MetLife 2006 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

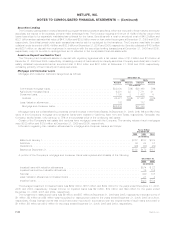

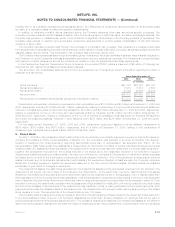

7. Insurance

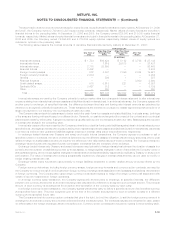

Value of Distribution Agreements and Customer Relationships Acquired

Information regarding the value of distribution agreements (“VODA”) and the value of customer relationships acquired (“VOCRA”), which

are reported in other assets, is as follows:

2006 2005 2004

Years Ended

December 31,

(In millions)

BalanceatJanuary1,...................................................... $715 $ — $—

Acquisitions ............................................................ — 716 —

Amortization ............................................................ (6) (1) —

Less:Dispositionsandother,net............................................... (1) — —

BalanceatDecember31, ................................................... $708 $715 $—

The estimated future amortization expense allocated to other expenses for the next five years for VODA and VOCRA is $15 million in

2007, $21 million in 2008, $27 million in 2009, $32 million in 2010 and $27 million in 2011.

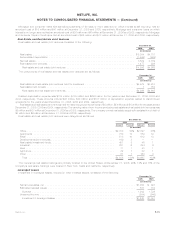

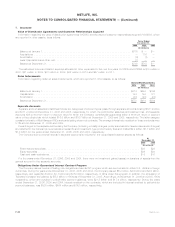

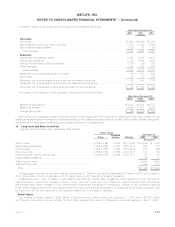

Sales Inducements

Information regarding deferred sales inducements, which are reported in other assets, is as follows:

2006 2005 2004

Years Ended December 31,

(In millions)

BalanceatJanuary1, ..................................................... $414 $294 $196

Capitalization........................................................... 194 140 121

Amortization ........................................................... (30) (20) (23)

BalanceatDecember31,................................................... $578 $414 $294

Separate Accounts

Separate account assets and liabilities include two categories of account types: pass-through separate accounts totaling $127.9 billion

and $111.2 billion at December 31, 2006 and 2005, respectively, for which the policyholder assumes all investment risk, and separate

accounts with a minimum return or account value for which the Company contractually guarantees either a minimum return or account

value to the policyholder which totaled $16.5 billion and $16.7 billion at December 31, 2006 and 2005, respectively. The latter category

consisted primarily of Met Managed GICs and participating close-out contracts. The average interest rate credited on these contracts were

5.1% at both December 31, 2006 and 2005.

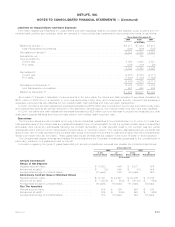

Fees charged to the separate accounts by the Company (including mortality charges, policy administration fees and surrender charges)

are reflected in the Company’s revenues as universal life and investment-type product policy fees and totaled $2.4 billion, $1.7 billion and

$1.3 billion for the years ended December 31, 2006, 2005 and 2004, respectively.

The Company’s proportional interest in separate accounts is included in the consolidated balance sheets as follows:

2006 2005

At

December 31,

(In millions)

Fixedmaturitysecurities.......................................................... $30 $29

Equitysecurities............................................................... $36 $34

Cashandcashequivalents........................................................ $ 5 $ 6

For the years ended December 31, 2006, 2005 and 2004, there were no investment gains (losses) on transfers of assets from the

general account to the separate accounts.

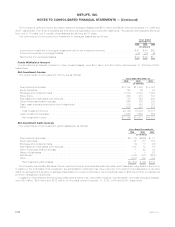

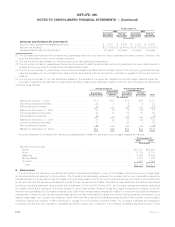

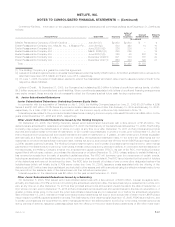

Obligations Under Guaranteed Interest Contract Program

The Company issues fixed and floating rate obligations under its GIC program which are denominated in either U.S. dollars or foreign

currencies. During the years ended December 31, 2006, 2005 and 2004, the Company issued $5.2 billion, $4.0 billion and $4.0 billion,

respectively, and repaid $2.6 billion, $1.1 billion and $150 million, respectively, of GICs under this program. In addition, the acquisition of

Travelers increased the balance by $5.3 billion in GICs as of December 31, 2005. Accordingly, at December 31, 2006 and 2005, GICs

outstanding, which are included in policyholder account balances, were $21.5 billion and $17.4 billion, respectively. During the years

ended December 31, 2006, 2005 and 2004, interest credited on the contracts, which are included in interest credited to policyholder

account balances, was $835 million, $464 million and $142 million, respectively.

F-40 MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)