MetLife 2006 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

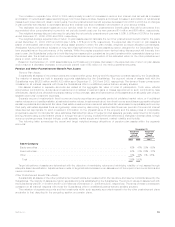

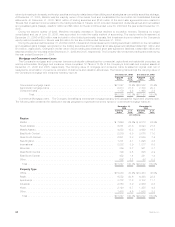

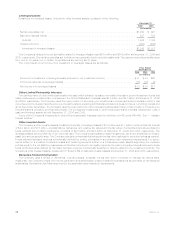

The cost or amortized cost and estimated fair value of fixed maturity securities, by contractual maturity date (excluding scheduled

sinking funds), are shown below:

Cost or

Amortized

Cost Estimated

Fair Value

Cost or

Amortized

Cost

Estimated

Fair

Value

2006 2005

December 31,

(In millions)

Dueinoneyearorless.................................... $ 7,014 $ 7,102 $ 7,111 $ 7,152

Due after one year through five years . . . . . . . . . . . . . . . . . . . . . . . . . . 45,782 46,367 36,105 36,562

Due after five years through ten years . . . . . . . . . . . . . . . . . . . . . . . . . . 40,213 40,817 45,303 46,256

Dueaftertenyears ...................................... 63,280 66,982 58,827 63,563

Subtotal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 156,289 161,268 147,346 153,533

Mortgage-backed and asset-backed securities . . . . . . . . . . . . . . . . . . . . 82,026 82,160 76,580 76,517

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . $238,315 $243,428 $223,926 $230,050

Fixed maturity securities not due at a single maturity date have been included in the above table in the year of final contractual maturity.

Actual maturities may differ from contractual maturities due to the exercise of prepayment options.

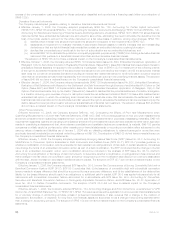

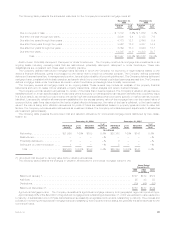

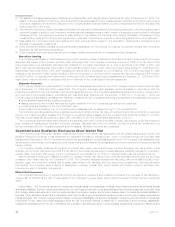

Sales or disposals of fixed maturity and equity securities classified as available-for-sale are as follows:

2006 2005 2004

Years Ended December 31,

(In millions)

Proceeds....................................................... $89,869 $127,709 $57,604

Grossinvestmentgains ............................................. $ 580 $ 704 $ 844

Grossinvestmentlosses............................................. $(1,533) $ (1,391) $ (516)

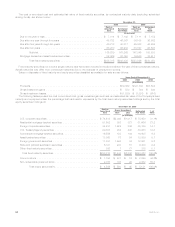

The following tables present the cost or amortized cost, gross unrealized gain and loss, and estimated fair value of the Company’s fixed

maturity and equity securities, the percentage that each sector represents by the total fixed maturity securities holdings and by the total

equity securities holdings at:

Cost or

Amortized

Cost Gain Loss Estimated

Fair Value %of

Total

Gross Unrealized

December 31, 2006

(In millions)

U.S.corporatesecurities................................ $ 74,618 $2,049 $1,017 $ 75,650 31.1%

Residential mortgage-backed securities . . . . . . . . . . . . . . . . . . . . . . 51,602 385 321 51,666 21.2

Foreigncorporatesecurities.............................. 34,231 1,924 386 35,769 14.7

U.S.Treasury/agencysecurities ........................... 29,897 984 248 30,633 12.6

Commercialmortgage-backedsecurities...................... 16,556 193 144 16,605 6.8

Asset-backedsecurities ................................ 13,868 75 54 13,889 5.7

Foreigngovernmentsecurities ............................ 11,037 1,598 34 12,601 5.2

Stateandpoliticalsubdivisionsecurities...................... 6,121 230 51 6,300 2.6

Otherfixedmaturitysecurities............................. 385 7 77 315 0.1

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . $238,315 $7,445 $2,332 $243,428 100.0%

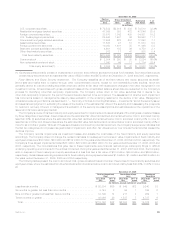

Commonstock ...................................... $ 1,798 $ 487 $ 16 $ 2,269 44.2%

Non-redeemablepreferredstock........................... 2,788 103 29 2,862 55.8

Total equity securities(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,586 $ 590 $ 45 $ 5,131 100.0%

64 MetLife, Inc.