MetLife 2006 Annual Report Download - page 34

Download and view the complete annual report

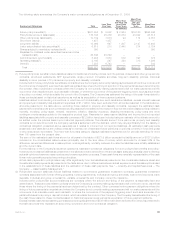

Please find page 34 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.rates and an increase in invested assets. Investment valuations and returns on invested assets in Chile are linked to the inflation rates.

South Korea and Taiwan’s net investment income increased by $20 million and $11 million, respectively, primarily due to an increase in their

invested assets. These increases in net investment income were partially offset by a decrease of $21 million due to the realignment of

economic capital. The remainder of the increases in total revenues, excluding net investment gains, can be attributed to business growth

and investment income in other countries.

Additionally, $221 million of the increase in total revenues, excluding net investment gains (losses), is due to changes in foreign

currency exchange rates.

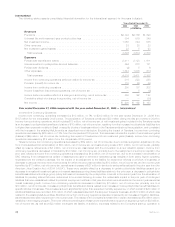

Expenses

Total expenses increased by $1,029 million, or 43%, to $3,411 million for the year ended December 31, 2005 from $2,382 million for

the comparable 2004 period. The acquisition of Travelers accounted for $404 million of this increase. Excluding the impact of the Travelers

acquisition, total expenses increased by $625 million, or 26%, over the comparable 2004 period. Policyholder benefits and claims,

policyholder dividends and interest credited to PABs increased by $451 million, or 26%, to $2,219 million for the year ended December 31,

2005 from $1,768 million for the comparable 2004 period.

Policyholder benefits and claims and dividends in Mexico increased by $177 million primarily due to an increase in certain policyholder

liabilities caused by unrealized investment gains (losses) on the invested assets supporting those liabilities of $110 million, as well as an

increase in interest credited to policyholder accounts of $65 million in line with the net investment income increase in Mexico. South Korea,

Taiwan and Brazil’s policyholder benefits and claims, policyholder dividends and interest credited to policyholder accounts increased by

$122 million, $41 million and $27 million, respectively, commensurate with the business growth discussed above. Chile’s policyholder

benefits and claims, policyholder dividends and interest credited to policyholder accounts increased by $86 million due to the business

growth primarily in the bank distribution channel business, as well as to an increase in the liabilities for annuity benefits, which, like net

investment income on related assets, are linked to the inflation rate. Hong Kong’s policyholder benefits and claims and policyholder

dividends increased by $3 million due to higher claims and the associated increase in liabilities in 2005. These increases were partially

offset by a decrease of $10 million in Canada’s policyholder benefits and claims, policyholder dividends and interest credited to PABs

primarily due to the strengthening of the liability on its pension business related to changes in mortality assumptions in the prior year.

Other expenses increased by $174 million, or 28%, to $788 million for the year ended December 31, 2005 from $614 million for the

comparable 2004 period. South Korea’s other expenses increased by $73 million primarily due to higher amortization of DAC driven by the

rapid growth in the business, a decrease in a payroll tax liability in the prior year resulting from the resolution of the related tax matter, an

accrual for an early retirement program in 2005, as well as additional overhead expenses in line with the growth in business. Mexico’s other

expenses increased by $17 million primarily due to incurred start up costs during the current year associated with the AFORE operations,

an increase in liabilities related to potential employment matters in 2005, an increase in consulting services and a decrease in the prior year

of severance accruals. Partially offsetting these increases in Mexico is a decrease in the amortization of DAC due to an adjustment for

management’s update of assumptions used to determine estimated gross margins. Brazil’s other expenses increased by $28 million,

primarily due to growth in business discussed above including an increase in non-deferrable sales expenses. Chile’s other expenses

increased by $24 million due primarily to increases in non-deferrable expenses for the bank distribution channel of business in 2005. Other

expenses at home office also increased by $26 million primarily due to increased consultant fees for growth initiative projects, an increase

in compensation resulting from increased headcount, higher incentive compensation, as well as higher costs for legal, marketing and other

corporate support expenses. The remainder of the increase in total expenses can be attributed to business growth in other countries.

Additionally, a component of the growth in total expenses is due to changes in foreign currency exchange rates of $202 million.

31MetLife, Inc.