MetLife 2006 Annual Report Download - page 148

Download and view the complete annual report

Please find page 148 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

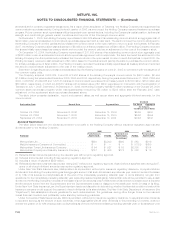

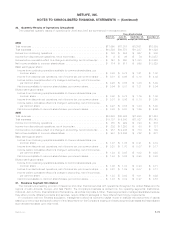

17. Equity

Preferred Stock

On September 29, 1999, the Holding Company adopted a stockholder rights plan (the “rights plan”) under which each outstanding

share of common stock issued between April 4, 2000 and the distribution date (as defined in the rights plan) will be coupled with a

stockholder right. Each right will entitle the holder to purchase one one-hundredth of a share of Series A Junior Participating Preferred

Stock. Each one one-hundredth of a share of Series A Junior Participating Preferred Stock will have economic and voting terms equivalent

to one share of common stock. Until it is exercised, the right itself will not entitle the holder thereof to any rights as a stockholder, including

the right to receive dividends or to vote at stockholder meetings.

Stockholder rights are not exercisable until the distribution date, and will expire at the close of business on April 4, 2010, unless earlier

redeemed or exchanged by the Holding Company. The rights plan is designed to protect stockholders in the event of unsolicited offers to

acquire the Holding Company and other coercive takeover tactics.

In connection with financing the acquisition of Travelers on July 1, 2005, which is more fully described in Note 2, the Holding Company

issued preferred shares as follows:

On June 13, 2005, the Holding Company issued 24 million shares of Floating Rate Non-Cumulative Preferred Stock, Series A

(the “Series A preferred shares”) with a $0.01 par value per share, and a liquidation preference of $25 per share, for aggregate

proceeds of $600 million.

On June 16, 2005, the Holding Company issued 60 million shares of 6.50% Non-Cumulative Preferred Stock, Series B (the

“Series B preferred shares”), with a $0.01 par value per share, and a liquidation preference of $25 per share, for aggregate proceeds

of $1.5 billion.

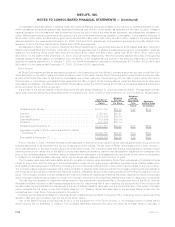

The Series A and Series B preferred shares (the “Preferred Shares”) rank senior to the common stock with respect to dividends and

liquidation rights. Dividends on the Preferred Shares are not cumulative. Holders of the Preferred Shares will be entitled to receive dividend

payments only when, as and if declared by the Holding Company’s Board of Directors or a duly authorized committee of the board. If

dividends are declared on the Series A preferred shares, they will be payable quarterly, in arrears, at an annual rate of the greater of:

(i) 1.00% above three-month LIBOR on the related LIBOR determination date; or (ii) 4.00%. Any dividends declared on the Series B

preferred shares will be payable quarterly, in arrears, at an annual fixed rate of 6.50%. Accordingly, in the event that dividends are not

declared on the Preferred Shares for payment on any dividend payment date, then those dividends will cease to accrue and be payable. If a

dividend is not declared before the dividend payment date, the Holding Company has no obligation to pay dividends accrued for that

dividend period whether or not dividends are declared and paid in future periods. No dividends may, however, be paid or declared on the

Holding Company’s common stock — or any other securities ranking junior to the Preferred Shares — unless the full dividends for the latest

completed dividend period on all Preferred Shares, and any parity stock, have been declared and paid or provided for.

The Holding Company is prohibited from declaring dividends on the Preferred Shares if it fails to meet specified capital adequacy, net

income and shareholders’ equity levels. In addition, under Federal Reserve Board policy, the Holding Company may not be able to pay

dividends if it does not earn sufficient operating income.

The Preferred Shares do not have voting rights except in certain circumstances where the dividends have not been paid for an

equivalent of six or more dividend payment periods whether or not those periods are consecutive. Under such circumstances, the holders

of the Preferred Shares have certain voting rights with respect to members of the Board of Directors of the Holding Company.

The Preferred Shares are not subject to any mandatory redemption, sinking fund, retirement fund, purchase fund or similar provisions.

The Preferred Shares are redeemable, but not prior to September 15, 2010. On and after that date, subject to regulatory approval, the

Preferred Shares will be redeemable at the Holding Company’s option in whole or in part, at a redemption price of $25 per Preferred Share,

plus declared and unpaid dividends.

In connection with the offering of the Preferred Shares, the Holding Company incurred $56.8 million of issuance costs which have been

recorded as a reduction of additional paid-in capital.

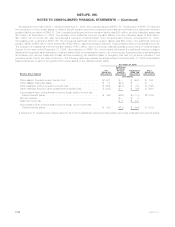

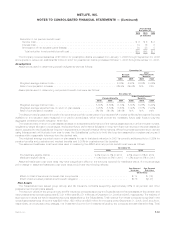

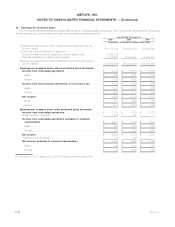

Information on the declaration, record and payment dates, as well as per share and aggregate dividend amounts, for the Preferred

Shares is as follows:

Declaration Date Record Date Payment Date Series A

Per Share Series A

Aggregate Series B

Per Share Series B

Aggregate

Dividend

(In millions, except per share data)

November 15, 2006 . . . . . . . . . . . . . November 30, 2006 December 15, 2006 $0.4038125 $10 $0.4062500 $24

August 15, 2006 . . . . . . . . . . . . . . . August 31, 2006 September 15, 2006 $0.4043771 $10 $0.4062500 $24

May 16, 2006 . . . . . . . . . . . . . . . . . May 31, 2006 June 15, 2006 $0.3775833 $ 9 $0.4062500 $24

March 6, 2006 . . . . . . . . . . . . . . . . . February 28, 2006 March 15, 2006 $0.3432031 $ 9 $0.4062500 $24

November 15, 2005 . . . . . . . . . . . . . November 30, 2005 December 15, 2005 $0.3077569 $ 8 $0.4062500 $24

August 22, 2005 . . . . . . . . . . . . . . . August 31, 2005 September 15, 2005 $0.2865690 $ 7 $0.4017361 $24

See Note 24 for further information.

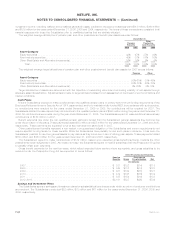

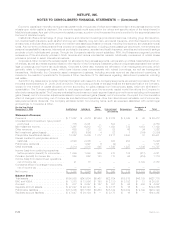

Common Stock

On October 26, 2004, the Holding Company’s Board of Directors authorized a $1 billion common stock repurchase program. On

February 27, 2007, the Holding Company’s Board of Directors authorized an additional $1 billion common stock repurchase program.

Upon the date of this authorization, the amount remaining under these repurchase programs is approximately $1.2 billion. Under these

authorizations, the Holding Company may purchase its common stock from the MetLife Policyholder Trust, in the open market (including

pursuant to the terms of a pre-set trading plan meeting the requirements of Rule 10b5-1 under the Securities Exchange Act of 1934, as

F-65MetLife, Inc.

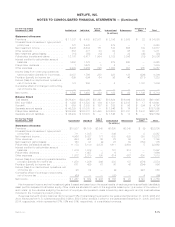

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)