................................................... 4,879 2,276 407

Interestexpense ...................................................... — — 13

Provisionforincometax ................................................. 1,723 808 138

Incomefromdiscontinuedoperations,netofincometax............................. $3,156 $1,468 $256

The carrying value of real estate related to discontinued operations was $7 million and $755 million at December 31, 2006 and 2005,

respectively.

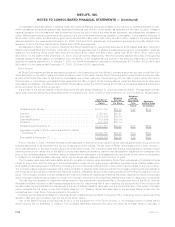

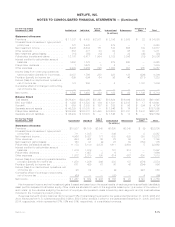

The following table presents the discontinued real estate operations by segment:

2006 2005 2004

Years Ended December 31,

(In millions)

Net investment income

Institutional......................................................... $ 6 $ 28 $ 37

Individual.......................................................... 4 20 30

Corporate&Other .................................................... 74 103 194

Totalnetinvestmentincome ............................................ $ 84 $ 151 $261

Net investment gains (losses)

Institutional......................................................... $ 58 $ 242 $ 9

Individual.......................................................... 23 443 3

Corporate&Other .................................................... 4,714 1,440 134

Totalnetinvestmentgains(losses) ........................................ $4,795 $2,125 $146

Interest expense

Institutional......................................................... $ — $ — $ —

Individual.......................................................... — — —

Corporate&Other .................................................... — — 13

Totalinterestexpense............................................... $ — $ — $ 13

In the fourth quarter of 2006, the Company closed the sale of its Peter Cooper Village and Stuyvesant Town properties located in

Manhattan, New York for $5.4 billion. The Peter Cooper Village and Stuyvesant Town properties together make up the largest apartment

complex in Manhattan, New York totaling over 11,000 units, spread over 80 contiguous acres. The properties were owned by the Holding

Company’s subsidiary, MTL. Net investment income on these properties was $73 million, $72 million and $70 million for the years ended

December 31, 2006, 2005 and 2004, respectively. The sale resulted in a gain of $3 billion, net of income tax.

In the second quarter of 2005, the Company sold its One Madison Avenue and 200 Park Avenue properties in Manhattan, New York for

$918 million and $1.72 billion, respectively, resulting in gains, net of income tax, of $431 million and $762 million, respectively. Net

investment income on One Madison Avenue and 200 Park Avenue was $13 million and $16 million, respectively, and $44 million and

$67 million, respectively, for the years ended December 31, 2005 and 2004, respectively. In connection with the sale of the 200 Park

Avenue property, the Company has retained rights to existing signage and is leasing space for associates in the property for 20 years with

optional renewal periods through 2205.

In 2004, the Company sold one of its real estate investments, Sears Tower, resulting in a realized gain of $85 million, net of income tax.

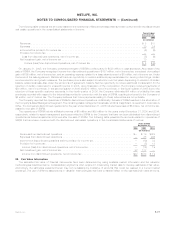

Operations

On September 29, 2005, the Company completed the sale of MetLife Indonesia to a third party, resulting in a gain upon disposal of

$10 million, net of income tax. As a result of this sale, the Company recognized income (loss) from discontinued operations of $5 million

and ($9) million, net of income tax, for the years ended December 31, 2005 and 2004, respectively. The Company reclassified the

operations of MetLife Indonesia into discontinued operations for all years presented.

F-76 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)