MetLife 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

law in the jurisdictions in which claims are filed, the possible impact of tort reform efforts, the willingness of courts to allow plaintiffs to

pursue claims against the Company when exposure to asbestos took place after the dangers of asbestos exposure were well known, and

the impact of any possible future adverse verdicts and their amounts. On a quarterly and annual basis the Company reviews relevant

information with respect to liabilities for litigation, regulatory investigations and litigation-related contingencies to be reflected in the

Company’s consolidated financial statements. It is possible that an adverse outcome in certain of the Company’s litigation and regulatory

investigations, including asbestos-related cases, or the use of different assumptions in the determination of amounts recorded could have

a material effect upon the Company’s consolidated net income or cash flows in particular quarterly or annual periods.

Economic Capital

Economic capital is an internally developed risk capital model, the purpose of which is to measure the risk in the business and to provide

a basis upon which capital is deployed. The economic capital model accounts for the unique and specific nature of the risks inherent in

MetLife’s businesses. As a part of the economic capital process, a portion of net investment income is credited to the segments based on

the level of allocated equity. This is in contrast to the standardized regulatory risk-based capital (“RBC”) formula, which is not as refined in

its risk calculations with respect to the nuances of the Company’s businesses.

Results of Operations

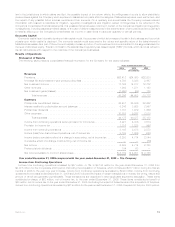

Discussion of Results

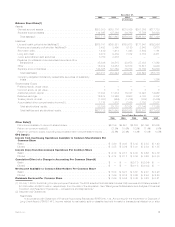

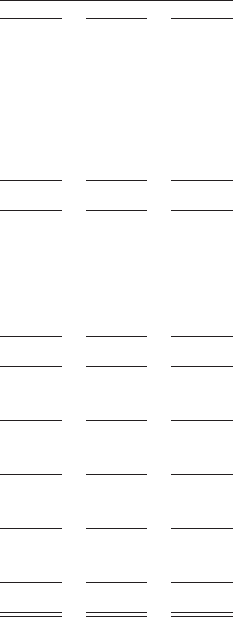

The following table presents consolidated financial information for the Company for the years indicated:

2006 2005 2004

Years Ended December 31,

(In millions)

Revenues

Premiums.................................................. $26,412 $24,860 $22,200

Universallifeandinvestment-typeproductpolicyfees..................... 4,780 3,828 2,867

Netinvestmentincome......................................... 17,192 14,817 12,272

Otherrevenues.............................................. 1,362 1,271 1,198

Netinvestmentgains(losses)..................................... (1,350) (93) 175

Totalrevenues .......................................... 48,396 44,683 38,712

Expenses

Policyholderbenefitsandclaims................................... 26,431 25,506 22,662

Interest credited to policyholder account balances . . . . . . . . . . . . . . . . . . . . . . . 5,246 3,925 2,997

Policyholderdividends ......................................... 1,701 1,679 1,666

Otherexpenses.............................................. 10,797 9,267 7,813

Totalexpenses.......................................... 44,175 40,377 35,138

Income from continuing operations before provision for income tax. . . . . . . . . . . . . 4,221 4,306 3,574

Provisionforincometax ........................................ 1,116 1,228 996

Incomefromcontinuingoperations ................................. 3,105 3,078 2,578

Income (loss) from discontinued operations, net of income tax . . . . . . . . . . . . . . . 3,188 1,636 266

Income before cumulative effect of a change in accounting, net of income tax . . . . . 6,293 4,714 2,844

Cumulative effect of a change in accounting, net of income tax . . . . . . . . . . . . . . . — — (86)

Netincome ................................................ 6,293 4,714 2,758

Preferredstockdividends ....................................... 134 63 —

Netincomeavailabletocommonshareholders.......................... $ 6,159 $ 4,651 $ 2,758

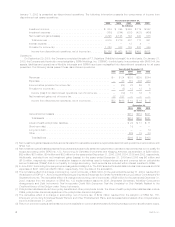

Year ended December 31, 2006 compared with the year ended December 31, 2005 — The Company

Income from Continuing Operations

Income from continuing operations increased by $27 million, or 1%, to $3,105 million for the year ended December 31, 2006 from

$3,078 million for the comparable 2005 period. Excluding the acquisition of Travelers, which contributed $317 million during the first six

months of 2006 to the year over year increase, income from continuing operations decreased by $290 million. Income from continuing

operations for the years ended December 31, 2006 and 2005 included the impact of certain transactions or events, the timing, nature and

amount of which are generally unpredictable. These transactions are described in each applicable segment’s discussion. These items

contributed a charge of $23 million, net of income tax, to the year ended December 31, 2006. These items contributed a benefit of

$48 million, net of income tax, to the year ended December 31, 2005. Excluding the impact of these items and the acquisition of Travelers,

income from continuing operations decreased by $219 million for the year ended December 31, 2006 compared to the prior 2005 period.

13MetLife, Inc.