MetLife 2006 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

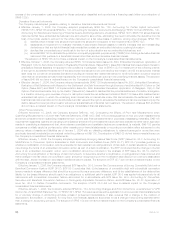

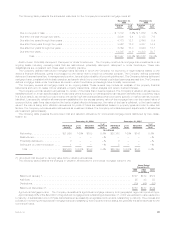

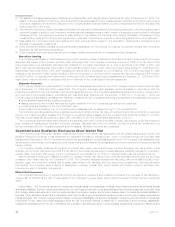

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized

Cost Gross Unrealized

Loss Number of

Securities

December 31, 2005

(In millions, except number of securities)

Lessthansixmonths .................................. $ 92,512 $213 $1,707 $51 11,441 308

Sixmonthsorgreaterbutlessthanninemonths................. 3,704 5 108 2 456 7

Ninemonthsorgreaterbutlessthantwelvemonths .............. 5,006 — 133 — 573 2

Twelvemonthsorgreater................................ 7,555 23 240 5 924 8

Total............................................ $108,777 $241 $2,188 $58 13,394 325

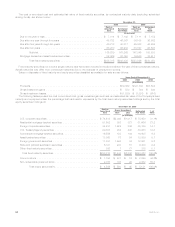

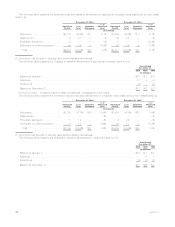

At December 31, 2006 and 2005, $2.4 billion and $2.2 billion, respectively, of unrealized losses related to securities with an unrealized

loss position of less than 20% of cost or amortized cost, which represented 2% of the cost or amortized cost of such securities.

At December 31, 2006, $24 million of unrealized losses related to securities with an unrealized loss position of 20% or more of cost or

amortized cost, which represented 29% of the cost or amortized cost of such securities. Of such unrealized losses of $24 million,

$12 million related to securities that were in an unrealized loss position for a period of less than six months. At December 31, 2005,

$58 million of unrealized losses related to securities with an unrealized loss position of 20% or more of cost or amortized cost, which

represented 24% of the cost or amortized cost of such securities. Of such unrealized losses of $58 million, $51 million related to securities

that were in an unrealized loss position for a period of less than six months.

The Company held eight fixed maturity securities and equity securities each with a gross unrealized loss at December 31, 2006 each

greater than $10 million. These securities represented 7%, or $169 million in the aggregate, of the gross unrealized loss on fixed maturity

securities and equity securities. The Company held one fixed maturity security with a gross unrealized loss at December 31, 2005 greater

than $10 million. This security represented less than 1%, or $10 million of the gross unrealized loss on fixed maturity and equity securities.

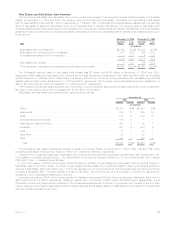

At December 31, 2006 and 2005, the Company had $2.4 billion and $2.2 billion, respectively, of gross unrealized loss related to its

fixed maturity and equity securities. These securities are concentrated, calculated as a percentage of gross unrealized loss, as follows:

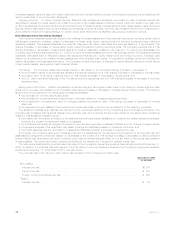

2006 2005

December 31,

Sector:

U.S.corporatesecurities.......................................................... 43% 37%

Residentialmortgage-backedsecurities ................................................ 14 21

Foreigncorporatesecurities........................................................ 16 20

U.S.Treasury/agencysecurities ..................................................... 10 4

Commercialmortgage-backedsecurities................................................ 6 9

Other....................................................................... 11 9

Total.................................................................. 100% 100%

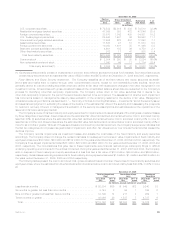

Industry:

Industrial .................................................................... 23% 22%

Mortgage-backed............................................................... 20 30

Government .................................................................. 12 5

Finance ..................................................................... 11 11

Utility....................................................................... 10 6

Other....................................................................... 24 26

Total.................................................................. 100% 100%

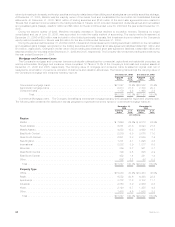

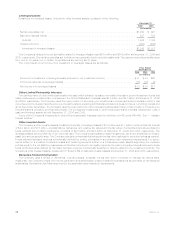

As described previously, the Company performs a regular evaluation, on a security-by-security basis, of its investment holdings in

accordance with its impairment policy in order to evaluate whether such securities are other-than-temporarily impaired. One of the criteria

which the Company considers in its other-than-temporary impairment analysis is its intent and ability to hold securities for a period of time

sufficient to allow for the recovery of their value to an amount equal to or greater than cost or amortized cost. The Company’s intent and

ability to hold securities considers broad portfolio management objectives such as asset/liability duration management, issuer and industry

segment exposures, interest rate views and the overall total return focus. In following these portfolio management objectives, changes in

facts and circumstances that were present in past reporting periods may trigger a decision to sell securities that were held in prior reporting

periods. Decisions to sell are based on current conditions or the Company’s need to shift the portfolio to maintain its portfolio management

objectives including liquidity needs or duration targets on asset/liability managed portfolios. The Company attempts to anticipate these

types of changes and if a sale decision has been made on an impaired security and that security is not expected to recover prior to the

expected time of sale, the security will be deemed other-than-temporarily impaired in the period that the sale decision was made and an

other-than-temporary impairment loss will be recognized.

Based upon the Company’s current evaluation of the securities in accordance with its impairment policy, the cause of the decline being

principally attributable to the general rise in rates during the holding period, and the Company’s current intent and ability to hold the fixed

maturity and equity securities with unrealized losses for a period of time sufficient for them to recover, the Company has concluded that the

aforementioned securities are not other-than-temporarily impaired.

66 MetLife, Inc.