MetLife 2006 Annual Report Download - page 64

Download and view the complete annual report

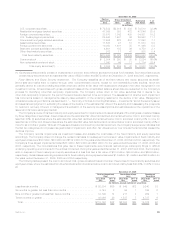

Please find page 64 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.by the exchange of a contract for a new contract, or by amendment, endorsement, or rider to a contract, or by the election of a feature or

coverage within a contract. It is effective for internal replacements occurring in fiscal years beginning after December 15, 2006.

In addition, in February 2007 related TPAs were issued by the AICPA to provide further clarification of SOP 05-1. The TPAs are effective

concurrently with the adoption of the SOP. Based on the Company’s interpretation of SOP 05-1 and related TPAs, the adoption of SOP 05-1

will result in a reduction to DAC and VOBA relating primarily to the Company’s group life and health insurance contracts that contain certain

rate reset provisions. The Company estimates that the adoption of SOP 05-1 as of January 1, 2007 will result in a cumulative effect

adjustment of between $275 million and $310 million, net of income tax, which will be recorded as a reduction to retained earnings. In

addition, the Company estimates that accelerated DAC and VOBA amortization will reduce 2007 net income by approximately $25 million

to $35 million, net of income tax.

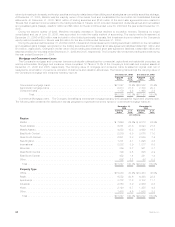

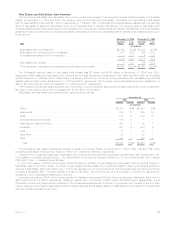

Investments

The Company’s primary investment objective is to optimize, net of income tax, risk-adjusted investment income and risk-adjusted total

return while ensuring that assets and liabilities are managed on a cash flow and duration basis. The Company is exposed to three primary

sources of investment risk:

• credit risk, relating to the uncertainty associated with the continued ability of a given obligor to make timely payments of principal and

interest;

• interest rate risk, relating to the market price and cash flow variability associated with changes in market interest rates; and

• market valuation risk.

The Company manages risk through in-house fundamental analysis of the underlying obligors, issuers, transaction structures and real

estate properties. The Company also manages credit risk and market valuation risk through industry and issuer diversification and asset

allocation. For real estate and agricultural assets, the Company manages credit risk and market valuation risk through geographic, property

type and product type diversification and asset allocation. The Company manages interest rate risk as part of its asset and liability

management strategies; product design, such as the use of market value adjustment features and surrender charges; and proactive

monitoring and management of certain non-guaranteed elements of its products, such as the resetting of credited interest and dividend

rates for policies that permit such adjustments. The Company also uses certain derivative instruments in the management of credit and

interest rate risks.

61MetLife, Inc.