MetLife 2006 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

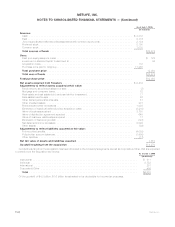

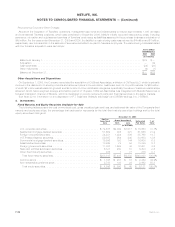

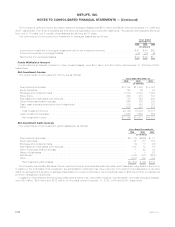

Unrealized Loss for Fixed Maturity and Equity Securities Available-for-Sale

The following tables present the estimated fair values and gross unrealized loss of the Company’s fixed maturity securities (aggregated

by sector) and equity securities in an unrealized loss position, aggregated by length of time that the securities have been in a continuous

unrealized loss position at:

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Less than 12 months Equal to or Greater than

12 months Total

December 31, 2006

(In millions, except number of securities)

U.S.corporatesecurities......................... $17,899 $304 $16,974 $ 713 $ 34,873 $1,017

Residential mortgage-backed securities . . . . . . . . . . . . . . . . 15,300 78 13,640 243 28,940 321

Foreign corporate securities . . . . . . . . . . . . . . . . . . . . . . . 6,753 105 7,579 281 14,332 386

U.S. Treasury/agency securities . . . . . . . . . . . . . . . . . . . . . 15,006 157 1,560 91 16,566 248

Commercial mortgage-backed securities . . . . . . . . . . . . . . . 4,976 31 4,096 113 9,072 144

Asset-backedsecurities.......................... 4,528 31 1,084 23 5,612 54

Foreigngovernmentsecurities...................... 1,162 18 507 16 1,669 34

State and political subdivision securities . . . . . . . . . . . . . . . 334 12 532 39 866 51

Otherfixedmaturitysecurities...................... 146 77 4 — 150 77

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . $66,104 $813 $45,976 $1,519 $112,080 $2,332

Equitysecurities............................... $ 842 $ 20 $ 575 $ 25 $ 1,417 $ 45

Total number of securities in an unrealized loss position . . . . . 11,021 4,793 15,814

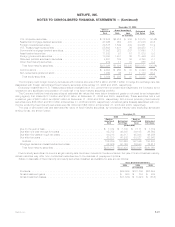

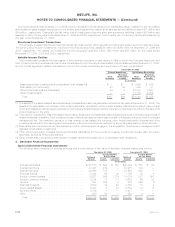

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Less than 12 months Equal to or Greater than

12 months Total

December 31, 2005

(In millions, except number of securities)

U.S.corporatesecurities......................... $29,095 $ 740 $2,685 $ 98 $ 31,780 $ 838

Residential mortgage-backed securities . . . . . . . . . . . . . . . . 31,258 434 1,291 38 32,549 472

Foreign corporate securities . . . . . . . . . . . . . . . . . . . . . . . 13,185 378 1,728 61 14,913 439

U.S.Treasury/agencysecurities..................... 7,759 85 113 1 7,872 86

Commercial mortgage-backed securities . . . . . . . . . . . . . . . 10,190 185 685 22 10,875 207

Asset-backedsecurities.......................... 4,709 42 305 9 5,014 51

Foreigngovernmentsecurities...................... 1,203 31 327 4 1,530 35

State and political subdivision securities . . . . . . . . . . . . . . . 1,050 36 16 — 1,066 36

Otherfixedmaturitysecurities...................... 319 36 52 5 371 41

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . $98,768 $1,967 $7,202 $238 $105,970 $2,205

Equitysecurities............................... $ 671 $ 34 $ 131 $ 7 $ 802 $ 41

Total number of securities in an unrealized loss position . . . . . 12,787 932 13,719

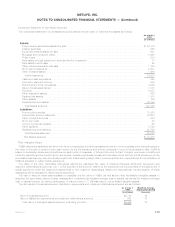

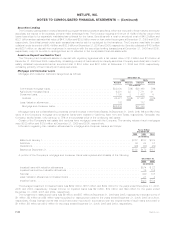

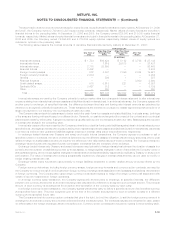

Aging of Gross Unrealized Loss for Fixed Maturity and Equity Securities Available-for-Sale

The following tables present the cost or amortized cost, gross unrealized loss and number of securities for fixed maturity securities and

equity securities, where the estimated fair value had declined and remained below cost or amortized cost by less than 20%, or 20% or more

at:

Less than

20% 20% or

more Less than

20% 20% or

more Less than

20% 20% or

more

Cost or Amortized

Cost Gross Unrealized

Loss Number of

Securities

December 31, 2006

(In millions, except number of securities)

Lessthansixmonths............................. $ 52,384 $36 $ 549 $12 9,240 83

Sixmonthsorgreaterbutlessthanninemonths ........... 3,143 3 56 1 706 2

Nine months or greater but less than twelve months . . . . . . . . . 12,199 14 211 4 989 1

Twelvemonthsorgreater .......................... 48,066 29 1,537 7 4,787 6

Total ...................................... $115,792 $82 $2,353 $24 15,722 92

F-28 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)