MetLife 2006 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

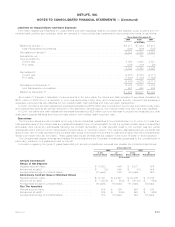

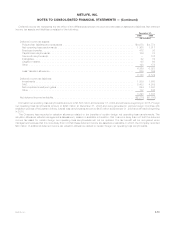

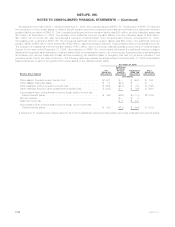

Deferred income tax represents the tax effect of the differences between the book and tax basis of assets and liabilities. Net deferred

income tax assets and liabilities consisted of the following:

2006 2005

December 31,

(In millions)

Deferred income tax assets:

Policyholderliabilitiesandreceivables............................................ $4,078 $4,774

Netoperatinglosscarryforwards ............................................... 1,368 1,017

Employeebenefits......................................................... 472 36

Capitallosscarryforwards.................................................... 156 75

Taxcreditcarryforwards..................................................... — 102

Intangibles.............................................................. 22 82

Litigation-related.......................................................... 65 64

Other................................................................. 198 178

6,359 6,328

Less:Valuationallowance.................................................... 239 199

6,120 6,129

Deferred income tax liabilities:

Investments............................................................. 1,839 1,563

DAC.................................................................. 5,433 4,989

Netunrealizedinvestmentgains................................................ 994 1,041

Other................................................................. 132 242

8,398 7,835

Netdeferredincometaxliability.................................................. $(2,278) $(1,706)

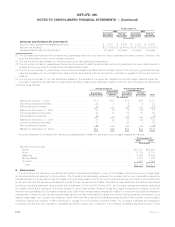

Domestic net operating loss carryforwards amount to $3,508 million at December 31, 2006 and will expire beginning in 2015. Foreign

net operating loss carryforwards amount to $493 million at December 31, 2006 and were generated in various foreign countries with

expiration periods of five years to infinity. Capital loss carryforwards amount to $447 million at December 31, 2006 and will expire beginning

in 2010.

The Company has recorded a valuation allowance related to tax benefits of certain foreign net operating loss carryforwards. The

valuation allowance reflects management’s assessment, based on available information, that it is more likely than not that the deferred

income tax asset for certain foreign net operating loss carryforwards will not be realized. The tax benefit will be recognized when

management believes that it is more likely than not that these deferred income tax assets are realizable. In 2006, the Company recorded

$40 million of additional deferred income tax valuation allowance related to certain foreign net operating loss carryforwards.

F-51MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)