MetLife 2006 Annual Report Download - page 38

Download and view the complete annual report

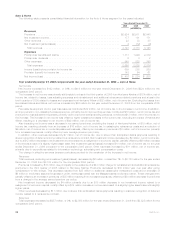

Please find page 38 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Expenses

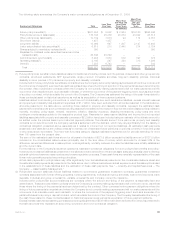

Total expenses increased by $446 million, or 47%, to $1,386 million for the year ended December 31, 2006 from $940 million for the

comparable 2005 period. The acquisition of Travelers, excluding Travelers financing and integration costs, contributed $59 million during

the first six months of 2006 to the period over period increase. Excluding the impact of Travelers, total expenses increased by $387 million,

or 41%, for the year ended December 31, 2006 from the comparable 2005 period.

The 2006 period included a $35 million contribution to the MetLife Foundation. The 2005 period included a $47 million benefit

associated with a reduction of a previously established liability for settlement death benefits related to the Company’s sales practices class

action settlement recorded in 1999 and a $28 million benefit associated with the reduction of a previously established real estate transfer

tax liability related to Metropolitan Life’s demutualization in 2000. Excluding the impact of these items, total expenses increased by

$277 million for the year ended December 31, 2006 from the comparable 2005 period. This increase was primarily attributable to higher

interest expense of $192 million. The principal reason was a result of the issuance of senior notes in 2005, which included $119 million of

expenses from the financing of the acquisition of Travelers. Additionally, as a result of the issuance of commercial paper, short-term interest

expense increased by $67 million. Corporate support expenses, which included advertising, start-up costs for new products and

information technology costs, were higher by $107 million, partially offset by lower integration costs of $95 million. As a result of growth

in the business and higher interest rates, interest credited to bankholder deposits increased by $85 million at MetLife Bank. Legal-related

costs were higher by $8 million, predominantly from the reduction of previously established liabilities related to legal disputes during the

2005 period. Also included as a component of total expenses were the elimination of intersegment amounts which were offset within total

revenues.

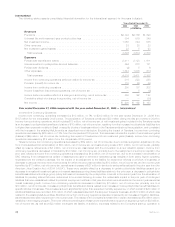

Year ended December 31, 2005 compared with the year ended December 31, 2004 — Corporate & Other

Income (Loss) from Continuing Operations

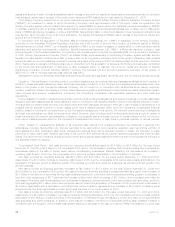

Income (loss) from continuing operations increased by $67 million, or 82%, to ($15) million for the year ended December 31, 2005 from

($82) million for the comparable 2004 period. The acquisition of Travelers, excluding Travelers financing and integration costs incurred by

the Company, contributed $88 million of this increase which included $1 million, net of income tax, of net investment losses. Excluding the

impact of Travelers, income from continuing operations decreased by $21 million for the year ended December 31, 2005 from the

comparable 2004 period. Included in this decrease were lower investment losses of $69 million, net of income tax. Excluding the impact of

Travelers and the decrease of net investment losses, income (loss) from continuing operations decreased by $90 million.

The 2005 period includes a $30 million benefit, net of income tax, associated with the reduction of a previously established liability for

settlement death benefits related to the Company’s sales practices class action settlement recorded in 1999, and an $18 million benefit,

net of income tax, associated with the reduction of a previously established real estate transfer tax liability related to Metropolitan Life’s

demutualization in 2000. The 2004 period includes a $105 million benefit associated with the resolution of issues relating to the Internal

Revenue Service’s audit of Metropolitan Life and its subsidiaries’ tax returns for the years 1997-1999. Also included in the 2004 period was

an expense related to a $32 million, net of income tax, contribution to the MetLife Foundation. Excluding the impact of these items, income

from continuing operations decreased by $65 million for the year ended December 31, 2005 from the comparable 2004 period. The

decrease was primarily attributable to higher interest expense on debt (principally associated with the issuance of debt to finance the

Travelers acquisition), integration costs associated with the acquisition of Travelers, interest credited to bank holder deposits and legal-

related liabilities of $119 million, $76 million, $44 million and $4 million, respectively, all of which were net of income tax. This was partially

offset by an increase in net investment income of $107 million, and a decrease in corporate support expenses of $10 million, both of which

were net of income tax. Tax benefits increased by $61 million over the comparable 2004 period due to the difference of finalizing the

Company’s 2004 tax return in 2005 when compared to finalizing the Company’s 2003 tax return in 2004 and the difference between the

actual and the estimated tax rate allocated to the various segments.

Revenues

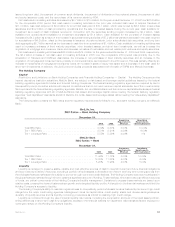

Total revenues, excluding net investment gains (losses), increased by $376 million, or 97%, to $762 million for the year ended

December 31, 2005 from $386 million for the comparable 2004 period. The acquisition of Travelers contributed $152 million to the period

over period increase. Excluding the impact of Travelers, the increase of $224 million was primarily attributable to increases in income on

fixed maturity securities due to improved yields from lengthening of the duration and a higher asset base, as well as increased income from

other limited partnerships and mortgage loans on real estate. Also included as a component of total revenues were the intersegment

eliminations which were offset within total expenses.

Expenses

Total expenses increased by $330 million, or 54%, to $940 million for the year ended December 31, 2005 from $610 million for the

comparable 2004 period. The acquisition of Travelers, excluding Travelers financing and integration costs, contributed $15 million to the

period over period increase. Excluding the impact of Travelers, total expenses increased by $315 million for the year ended December 31,

2005 from the comparable 2004 period.

The 2005 period includes a $47 million benefit associated with a reduction of a previously established liability for settlement death

benefits related to the Company’s sales practices class action settlement recorded in 1999, a $28 million benefit associated with the

reduction of a previously established real estate transfer tax liability related to Metropolitan Life’s demutualization in 2000. The 2004 period

includes a $50 million contribution to the MetLife Foundation, partially offset by a $22 million reduction of a liability associated with the

resolution of all issues relating to the Internal Revenue Service’s audit of Metropolitan Life and its subsidiaries’ tax returns for the years

1997-1999. Excluding the impact of these items, total expenses increased by $418 million for the year ended December 31, 2005 from the

comparable 2004 period. This increase was attributable to higher interest expense of $187 million as a result of the issuance of senior

notes in 2004 and 2005, which included $129 million of expenses from the financing of the acquisition of Travelers. Integration costs

associated with the acquisition of Travelers were $120 million. As a result of growth in the business, interest credited to bank holder

deposits increased by $70 million at MetLife Bank. In addition, legal-related liabilities increased by $5 million. These increases were offset

by a reduction in corporate support expenses of $16 million. Also included as a component of total expenses was the elimination of

intersegment amounts which was offset within total revenues.

35MetLife, Inc.