MetLife 2006 Annual Report Download - page 106

Download and view the complete annual report

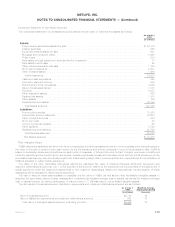

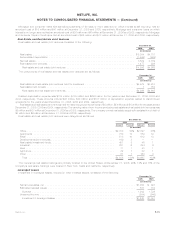

Please find page 106 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2. Acquisitions and Dispositions

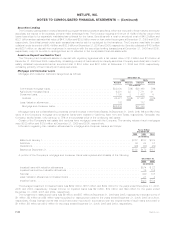

Travelers

On July 1, 2005, the Holding Company completed the acquisition of Travelers for $12.1 billion. The results of Travelers’ operations were

included in the Company’s financial statements beginning July 1, 2005. As a result of the acquisition, management of the Company

increased significantly the size and scale of the Company’s core insurance and annuity products and expanded the Company’s presence in

both the retirement & savings’ domestic and international markets. The distribution agreements executed with Citigroup as part of the

acquisition provide the Company with one of the broadest distribution networks in the industry. The initial consideration paid by the Holding

Company for the acquisition consisted of $10.9 billion in cash and 22,436,617 shares of the Holding Company’s common stock with a

market value of $1.0 billion to Citigroup and $100 million in other transaction costs. As described more fully below, additional consideration

of $115 million was paid by the Holding Company to Citigroup in 2006. In addition to cash on-hand, the purchase price was financed

through the issuance of common stock as described above, debt securities as described in Note 10, common equity units as described in

Note 12 and preferred stock as described in Note 17.

The acquisition was accounted for using the purchase method of accounting, which requires that the assets and liabilities of Travelers

be measured at their fair values as of July 1, 2005.

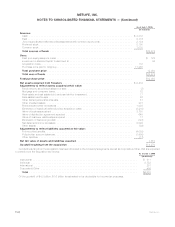

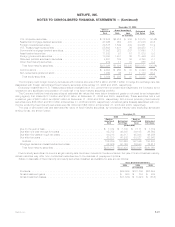

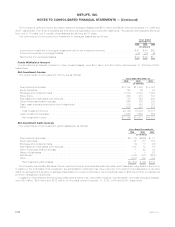

Final Purchase Price Allocation and Goodwill

The purchase price has been allocated to the assets acquired and liabilities assumed using management’s best estimate of their fair

values as of the acquisition date. The computation of the purchase price and the allocation of the purchase price to the net assets acquired

based upon their respective fair values as of July 1, 2005, and the resulting goodwill, as revised, are presented below.

The Company revised the purchase price as a result of the finalization by both parties of their review of the June 30, 2005 financial

statements and final resolution as to the interpretation of the provisions of the acquisition agreement which resulted in a payment of

additional consideration of $115 million by the Company to Citigroup. Further consideration paid to Citigroup of $115 million, as well as

additional transaction costs of $3 million, offset by a $4 million reduction in restructuring costs, resulted in a total increase in the purchase

price of $114 million.

The purchase price allocation was updated as a result of the additional consideration of $114 million, an increase of $20 million in the

value of the future policy benefit liabilities and other policyholder funds acquired resulting from the finalization of the evaluation of the

Travelers’ underwriting criteria, an increase in equity securities of $24 million resulting from the finalization of the determination of the fair

value of such securities, a decrease in current income tax payables of $21 million resulting from a decree by the Argentine Government

regarding the taxability of pesification-related gains, a decrease in other assets and an increase in other liabilities of $1 million and

$4 million, respectively, due to the receipt of additional information and the reduction in restructuring costs, and the net impact of

aforementioned adjustments increasing deferred income tax assets by $1 million. Goodwill increased by $93 million as a consequence of

such revisions to the purchase price and the purchase price allocation.

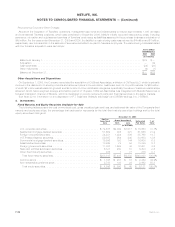

F-23MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)