MetLife 2006 Annual Report Download - page 109

Download and view the complete annual report

Please find page 109 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

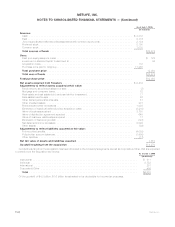

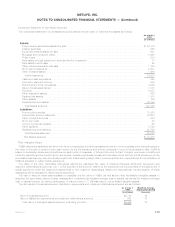

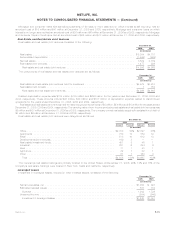

Restructuring Costs and Other Charges

As part of the integration of Travelers’ operations, management approved and initiated plans to reduce approximately 1,000 domestic

and international Travelers positions, which was completed in December 2006. MetLife initially recorded restructuring costs, including

severance, relocation and outplacement services of Travelers’ employees, as liabilities assumed in the purchase business combination of

$49 million. For the years ended December 31, 2006 and 2005, the liability for restructuring costs was reduced by $4 million and $1 million,

respectively, due to a reduction in the estimate of severance benefits to be paid to Travelers employees. The restructuring costs associated

with the Travelers acquisition were as follows:

2006 2005

Years Ended

December 31,

(In millions)

BalanceatJanuary1, ............................................................ $28 $—

Acquisition ................................................................... — 49

Cashpayments ................................................................ (24) (20)

Otherreductions ............................................................... (4) (1)

BalanceatDecember31,.......................................................... $— $28

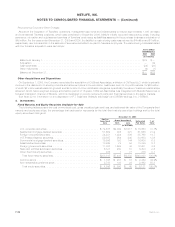

Other Acquisitions and Dispositions

On September 1, 2005, the Company completed the acquisition of CitiStreet Associates, a division of CitiStreet LLC, which is primarily

involved in the distribution of annuity products and retirement plans to the education, healthcare, and not-for-profit markets, for $56 million,

of which $2 million was allocated to goodwill and $54 million to other identifiable intangibles, specifically the value of customer relationships

acquired, which has a weighted average amortization period of 16 years. CitiStreet Associates was integrated with MetLife Resources, a

focused distribution channel of MetLife, which is dedicated to provide retirement plans and financial services to the same markets.

SeeNote22forinformationonthedispositionofP.T.Sejahtera (“MetLife Indonesia”) and SSRM Holdings, Inc. (“SSRM”).

3. Investments

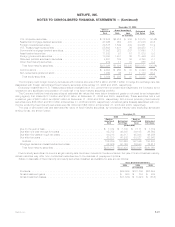

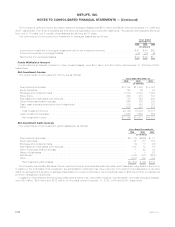

Fixed Maturity and Equity Securities Available-for-Sale

The following tables present the cost or amortized cost, gross unrealized gain and loss, and estimated fair value of the Company’s fixed

maturity and equity securities, the percentage that each sector represents by the total fixed maturity securities holdings and by the total

equity securities holdings at:

Cost or

Amortized

Cost Gain Loss Estimated

Fair Value %of

Total

Gross Unrealized

December 31, 2006

(In millions)

U.S.corporatesecurities................................ $ 74,618 $2,049 $1,017 $ 75,650 31.1%

Residential mortgage-backed securities . . . . . . . . . . . . . . . . . . . . . . 51,602 385 321 51,666 21.2

Foreigncorporatesecurities.............................. 34,231 1,924 386 35,769 14.7

U.S.Treasury/agencysecurities............................ 29,897 984 248 30,633 12.6

Commercialmortgage-backedsecurities...................... 16,556 193 144 16,605 6.8

Asset-backedsecurities ................................ 13,868 75 54 13,889 5.7

Foreigngovernmentsecurities ............................ 11,037 1,598 34 12,601 5.2

Stateandpoliticalsubdivisionsecurities...................... 6,121 230 51 6,300 2.6

Otherfixedmaturitysecurities............................. 385 7 77 315 0.1

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . $238,315 $7,445 $2,332 $243,428 100.0%

Commonstock ...................................... $ 1,798 $ 487 $ 16 $ 2,269 44.2%

Non-redeemablepreferredstock........................... 2,788 103 29 2,862 55.8

Total equity securities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 4,586 $ 590 $ 45 $ 5,131 100.0%

F-26 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)