MetLife 2006 Annual Report Download - page 162

Download and view the complete annual report

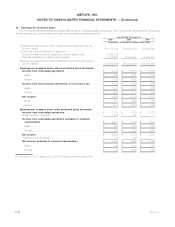

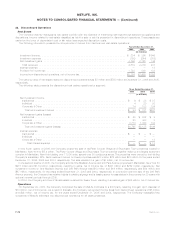

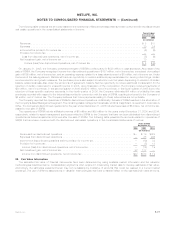

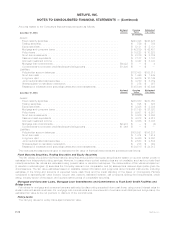

Please find page 162 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash and Cash Equivalents and Short-term Investments

The carrying values for cash and cash equivalents and short-term investments approximated fair values due to the short-term maturities

of these instruments.

Accrued Investment Income

The carrying value for accrued investment income approximates fair value.

Policyholder Account Balances

The fair value of PABs which have final contractual maturities are estimated by discounting expected future cash flows based upon

interest rates currently being offered for similar contracts with maturities consistent with those remaining for the agreements being valued.

The fair value of PABs without final contractual maturities are assumed to equal their current net surrender value.

Short-term and Long-term Debt, Junior Subordinated Debt Securities and Shares Subject to Mandatory Redemption

The fair values of short-term and long-term debt, junior subordinated debt securities,and shares subject to mandatory redemption are

determined by discounting expected future cash flows using risk rates currently available for debt with similar terms and remaining

maturities.

Payables for Collateral Under Securities Loaned and Other Transactions

The carrying value for payables for collateral under securities loaned and other transactions approximate fair value.

Derivative Financial Instruments

The fair value of derivative financial instruments, including financial futures, financial forwards, interest rate, credit default and foreign

currency swaps, foreign currency forwards, caps, floors, and options are based upon quotations obtained from dealers or other reliable

sources. See Note 4 for derivative fair value disclosures.

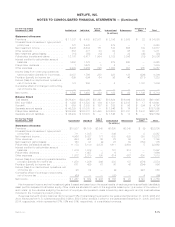

24. Subsequent Events

On February 27, 2007, the Holding Company’s Board of Directors authorized an additional $1 billion common stock repurchase

program. See Note 17 for further information.

On February 16, 2007, the Holding Company’s Board of Directors announced dividends of $0.3975000 per share, for a total of

$10 million, on its Series A preferred shares, and $0.4062500 per share, for a total of $24 million, on its Series B preferred shares, subject

to the final confirmation that it has met the financial tests specified in the Series A and Series B preferred shares, which the Holding

Company anticipates will be made on or about March 5, 2007, the earliest date permitted in accordance with the terms of the securities.

Both dividends will be payable March 15, 2007 to shareholders of record as of February 28, 2007.

F-79MetLife, Inc.

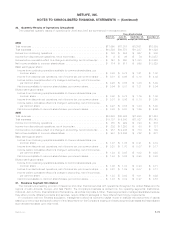

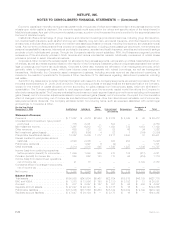

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)