MetLife 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

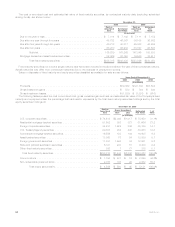

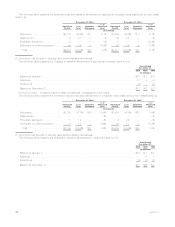

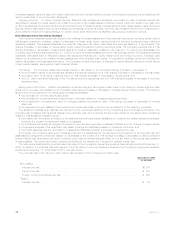

Real Estate and Real Estate Joint Ventures

The Company’s real estate and real estate joint venture investments consist of commercial properties located primarily in the United

States. At December 31, 2006 and 2005, the carrying value of the Company’s real estate, real estate joint ventures and real estate

held-for-sale was $5.0 billion and $4.7 billion, respectively, or 1.5% and 1.5%, of total cash and invested assets, respectively. The carrying

value of real estate is stated at depreciated cost net of impairments and valuation allowances. The carrying value of real estate joint

ventures is stated at the Company’s equity in the real estate joint ventures net of impairments and valuation allowances. The following table

presents the carrying value of the Company’s real estate, real estate joint ventures, real estate held-for-sale and real estate acquired upon

foreclosure at:

Type Carrying

Value %of

Total Carrying

Value %of

Total

December 31, 2006 December 31, 2005

(In millions)

Realestateheld-for-investment ...................................... $3,499 70.2% $2,980 63.9%

Realestatejointventuresheld-for-investment............................. 1,477 29.6 926 19.8

Foreclosedrealestateheld-for-investment............................... 3 0.1 4 0.1

4,979 99.9 3,910 83.8

Realestateheld-for-sale........................................... 7 0.1 755 16.2

Total real estate, real estate joint ventures and real estate held-for-sale . . . . . . . . . . . . $4,986 100.0% $4,665 100.0%

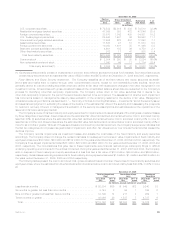

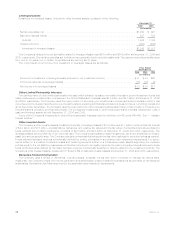

The Company’s carrying value of real estate held-for-sale was $7 million and $755 million at December 31, 2006 and 2005,

respectively. Real estate and real estate joint ventures held-for-sale recognized impairments of $8 million and $5 million for the years

ended December 31, 2006 and 2005, respectively. The carrying value of non-income producing real estate and real estate joint ventures

was $8 million and $37 million at December 31, 2006 and 2005, respectively. The Company owned real estate acquired in satisfaction of

debt of $3 million and $4 million at December 31, 2006 and 2005, respectively.

The Company records real estate acquired upon foreclosure of commercial and agricultural mortgage loans at the lower of estimated

fair value or the carrying value of the mortgage loan at the date of foreclosure.

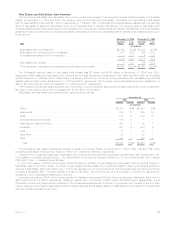

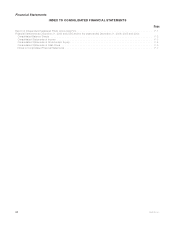

Real estate and real estate joint ventures were categorized as follows:

Amount Percent Amount Percent

2006 2005

December 31,

(In millions)

Office...................................................... $2,709 55% $2,597 56%

Apartments .................................................. 739 15 889 19

Retail ...................................................... 513 10 612 13

Developmentaljointventures....................................... 169 3 — —

Realestateinvestmentfunds....................................... 401 8 45 1

Industrial.................................................... 291 6 284 6

Land....................................................... 71 1 43 1

Agriculture................................................... 32 1 32 1

Other ...................................................... 61 1 163 3

Total ..................................................... $4,986 100% $4,665 100%

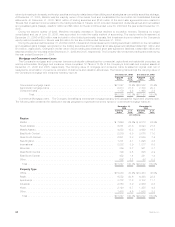

The Company’s real estate holdings are primarily located in the United States. At December 31, 2006, 26%, 15% and 15% of the

Company’s real estate holdings were located in New York, Texas and California, respectively.

Certain of the Company’s investments in real estate joint ventures meet the definition of a variable interest entity (“VIE”) under FIN No. 46,

Consolidation of Variable Interest Entities — An Interpretation of Accounting Research Bulletin No. 51, and its December 2003 revision

(“FIN 46(r)”). See “— Variable Interest Entities.”

In the fourth quarter of 2006, the Company closed the sale of its Peter Cooper Village and Stuyvesant Town properties located in

Manhattan, New York for $5.4 billion. The Peter Cooper Village and Stuyvesant Town properties together make up the largest apartment

complex in Manhattan, New York totaling over 11,000 units, spread over 80 contiguous acres. The properties were owned by the Holding

Company’s subsidiary, MTL. The sale resulted in a gain of $3 billion, net of income tax, and is included in income from discontinued

operations in the consolidated statements of income.

In the second quarter of 2005, the Company sold its One Madison Avenue and 200 Park Avenue properties in Manhattan, New York for

$918 million and $1.72 billion, respectively, resulting in gains, net of income tax, of $431 million and $762 million, respectively, and is

included in income from discontinued operations in the consolidated statements of income. In connection with the sale of the 200 Park

Avenue property, the Company has retained rights to existing signage and is leasing space for associates in the property for 20 years with

optional renewal periods through 2205.

71MetLife, Inc.