MetLife 2006 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.An increase in interest margins of $124 million, net of income tax, compared to the prior year period contributed to the increase in

income from continuing operations. Management attributed this increase primarily to the retirement & savings and the non-medical health &

other businesses of $81 million and $44 million, both net of income tax, respectively. Interest margin is the difference between interest

earned and interest credited to PABs. Interest earned approximates net investment income on investable assets attributed to the segment

with minor adjustments related to the consolidation of certain separate accounts and other minor non-policyholder elements. Interest

credited is the amount attributed to insurance products, recorded in policyholder benefits, and the amount credited to PABs for

investment-type products recorded in interest credited to PABs. Interest credited on insurance products reflects the current period

impact of the interest rate assumptions established at issuance or acquisition. Interest credited to PABs is subject to contractual terms,

including some minimum guarantees. This tends to move gradually over time to reflect market interest rate movements and may reflect

actions by management to respond to competitive pressures and therefore, generally does not introduce volatility in expense.

The increase in interest margins was partially offset by a decrease of $57 million, net of income tax, in net investment gains (losses),

which was partially offset by a decrease of $10 million, net of income tax, in policyholder benefits and claims related to net investment gains

(losses).

Also contributing to the decline in income from continuing operations was a $14 million charge, net of income tax, related to an

adjustment recorded on DAC associated with certain LTC products in 2005 and a reduction of a premium tax liability of $31 million, net of

income tax, recorded in 2004.

Underwriting results decreased by $7 million, net of income tax, compared to the prior year. This decline was primarily due to less

favorable results of $27 million, net of income tax, in retirement & savings and a $24 million, net of income tax, decrease in non-medical

health & other. These unfavorable results were partially offset by an improvement of $44 million, net of income tax, in group life’s

underwriting results, primarily due to favorable claim experience. Underwriting results are generally the difference between the portion of

premium and fee income intended to cover mortality, morbidity or other insurance costs less claims incurred and the change in insurance-

related liabilities. Underwriting results are significantly influenced by mortality, morbidity, or other insurance-related experience trends and

the reinsurance activity related to certain blocks of business and, as a result, can fluctuate from period to period.

In addition, increases in operating expenses, which included higher expenses related to the Travelers integration, had more than offset

the remaining growth in premiums, fees and other revenues.

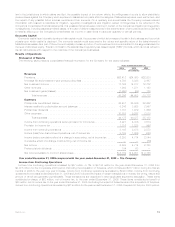

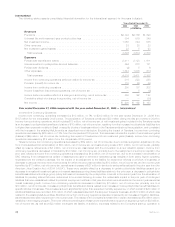

Revenues

Total revenues, excluding net investment gains (losses), increased by $2,787 million, or 17%, to $18,755 million for the year ended

December 31, 2005 from $15,968 million for the comparable 2004 period. The acquisition of Travelers accounted for $855 million of this

increase. Excluding the impact of the Travelers acquisition, total revenues, excluding net investment gains (losses), increased by

$1,932 million, or 12%, from the comparable 2004 period.

This increase was comprised of growth in premiums, fees and other revenues of $1,266 million and higher net investment income of

$666 million. The increase of $1,266 million in premiums, fees, and other revenues was largely due to an increase in non-medical health &

other of $520 million, primarily due to growth in the disability, dental and AD&D products of $360 million. In addition, continued growth in

the LTC business contributed $138 million, of which $25 million was related to the 2004 acquisition of TIAA-CREF’s LTC business. Group

life insurance premiums, fees and other revenues increased by $481 million, which management primarily attributed to improved sales and

favorable persistency, as well as a significant increase in premiums from two large customers. Retirement & savings’ premiums, fees and

other revenues increased by $265 million, which was largely due to growth in premiums, resulting primarily from an increase of $166 million

in structured settlement sales and $107 million in pension close-outs. Premiums, fees and other revenues from retirement & savings

products are significantly influenced by large transactions, and as a result, can fluctuate from period to period.

The increase in net investment income of $666 million, management attributed to $439 million solely from growth in the average asset

base, primarily driven by sales, particularly in GICs and the structured settlement business and $227 million from an increase in higher

income from corporate and real estate joint ventures interest on the growth of allocated capital, and securities lending activities across the

businesses and higher short-term interest rates.

Expenses

Total expenses increased by $2,497 million, or 18%, to $16,658 million for the year ended December 31, 2005 from $14,161 million for

the comparable 2004 period. The acquisition of Travelers accounted for $658 million of this increase. Excluding the impact of the

acquisition of Travelers, total expenses increased by $1,839 million, or 13%, from the comparable 2004 period. This increase was

comprised of higher policyholder benefits and claims of $1,278 million, an increase in interest credited to PABs of $334 million and an

increase in other expenses of $227 million.

The increase in policyholder benefits and claims of $1,278 million was attributable to a $482 million, a $452 million, and a $344 million

increase in the non-medical health & other, group life, and retirement & savings businesses, respectively. These increases were

predominantly attributable to the business growth referenced in the revenue discussion above. The increase in policyholder benefits

and claims in the non-medical health & other business included the impact of the acquisition of TIAA-CREF’s LTC business of $43 million.

These increases included $2 million and $18 million of policyholder benefits and claims related to Hurricane Katrina in the group life and

non-medical health & other business, respectively.

Management attributed the increase in interest credited to PABs of $334 million to $229 million from an increase in average crediting

rates, which was largely due to the impact of higher short-term rates in the current year period and $105 million solely from growth in the

average PAB, primarily resulting from GICs within the retirement & savings business.

The rise in other expenses of $227 million was primarily due to higher non-deferrable volume-related expenses of $61 million, which

were largely associated with business growth, an increase of $39 million in corporate support expenses, and $43 million of Travelers-

related integration costs, principally incentive accruals. In addition, expenses increased as a result of the impact of a $49 million benefit

recorded in the second quarter of 2004, which was related to a reduction in a premium tax liability. Expenses also increased by $22 million

related to an adjustment of DAC for certain LTC products in 2005.

22 MetLife, Inc.