MetLife 2006 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

other reinsured losses in connection with Hurricanes Katrina and Wilma and otherwise. In addition, lawsuits, including purported class

actions, have been filed in Louisiana, Mississippi and Alabama challenging denial of claims for damages caused to property during

Hurricane Katrina. MPC is a named party in some of these lawsuits. In addition, rulings in cases in which MPC is not a party may affect

interpretation of its policies. MPC intends to vigorously defend these matters. However, any adverse rulings could result in an increase in

the Company’s hurricane-related claim exposure and losses. Based on information known by management, it does not believe that

additional claim losses resulting from Hurricane Katrina will have a material adverse impact on the Company’s consolidated financial

statements.

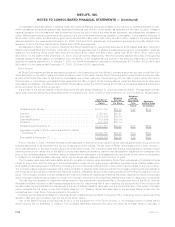

Argentina

The Argentinean economic, regulatory and legal environment, including interpretations of laws and regulations by regulators and courts,

is uncertain. Potential legal or governmental actions related to pension reform, fiduciary responsibilities, performance guarantees and tax

rulings could adversely affect the results of the Company. Upon acquisition of Citigroup’s insurance operations in Argentina, the Company

established insurance liabilities, most significantly death and disability policy liabilities, based upon its interpretation of Argentinean law and

the Company’s best estimate of its obligations under such law. In 2006, a decree was issued by the Argentine Government regarding the

taxability of pesification-related gains resulting in the reduction of certain tax liabilities. See Note 2.

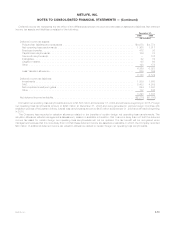

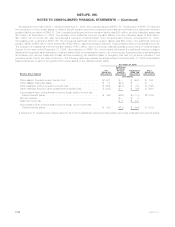

Commitments

Leases

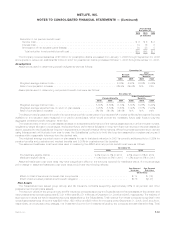

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants are contingent upon

the level of the tenants’ sales revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for

office space, data processing and other equipment. Future minimum rental and sublease income, and minimum gross rental payments

relating to these lease agreements are as follows:

Rental

Income Sublease

Income

Gross

Rental

Payments

(In millions)

2007 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $328 $23 $ 247

2008 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $278 $20 $ 198

2009 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $225 $12 $ 196

2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $185 $ 8 $ 172

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $155 $ 8 $ 146

Thereafter......................................................... $564 $15 $1,206

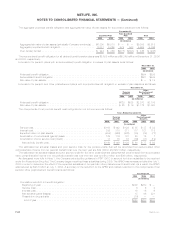

Commitments to Fund Partnership Investments

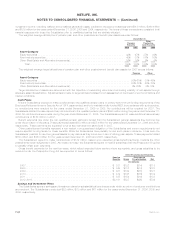

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded

commitments were $3.0 billion and $2.7 billion at December 31, 2006 and 2005, respectively. The Company anticipates that these

amounts will be invested in partnerships over the next five years.

Mortgage Loan Commitments

The Company commits to lend funds under mortgage loan commitments. The amounts of these mortgage loan commitments were

$4.0 billion and $3.0 billion at December 31, 2006 and 2005, respectively.

Commitments to Fund Bank Credit Facilities and Bridge Loans

The Company commits to lend funds under bank credit facilities and bridge loans. The amounts of these unfunded commitments were

$1.9 billion and $346 million at December 31, 2006 and 2005, respectively.

Other Commitments

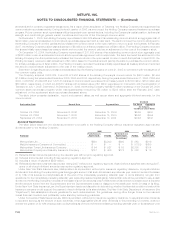

MICCisamemberoftheFederalHomeLoanBankofBoston(the“FHLBofBoston”)andholds$70millionofcommonstockoftheFHLB

of Boston, which is included in equity securities on the Company’s consolidated balance sheets. MICC has also entered into several

funding agreements with the FHLB of Boston whereby MICC has issued such funding agreements in exchange for cash and for which the

FHLB of Boston has been granted a blanket lien on MICC’s residential mortgages and mortgage-backed securities to collateralize MICC’s

obligations under the funding agreements. MICC maintains control over these pledged assets, and may use, commingle, encumber or

dispose of any portion of the collateral as long as there is no event of default and the remaining qualified collateral is sufficient to satisfy the

collateral maintenance level. The funding agreements and the related security agreement represented by this blanket lien provide that upon

any event of default by MICC, the FHLB of Boston’s recovery is limited to the amount of MICC’s liability under the outstanding funding

agreements. The amount of the Company’s liability for funding agreements with the FHLB of Boston was $926 million and $1.1 billion at

December 31, 2006 and 2005, respectively, which is included in PABs.

MetLife Bank is a member of the FHLB of NY and holds $54 million and $43 million of common stock of the FHLB of NY, at December 31,

2006 and 2005, respectively, which is included in equity securities on the Company’s consolidated balance sheet. MetLife Bank has also

entered into repurchase agreements with the FHLB of NY whereby MetLife Bank has issued repurchase agreements in exchange for cash

and for which the FHLB of NY has been granted a blanket lien on MetLife Bank’s residential mortgages and mortgage-backed securities to

collateralize MetLife Bank’s obligations under the repurchase agreements. MetLife Bank maintains control over these pledged assets, and

may use, commingle, encumber or dispose of any portion of the collateral as long as there is no event of default and the remaining qualified

collateral is sufficient to satisfy the collateral maintenance level. The repurchase agreements and the related security agreement

represented by this blanket lien provide that upon any event of default by MetLife Bank, the FHLB of NY’s recovery is limited to the

amount of MetLife Bank’s liability under the outstanding repurchase agreements. The amount of the Company’s liability for repurchase

F-58 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)