MetLife 2006 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

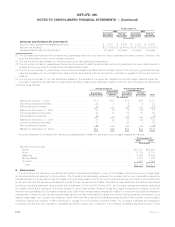

On June 28, 2006, Timberlake Financial L.L.C., (“Timberlake”), a subsidiary of RGA, completed an offering of $850 million of Series A

Floating Rate Insured Notes due June 2036, which is included in the Company’s long-term debt. Interest on the notes will accrue at an

annual rate of 1-month LIBOR plus a base margin, payable monthly. The notes represent senior, secured indebtedness of Timberlake

Financial, L.L.C. with no recourse to RGA or its other subsidiaries. Up to $150 million of additional notes may be offered in the future. The

proceeds of the offering provide long-term collateral to support Regulation XXX statutory reserves on 1.5 million term life insurance policies

with guaranteed level premium periods reinsured by RGA Reinsurance Company, a U.S. subsidiary of RGA. Issuance costs associated with

the offering of the notes of $13 million have been capitalized, are included in other assets, and will be amortized using the effective interest

method over the period from the issuance date of the notes until their maturity.

In connection with financing the acquisition of Travelers on July 1, 2005, which is more fully described in Note 2, the Holding Company

issued the following debt:

On June 23, 2005, the Holding Company issued in the United States public market $1,000 million aggregate principal amount of

5.00% senior notes due June 15, 2015 at a discount of $2.7 million ($997.3 million) and $1,000 million aggregate principal amount of

5.70% senior notes due June 15, 2035 at a discount of $2.4 million ($997.6 million). In connection with the offering, the Holding Company

incurred $12.4 million of issuance costs which have been capitalized and included in other assets. These costs are being amortized using

the effective interest method over the respective term of the related senior notes.

On June 29, 2005, the Holding Company issued 400 million pounds sterling ($729.2 million at issuance) aggregate principal

amount of 5.25% senior notes due June 29, 2020 at a discount of 4.5 million pounds sterling ($8.1 million at issuance), for aggregate

proceeds of 395.5 million pounds sterling ($721.1 million at issuance). The senior notes were initially offered and sold outside the United

States in reliance upon Regulation S under the Securities Act of 1933, as amended. In connection with the offering, the Holding Company

incurred $3.7 million of issuance costs which have been capitalized and included in other assets. These costs are being amortized using

the effective interest method over the term of the related senior notes.

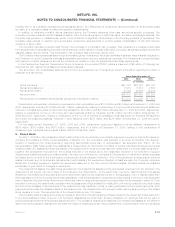

Repurchase Agreements with Federal Home Loan Bank

MetLifeBank,NationalAssociation(“MetLifeBank”or“MetLifeBank,N.A.”)isamemberoftheFederalHomeLoanBankofNewYork

(the “FHLB of NY”). See Note 15 for a description of the Company’s liability for repurchase agreements with the FHLB of NY as of

December 31, 2006 and 2005, which is included in long-term debt.

Surplus Notes

Metropolitan Life repaid a $250 million 7% surplus note which matured on November 1, 2005.

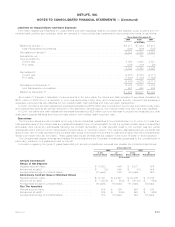

Short-term Debt

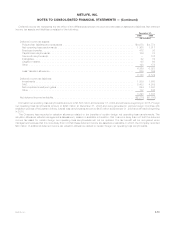

During the years ended December 31, 2006 and 2005, the Company’s short-term debt consisted of commercial paper with a weighted

average interest rate of 5.2% and 3.4%, respectively. The average daily balance of commercial paper outstanding was $1.9 billion and

$1.0 billion during the years ended December 31, 2006 and 2005, respectively. The commercial paper was outstanding for an average of

39 days and 53 days during the years ended December 31, 2006 and 2005, respectively.

Interest Expense

Interest expense related to the Company’s indebtedness included in other expenses was $703 million, $542 million and $428 million for

the years ended December 31, 2006, 2005 and 2004, respectively, and does not include interest expense on junior subordinated debt

securities. See Note 11.

Credit and Committed Facilities and Letters of Credit

Credit Facilities. The Company maintains committed and unsecured credit facilities aggregating $3.9 billion as of December 31, 2006.

When drawn upon, these facilities bear interest at varying rates in accordance with the respective agreements. The facilities can be used

for general corporate purposes and at December 31, 2006, $3.0 billion of the facilities also served as back-up lines of credit for the

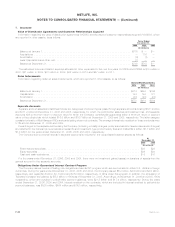

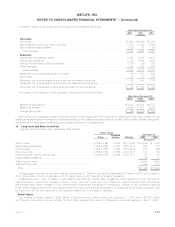

Company’s commercial paper programs. Information on these facilities as of December 31, 2006 is as follows:

Borrower(s) Expiration Capacity

Letters of

Credit

Issuances Drawdowns Unused

Commitments

(In millions)

MetLife, Inc. and MetLife Funding, Inc. . . . . . . . . . . . . . . . . . . April 2009 $1,500(1) $ 487 $ — $1,013

MetLife, Inc. and MetLife Funding, Inc. . . . . . . . . . . . . . . . . . . April 2010 1,500(1) 483 — 1,017

MetLife Bank, N.A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . July 2007 200 — — 200

Reinsurance Group of America, Incorporated . . . . . . . . . . . . . . May 2007 29 — 29 —

Reinsurance Group of America, Incorporated . . . . . . . . . . . . . . September 2010 600 315 50 235

Reinsurance Group of America, Incorporated . . . . . . . . . . . . . . March 2011 39 — 28 11

Total....................................... $3,868 $1,285 $107 $2,476

(1) These facilities serve as back up lines of credit for the Company’s commercial paper programs.

F-46 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)