MetLife 2006 Annual Report Download - page 157

Download and view the complete annual report

Please find page 157 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

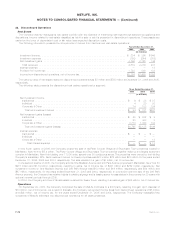

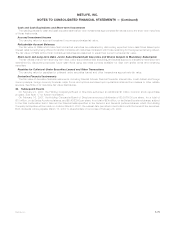

Economic capital is an internally developed risk capital model, the purpose of which is to measure the risk in the business and to provide

a basis upon which capital is deployed. The economic capital model accounts for the unique and specific nature of the risks inherent in

MetLife’s businesses. As a part of the economic capital process, a portion of net investment income is credited to the segments based on

the level of allocated equity.

Institutional offers a broad range of group insurance and retirement & savings products and services, including group life insurance,

non-medical health insurance, such as short and long-term disability, long-term care, and dental insurance, and other insurance products

and services. Individual offers a wide variety of protection and asset accumulation products, including life insurance, annuities and mutual

funds. Auto & Home provides personal lines property and casualty insurance, including private passenger automobile, homeowners and

personal excess liability insurance. International provides life insurance, accident and health insurance, annuities and retirement & savings

products to both individuals and groups. Through the Company’s majority-owned subsidiary, RGA, the Reinsurance segment provides

reinsurance of life and annuity policies in North America and various international markets. Additionally, reinsurance of critical illness

policies is provided in select international markets.

Corporate & Other contains the excess capital not allocated to the business segments, various start-up entities, MetLife Bank and run-

off entities, as well as interest expense related to the majority of the Company’s outstanding debt and expenses associated with certain

legal proceedings and income tax audit issues. Corporate & Other also includes the elimination of all intersegment amounts, which

generally relate to intersegment loans, which bear interest rates commensurate with related borrowings, as well as intersegment

transactions. Additionally, the Company’s asset management business, including amounts reported as discontinued operations, is

included in the results of operations for Corporate & Other. See Note 22 for disclosures regarding discontinued operations, including

real estate.

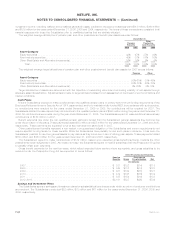

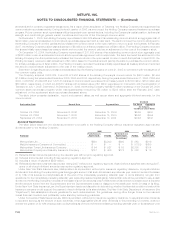

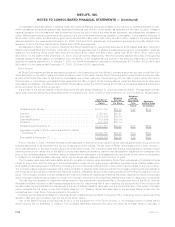

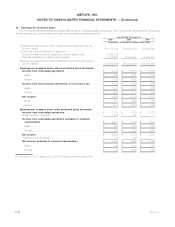

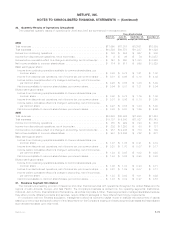

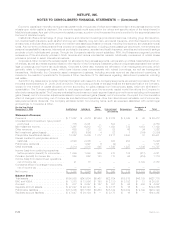

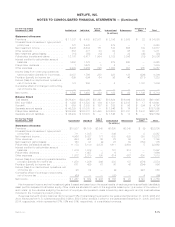

Set forth in the tables below is certain financial information with respect to the Company’s segments, as well as Corporate & Other, for

the years ended December 31, 2006, 2005 and 2004. The accounting policies of the segments are the same as those of the Company,

except for the method of capital allocation and the accounting for gains (losses) from intercompany sales, which are eliminated in

consolidation. The Company allocates equity to each segment based upon the economic capital model that allows the Company to

effectively manage its capital. The Company evaluates the performance of each segment based upon net income excluding net investment

gains (losses), net of income tax, adjustments related to net investment gains (losses), net of income tax, the impact from the cumulative

effect of changes in accounting, net of income tax and discontinued operations, other than discontinued real estate, net of income tax,

less preferred stock dividends. The Company allocates certain non-recurring items, such as expenses associated with certain legal

proceedings, to Corporate & Other.

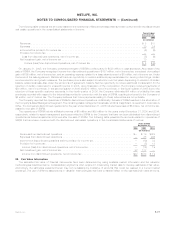

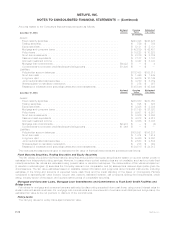

For the Year Ended

December 31, 2006 Institutional Individual Auto &

Home International Reinsurance Corporate &

Other Total

(In millions)

Statement of Income:

Premiums ....................... $ 11,867 $ 4,516 $2,924 $ 2,722 $ 4,348 $ 35 $ 26,412

Universal life and investment- type product

policyfees ..................... 775 3,201 — 804 — — 4,780

Net investment income . . . . . . . . . . . . . . . 7,267 6,912 177 1,050 732 1,054 17,192

Otherrevenues.................... 685 527 22 28 66 34 1,362

Net investment gains (losses) . . . . . . . . . . . (631) (598) 4 22 7 (154) (1,350)

Policyholder benefits and claims . . . . . . . . . 13,367 5,409 1,717 2,411 3,490 37 26,431

Interest credited to policyholder account

balances....................... 2,593 2,035 — 364 254 — 5,246

Policyholderdividends ............... — 1,697 6 (2) — — 1,701

Other expenses. . . . . . . . . . . . . . . . . . . . 2,314 3,519 845 1,543 1,227 1,349 10,797

Income (loss) from continuing operations

before provision (benefit) for income tax. . . 1,689 1,898 559 310 182 (417) 4,221

Provision (benefit) for income tax. . . . . . . . . 563 652 143 110 64 (416) 1,116

Income (loss) from discontinued operations,

netofincometax ................. 41 18 — — — 3,129 3,188

Cumulative effect of a change in accounting,

netofincometax ................. — — — — — — —

Netincome ...................... $ 1,167 $ 1,264 $ 416 $ 200 $ 118 $ 3,128 $ 6,293

Balance Sheet:

Total assets . . . . . . . . . . . . . . . . . . . . . . $190,963 $243,604 $5,467 $22,724 $18,818 $46,139 $527,715

DAC and VOBA . . . . . . . . . . . . . . . . . . . . $ 1,370 $ 13,996 $ 190 $ 2,130 $ 3,152 $ 13 $ 20,851

Goodwill ........................ $ 977 $ 2,957 $ 157 $ 301 $ 96 $ 409 $ 4,897

Separate account assets . . . . . . . . . . . . . . $ 47,047 $ 94,124 $ — $ 3,178 $ 16 $ — $144,365

Policyholder liabilities . . . . . . . . . . . . . . . . $113,205 $117,866 $3,453 $15,139 $13,332 $ 9,199 $272,194

Separate account liabilities . . . . . . . . . . . . $ 47,047 $ 94,124 $ — $ 3,178 $ 16 $ — $144,365

F-74 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)