MetLife 2006 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.agreements with the FHLB of NY was $998 million and $855 million at December 31, 2006 and 2005, respectively, which is included in

long-term debt.

Metropolitan Life is a member of the FHLB of NY and holds $136 million of common stock of the FHLB of NY, which is included in equity

securities on the Company’s consolidated balance sheet. Metropolitan Life had no funding agreements with the FHLB of NY at

December 31, 2006 or 2005.

On December 12, 2005, RGA repurchased 1.6 million shares of its outstanding common stock at an aggregate price of $76 million

under an accelerated share repurchase agreement with a major bank. The bank borrowed the stock sold to RGA from third parties and

purchased the shares in the open market over the subsequent few months to return to the lenders. RGA would either pay or receive an

amount based on the actual amount paid by the bank to purchase the shares. These repurchases resulted in an increase in the Company’s

ownership percentage of RGA to approximately 53% at December 31, 2005 from approximately 52% at December 31, 2004. In February

2006, the final purchase price was determined, resulting in a cash settlement substantially equal to the aggregate cost. RGA recorded the

initial repurchase of shares as treasury stock and recorded the amount received as an adjustment to the cost of the treasury stock. At

December 31, 2006, the Company’s ownership was approximately 53% of RGA.

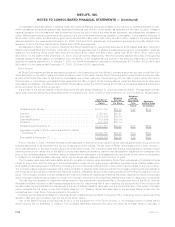

Guarantees

In the normal course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties

pursuant to which it may be required to make payments now or in the future. In the context of acquisition, disposition, investment and other

transactions, the Company has provided indemnities and guarantees, including those related to tax, environmental and other specific

liabilities, and other indemnities and guarantees that are triggered by, among other things, breaches of representations, warranties or

covenants provided by the Company. In addition, in the normal course of business, the Company provides indemnifications to counter-

parties in contracts with triggers similar to the foregoing, as well as for certain other liabilities, such as third party lawsuits. These

obligations are often subject to time limitations that vary in duration, including contractual limitations and those that arise by operation of

law, such as applicable statutes of limitation. In some cases, the maximum potential obligation under the indemnities and guarantees is

subject to a contractual limitation ranging from less than $1 million to $2 billion, with a cumulative maximum of $3.6 billion, while in other

cases such limitations are not specified or applicable. Since certain of these obligations are not subject to limitations, the Company does

not believe that it is possible to determine the maximum potential amount that could become due under these guarantees in the future.

In addition, the Company indemnifies its directors and officers as provided in its charters and by-laws. Also, the Company indemnifies

its agents for liabilities incurred as a result of their representation of the Company’s interests. Since these indemnities are generally not

subject to limitation with respect to duration or amount, the Company does not believe that it is possible to determine the maximum

potential amount that could become due under these indemnities in the future.

The Company has also guaranteed minimum investment returns on certain international retirement funds in accordance with local laws.

Since these guarantees are not subject to limitation with respect to duration or amount, the Company does not believe that it is possible to

determine the maximum potential amount that could become due under these guarantees in the future.

During the year ended December 31, 2006, the Company did not record any additional liabilities for indemnities, guarantees and

commitments. In the fourth quarter of 2006, the Company eliminated $4 million of a liability that was previously recorded with respect to

indemnities provided in connection with a certain disposition. The Company’s recorded liabilities at December 31, 2006 and 2005 for

indemnities, guarantees and commitments were $5 million and $9 million, respectively.

In connection with synthetically created investment transactions, the Company writes credit default swap obligations requiring payment

of principal due in exchange for the referenced credit obligation, depending on the nature or occurrence of specified credit events for the

referenced entities. In the event of a specified credit event, the Company’s maximum amount at risk, assuming the value of the referenced

credits becomes worthless, was $396 million at December 31, 2006. The credit default swaps expire at various times during the next ten

years.

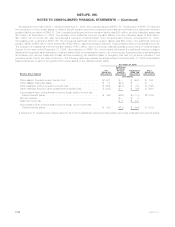

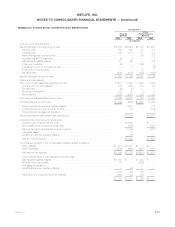

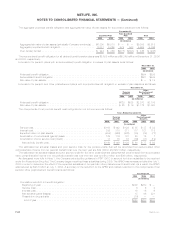

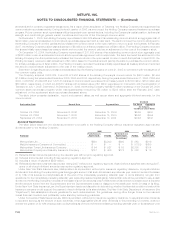

16. Employee Benefit Plans

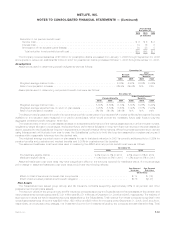

Pension and Other Postretirement Benefit Plans

The Subsidiaries sponsor and/or administer various qualified and non-qualified defined benefit pension plans and other postretirement

employee benefit plans covering eligible employees and sales representatives who meet specified eligibility requirements. Pension benefits

are provided utilizing either a traditional formula or cash balance formula. The traditional formula provides benefits based upon years of

credited service and either final average or career average earnings. The cash balance formula utilizes hypothetical or notional accounts

which credit participants with benefits equal to a percentage of eligible pay as well as earnings credits, determined annually based upon

the average annual rate of interest on 30-year U.S. Treasury securities, for each account balance. As of December 31, 2006, virtually all of

the Subsidiaries’ obligations have been calculated using the traditional formula. The non-qualified pension plans provide supplemental

benefits, in excess of amounts permitted by governmental agencies, to certain executive level employees.

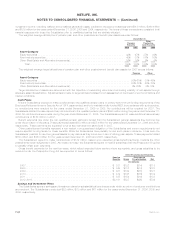

The Subsidiaries also provide certain postemployment benefits and certain postretirement health and life insurance benefits for retired

employees. Employees of the Subsidiaries who were hired prior to 2003 (or, in certain cases, rehired during or after 2003) and meet age

and service criteria while working for one of the Subsidiaries, may become eligible for these other postretirement benefits, at various levels,

in accordance with the applicable plans. Virtually all retirees, or their beneficiaries, contribute a portion of the total cost of postretirement

medical benefits. Employees hired after 2003 are not eligible for any employer subsidy for postretirement medical benefits.

In connection with the acquisition of Travelers, the employees of Travelers and any other Citigroup affiliate in the United States who

became employees of certain Subsidiaries in connection with that acquisition (including those who remained employees of companies

acquired in that acquisition) will be credited with service recognized by Citigroup for purposes of determining eligibility and vesting under

the Plan with respect to benefits earned under the Plan subsequent to the closing date of the acquisition. Neither the Holding Company nor

its subsidiaries assumed an obligation for benefits earned under defined benefit plans of Citigroup or Travelers prior to the acquisition.

F-59MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)