MetLife 2006 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

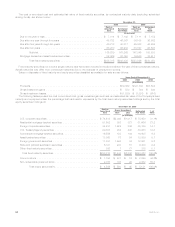

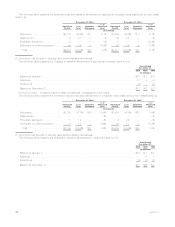

Leveraged Leases

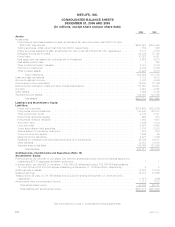

Investment in leveraged leases, included in other invested assets, consisted of the following:

2006 2005

December 31,

(In millions)

Rentalreceivables,net........................................................ $1,055 $ 991

Estimatedresidualvalues ...................................................... 887 735

Subtotal................................................................ 1,942 1,726

Unearnedincome ........................................................... (694) (645)

Investmentinleveragedleases ................................................. $1,248 $1,081

The Company’s deferred income tax liability related to leveraged leases was $670 million and $679 million at December 31, 2006 and

2005, respectively. The rental receivables set forth above are generally due in periodic installments. The payment periods generally range

from one to 15 years, but in certain circumstances are as long as 30 years.

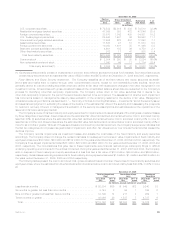

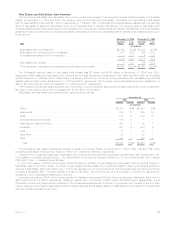

The components of net income from investment in leveraged leases are as follows:

2006 2005 2004

Years Ended

December 31,

(In millions)

Incomefrominvestmentinleveragedleases(includedinnetinvestmentincome) ................. $51 $54 $26

Incometaxexpenseonleveragedleases........................................... (18) (19) (9)

Netincomefromleveragedleases ............................................... $33 $35 $17

Other Limited Partnership Interests

The carrying value of other limited partnership interests (which primarily represent ownership interests in pooled investment funds that

make private equity investments in companies in the United States and overseas) was $4.8 billion and $4.3 billion at December 31, 2006

and 2005, respectively. The Company uses the equity method of accounting for investments in limited partnership interests in which it has

more than a minor interest, has influence over the partnership’s operating and financial policies, but does not have a controlling interest and

is not the primary beneficiary. The Company uses the cost method for minor interest investments and when it has virtually no influence over

the partnership’s operating and financial policies. The Company’s investments in other limited partnership interests represented 1.4% of

cash and invested assets at both December 31, 2006 and 2005.

Some of the Company’s investments in other limited partnership interests meet the definition of a VIE under FIN 46(r). See “— Variable

Interest Entities.”

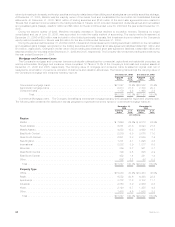

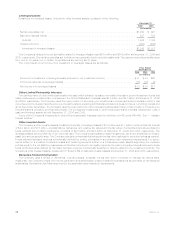

Other Invested Assets

The Company’s other invested assets consisted principally of leveraged leases of $1.3 billion and $1.1 billion, funds withheld at interest

of $4.0 billion and $3.5 billion, and standalone derivatives with positive fair values and the fair value of embedded derivatives related to

funds withheld and modified coinsurance contracts of $2.5 billion and $2.0 billion at December 31, 2006 and 2005, respectively. The

leveraged leases are recorded net of non-recourse debt. The Company participates in lease transactions, which are diversified by industry,

asset type and geographic area. The Company regularly reviews residual values and writes down residuals to expected values as needed.

Funds withheld represent amounts contractually withheld by ceding companies in accordance with reinsurance agreements. For agree-

ments written on a modified coinsurance basis and certain agreements written on a coinsurance basis, assets supporting the reinsured

policies equal to the net statutory reserves are withheld and continue to be legally owned by the ceding company. Interest accrues to these

funds withheld at rates defined by the treaty terms and may be contractually specified or directly related to the investment portfolio. The

Company’s other invested assets represented 3.1% and 2.6% of cash and invested assets at December 31, 2006 and 2005, respectively.

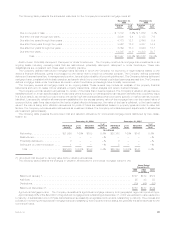

Derivative Financial Instruments

The Company uses a variety of derivatives, including swaps, forwards, futures and option contracts, to manage its various risks.

Additionally, the Company enters into income generation and synthetically created investment transactions as permitted by its insurance

subsidiaries’ Derivatives Use Plans approved by the applicable state insurance departments.

72 MetLife, Inc.