MetLife 2006 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

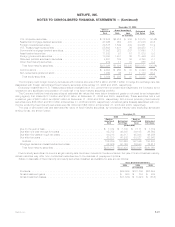

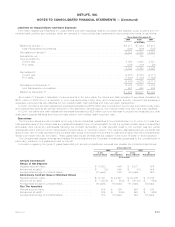

Mortgage and consumer loans with scheduled payments of 90 days or more past due on which interest is still accruing, had an

amortized cost of $15 million and $41 million at December 31, 2006 and 2005, respectively. Mortgage and consumer loans on which

interest is no longer accrued had an amortized cost of $36 million and $6 million at December 31, 2006 and 2005, respectively. Mortgage

and consumer loans in foreclosure had an amortized cost of $35 million and $13 million at December 31, 2006 and 2005, respectively.

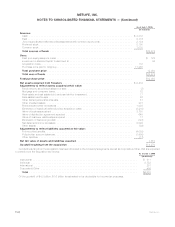

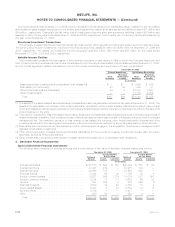

Real Estate and Real Estate Joint Ventures

Real estate and real estate joint ventures consisted of the following:

2006 2005

December 31,

(In millions)

Realestate ............................................................... $5,004 $4,707

Accumulateddepreciation ..................................................... (1,495) (968)

Netrealestate............................................................. 3,509 3,739

Realestatejointventures...................................................... 1,477 926

Realestateandrealestatejointventures .......................................... $4,986 $4,665

The components of real estate and real estate joint ventures are as follows:

2006 2005

December 31,

(In millions)

Realestateandrealestatejointventuresheld-for-investment ............................... $4,979 $3,910

Realestateheld-for-sale....................................................... 7 755

Realestateandrealestatejointventures........................................... $4,986 $4,665

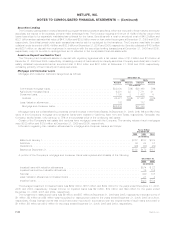

Related depreciation expense was $158 million, $185 million and $286 million for the years ended December 31, 2006, 2005 and

2004, respectively. These amounts include $26 million, $50 million and $107 million of depreciation expense related to discontinued

operations for the years ended December 31, 2006, 2005 and 2004, respectively.

Real estate and real estate joint ventures held-for-sale recognized impairments of $8 million, $5 million and $13 million for the years ended

December 31, 2006, 2005 and 2004, respectively. The carrying value of non-income producing real estate and real estate joint ventures was

$8 million and $37 million at December 31, 2006 and 2005, respectively. The company owned real estate acquired in satisfaction of debt of

$3 million and $4 million at December 31, 2006 and 2005, respectively.

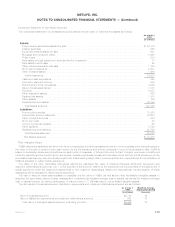

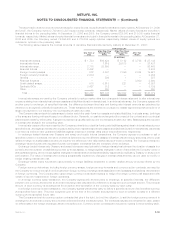

Real estate and real estate joint ventures were categorized as follows:

Amount Percent Amount Percent

2006 2005

December 31,

(In millions)

Office...................................................... $2,709 55% $2,597 56%

Apartments .................................................. 739 15 889 19

Retail ...................................................... 513 10 612 13

Developmentaljointventures....................................... 169 3 — —

Realestateinvestmentfunds....................................... 401 8 45 1

Industrial.................................................... 291 6 284 6

Land....................................................... 71 1 43 1

Agriculture................................................... 32 1 32 1

Other ...................................................... 61 1 163 3

Total ..................................................... $4,986 100% $4,665 100%

The Company’s real estate holdings are primarily located in the United States. At December 31, 2006, 26%, 15% and 15% of the

Company’s real estate holdings were located in New York, Texas and California, respectively.

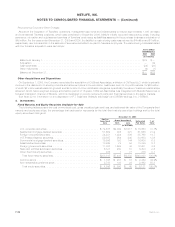

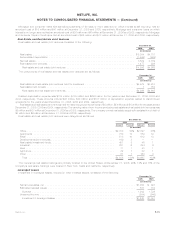

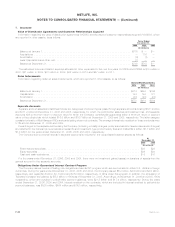

Leveraged Leases

Investment in leveraged leases, included in other invested assets, consisted of the following:

2006 2005

December 31,

(In millions)

Rentalreceivables,net........................................................ $1,055 $ 991

Estimatedresidualvalues ...................................................... 887 735

Subtotal................................................................ 1,942 1,726

Unearnedincome ........................................................... (694) (645)

Investmentinleveragedleases ................................................. $1,248 $1,081

F-31MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)