MetLife 2006 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

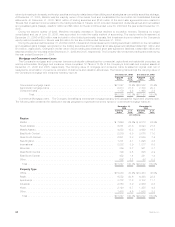

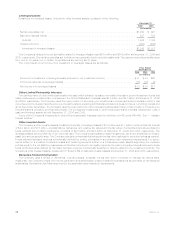

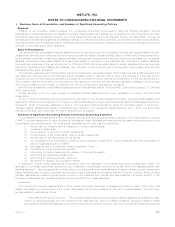

The table below provides additional detail regarding the potential loss in fair value of the Company’s non-trading interest sensitive

financial instruments by type of asset or liability:

Notional

Amount Estimated

Fair Value

Assuming a

10% increase

in the yield

curve

December 31, 2006

(In millions)

Assets

Fixedmaturitysecurities............................................... $243,428 $(6,034)

Equitysecurities .................................................... 5,131 —

Mortgageandconsumerloans........................................... 42,451 (733)

Policyloans....................................................... 10,228 (307)

Short-terminvestments................................................ 2,709 (36)

Cashandcashequivalents ............................................. 7,107 —

Mortgageloancommitments ............................................ $ 4,022 4 (12)

Commitmentstofundbankcreditfacilitiesandbridgeloans........................ $ 1,908 — —

Totalassets...................................................... $(7,122)

Liabilities

Policyholderaccountbalances........................................... $108,318 $ 833

Short-termdebt .................................................... 1,449 —

Long-termdebt..................................................... 10,149 364

Juniorsubordinateddebtsecurities........................................ 3,759 60

Sharessubjecttomandatoryredemption .................................... 357 —

Payablesforcollateralundersecuritiesloanedandothertransactions.................. 45,846 —

Totalliabilities .................................................... $1,257

Other

Derivative instruments (designated hedges or otherwise)

Interestrateswaps................................................. $27,148 $ 489 $ (37)

Interestratefloors.................................................. 37,437 279 (100)

Interestratecaps.................................................. 26,468 125 70

Financialfutures................................................... 8,432 25 84

Foreigncurrencyswaps.............................................. 19,627 (188) (95)

Foreigncurrencyforwards ............................................ 2,934 4 (1)

Options ........................................................ 587 298 (31)

Financialforwards.................................................. 3,800 (28) —

Creditdefaultswaps................................................ 6,357 (16) —

SyntheticGICs.................................................... 3,739 — —

Other.......................................................... 250 56 —

Totalother ..................................................... $ (110)

Net change ........................................................ $(5,975)

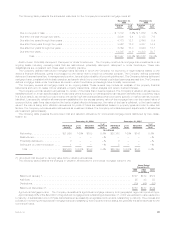

This quantitative measure of risk has increased by $452 million, or 8%, at December 31, 2006, from $5,523 million at December 31,

2005. This change was due to an increase of $540 million due to an increase in the yield curve, an increase of $550 million due to asset

growth and $72 million of other. These increases are partially offset by a decrease of $140 million due to growth in derivative usage and a

decrease of $570 million due to a decline in asset duration.

In addition to the analysis above, as part of its asset liability management program, the Company also performs an analysis of the

sensitivity to changes in interest rates, including both insurance liabilities and financial instruments. As of December 31, 2006, a

hypothetical instantaneous 10% decrease in interest rates applied to the Company’s liabilities, insurance and associated asset portfolios

would reduce the fair value of equity by $350 million. Management does not expect that this sensitivity would produce a liquidity strain on

the Company.

77MetLife, Inc.