MetLife 2006 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

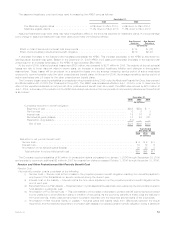

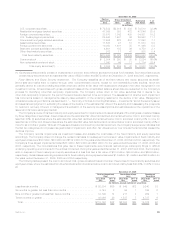

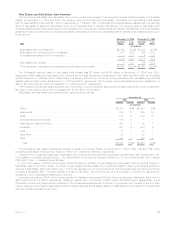

(2) Fixed maturity securities include $759 million and $825 million in ending carrying value and $71 million and $14 million of investment

income related to trading securities for the years ended December 31, 2006 and 2005, respectively. The Company did not have any

trading securities during the year ended December 31, 2004.

(3) Investment income from mortgage and consumer loans includes prepayment fees.

(4) Included in investment income from real estate and real estate joint ventures is $84 million, $151 million and $261 million of gains related to

discontinued operations for the years ended December 31, 2006, 2005 and 2004, respectively. Included in investment gains (losses)

from real estate and real estate joint ventures is $4.8 billion, $2.1 billion and $146 million of gains related to discontinued operations for the

years ended December 31, 2006, 2005 and 2004, respectively.

(5) Included in investment income from other invested assets are scheduled periodic settlement payments on derivative instruments that do

not qualify for hedge accounting under SFAS 133 of $290 million, $99 million and $51 million for the years ended December 31, 2006,

2005 and 2004, respectively. These amounts are excluded from investment gains (losses). Additionally, excluded from investment gains

(losses) is $6 million and ($13) million for the years ended December 31, 2006 and 2005, respectively, related to settlement payments on

derivatives used to hedge interest rate and currency risk on PABs that do not qualify for hedge accounting. Such amounts are included

within interest credited to policyholder account balances.

(6) Included in investment gains (losses) from other invested assets for the year ended December 31, 2004 is a charge of $26 million related

to a funds withheld reinsurance treaty that was converted to a coinsurance agreement. This amount is classified in investment income in

the consolidated statements of income.

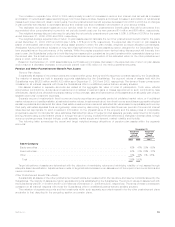

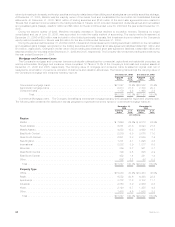

Fixed Maturity and Equity Securities Available-for-Sale

Fixed maturity securities consisted principally of publicly traded and privately placed debt securities, and represented 73% and 75% of

total cash and invested assets at December 31, 2006 and 2005, respectively. Based on estimated fair value, public fixed maturity

securities represented $210.6 billion, or 87%, and $200.2 billion, or 87%, of total fixed maturity securities at December 31, 2006 and

2005, respectively. Based on estimated fair value, private fixed maturity securities represented $32.8 billion, or 13%, and $29.9 billion, or

13%, of total fixed maturity securities at December 31, 2006 and 2005, respectively.

In cases where quoted market prices are not available, fair values are estimated using present value or valuation techniques. The fair

value estimates are made at a specific point in time, based on available market information and judgments about the financial instruments,

including estimates of the timing and amounts of expected future cash flows and the credit standing of the issuer or counterparty. Factors

considered in estimating fair value include: coupon rate, maturity, estimated duration, call provisions, sinking fund requirements, credit

rating, industry sector of the issuer and quoted market prices of comparable securities.

The Securities Valuation Office of the NAIC evaluates the fixed maturity investments of insurers for regulatory reporting purposes and

assigns securities to one of six investment categories called “NAIC designations.” The NAIC ratings are similar to the rating agency

designations of the Nationally Recognized Statistical Rating Organizations (“NRSROs”) for marketable bonds. NAIC ratings 1 and 2 include

bonds generally considered investment grade (rated “Baa3” or higher by Moody’s, or rated “BBB-” or higher by Standard & Poor’s (“S&P”)

and Fitch Ratings Insurance Group (“Fitch”)), by such rating organizations. NAIC ratings 3 through 6 include bonds generally considered

below investment grade (rated “Ba1” or lower by Moody’s, or rated “BB+” or lower by S&P and Fitch).

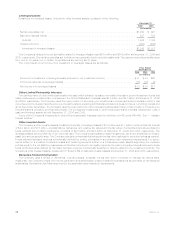

The following table presents the Company’s total fixed maturity securities by NRSRO designation and the equivalent ratings of the NAIC,

as well as the percentage, based on estimated fair value, that each designation is comprised of at:

NAIC

Rating Rating Agency Designation(1)

Cost or

Amortized

Cost Estimated

Fair Value %of

Total

Cost or

Amortized

Cost Estimated

Fair Value %of

Total

December 31, 2006 December 31, 2005

(In millions)

1 Aaa/Aa/A . . . . . . . . . . . . . . . . . . . . . . . . . . . $175,400 $178,915 73.5% $161,427 $165,748 72.0%

2 Baa . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46,217 47,189 19.4 47,720 49,132 21.4

3 Ba ............................... 9,403 9,806 4.0 8,807 9,154 4.0

4 B................................ 6,913 7,125 2.9 5,667 5,711 2.5

5 Caaandlower........................ 370 377 0.2 287 290 0.1

6 Inorneardefault...................... 12 16 — 18 15 —

Total fixed maturity securities . . . . . . . . . . . . . . $238,315 $243,428 100.0% $223,926 $230,050 100.0%

(1) Amounts presented are based on rating agency designations. Comparisons between NAIC ratings and rating agency designations are

published by the NAIC. The rating agency designations are based on availability and the midpoint of the applicable ratings among

Moody’s, S&P and Fitch. Beginning in the third quarter of 2005, the Company incorporated Fitch into its rating agency designations to be

consistent with the Lehman Brothers’ ratings convention. If no rating is available from a rating agency, then the MetLife rating is used.

The Company held fixed maturity securities at estimated fair values that were below investment grade or not rated by an independent

rating agency that totaled $17.3 billion and $15.2 billion at December 31, 2006 and 2005, respectively. These securities had a net

unrealized gain of $627 million and $392 million at December 31, 2006 and 2005, respectively. Non-income producing fixed maturity

securities were $16 million and $15 million at December 31, 2006 and 2005, respectively. Unrealized gains (losses) associated with non-

income producing fixed maturity securities were $4 million and ($3) million at December 31, 2006 and 2005, respectively.

63MetLife, Inc.