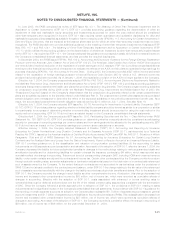

MetLife 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

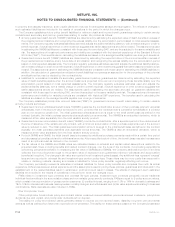

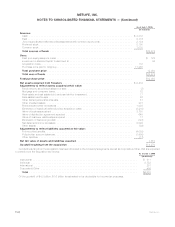

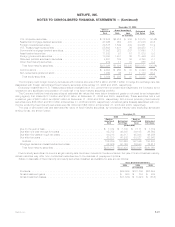

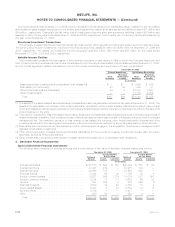

As of July 1, 2005

(In millions)

Sources:

Cash ................................................................ $ 4,312

Debt................................................................. 2,716

Juniorsubordinateddebtsecuritiesassociatedwithcommonequityunits.................... 2,134

Preferredstock.......................................................... 2,100

Commonstock.......................................................... 1,010

Total sources of funds ................................................... $12,272

Uses:

Debtandequityissuancecosts............................................... $ 128

InvestmentinMetLifeCapitalTrustsIIandIII ....................................... 64

Acquisitioncosts......................................................... 112

PurchasepricepaidtoCitigroup............................................... 11,968

Total purchase price ..................................................... 12,080

Total uses of funds ...................................................... $12,272

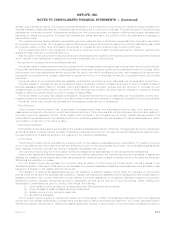

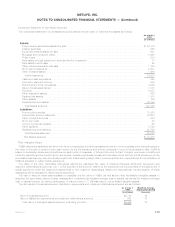

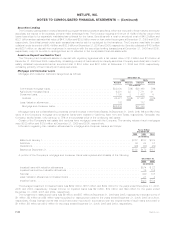

Total purchase price ...................................................... $12,080

Net assets acquired from Travelers ........................................... $ 9,412

Adjustments to reflect assets acquired at fair value:

Fixedmaturitysecuritiesavailable-for-sale......................................... (7)

Mortgageandconsumerloans................................................ 72

Realestateandrealestatejointventuresheld-for-investment............................ 17

Realestateheld-for-sale.................................................... 22

Otherlimitedpartnershipinterests.............................................. 51

Otherinvestedassets ..................................................... 201

Premiumsandotherreceivables............................................... 1,008

Eliminationofhistoricaldeferredpolicyacquisitioncosts ............................... (3,210)

Valueofbusinessacquired .................................................. 3,780

Valueofdistributionagreementacquired ......................................... 645

Valueofcustomerrelationshipsacquired ......................................... 17

Eliminationofhistoricalgoodwill............................................... (197)

Netdeferredincometaxassets ............................................... 2,099

Otherassets ........................................................... (89)

Adjustments to reflect liabilities assumed at fair value:

Futurepolicybenefits...................................................... (4,089)

Policyholderaccountbalances................................................ (1,905)

Otherliabilities .......................................................... (17)

Net fair value of assets and liabilities assumed ................................... 7,810

Goodwill resulting from the acquisition ........................................ $ 4,270

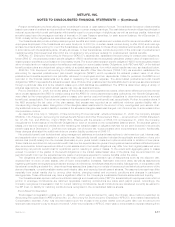

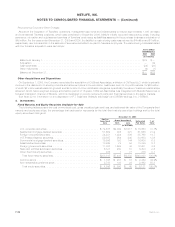

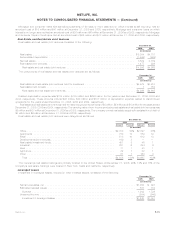

Goodwill resulting from the acquisition has been allocated to the Company’s segments, as well as Corporate & Other, that are expected

to benefit from the acquisition as follows: As of July 1, 2005

(In millions)

Institutional................................................................. $ 911

Individual .................................................................. 2,752

International ................................................................ 201

Corporate&Other ............................................................ 406

Total ................................................................... $4,270

Of the goodwill of $4.3 billion, $1.6 billion is estimated to be deductible for income tax purposes.

F-24 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)