MetLife 2006 Annual Report Download - page 150

Download and view the complete annual report

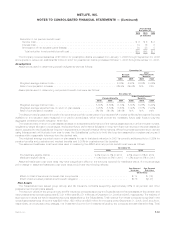

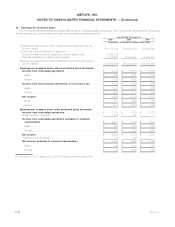

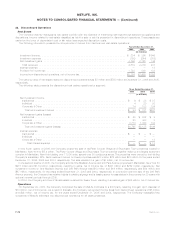

Please find page 150 of the 2006 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.gain from operations for the immediately preceding calendar year. MICC will be permitted to pay a cash dividend in excess of the greater of

such two amounts only if it files notice of its declaration of such a dividend and the amount thereof with the Connecticut Commissioner of

Insurance (“Commissioner”) and the Commissioner does not disapprove the payment within 30 days after notice. In addition, any dividend

that exceeds earned surplus (unassigned funds, reduced by 25% of unrealized appreciation in value or revaluation of assets or unrealized

profits on investments) as of the last filed annual statutory statement requires insurance regulatory approval. Under Connecticut State

Insurance Law, the Commissioner has broad discretion in determining whether the financial condition of a stock life insurance company

would support the payment of such dividends to its shareholders. The Connecticut State Insurance Law requires prior approval for any

dividends for a period of two years following a change in control. As a result of the acquisition of MICC by the Holding Company on July 1,

2005, under Connecticut State Insurance Law, all dividend payments by MICC through June 30, 2007 require prior approval of the

Commissioner.

Under Rhode Island State Insurance Law, MPC is permitted, without prior insurance regulatory clearance, to pay a stockholder dividend

to the Holding Company as long as the aggregate amount of all such dividends in any twelve-month period does not exceed the lesser of:

(i) 10% of its surplus to policyholders as of the end of the immediately preceding calendar year; or (ii) net income, not including realized

capital gains, for the immediately preceding calendar year. MPC will be permitted to pay a cash dividend to the Holding Company in excess

of the lesser of such two amounts only if it files notice of its intention to declare such a dividend and the amount thereof with the Rhode

Island Commissioner of Insurance (the “Rhode Island Commissioner”) and the Rhode Island Commissioner does not disapprove the

distribution within 30 days of its filing. Under Rhode Island State Insurance Code, the Rhode Island Commissioner has broad discretion in

determining whether the financial condition of a stock property and casualty insurance company would support the payment of such

dividends to its shareholders.

Under Delaware State Insurance Law, Metropolitan Tower Life Insurance Company (“MTL”) is permitted, without prior insurance

regulatory clearance, to pay a stockholder dividend to the Holding Company as long as the amount of the dividend when aggregated with

all other dividends in the preceding 12 months does not exceed the greater of: (i) 10% of its surplus to policyholders as of the end of the

immediately preceding calendar year; or (ii) its statutory net gain from operations for the immediately preceding calendar year (excluding

realized capital gains). MTL will be permitted to pay a cash dividend to the Holding Company in excess of the greater of such two amounts

only if it files notice of the declaration of such a dividend and the amount thereof with the Delaware Commissioner of Insurance (the

“Delaware Commissioner”) and the Delaware Commissioner does not disapprove the distribution within 30 days of its filing. In addition, any

dividend that exceeds earned surplus (defined as unassigned funds) as of the last filed annual statutory statement requires insurance

regulatory approval. Under Delaware State Insurance Law, the Delaware Commissioner has broad discretion in determining whether the

financial condition of a stock life insurance company would support the payment of such dividends to its shareholders.

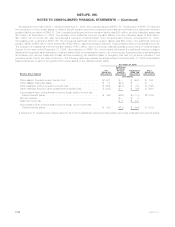

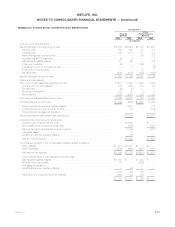

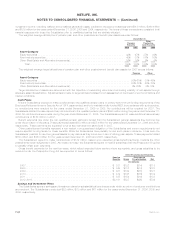

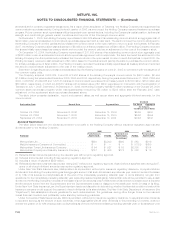

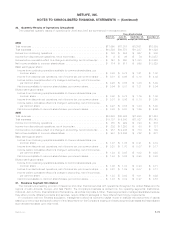

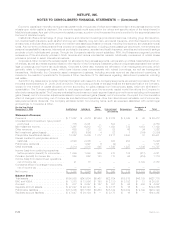

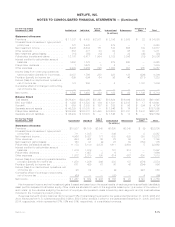

Stock-BasedCompensationPlans

Overview

As described more fully in Note 1, effective January 1, 2006, the Company adopted SFAS 123(r) using the modified prospective

transition method. The adoption of SFAS 123(r) did not have a significant impact on the Company’s consolidated financial position or

consolidated results of operations.

Description of Plans

The MetLife, Inc. 2000 Stock Incentive Plan, as amended (the “Stock Incentive Plan”), authorized the granting of awards in the form of

options to buy shares of Holding Company common stock (“Stock Options”) that either qualify as incentive Stock Options under

Section 422A of the Internal Revenue Code or are non-qualified. The MetLife, Inc. 2000 Directors Stock Plan, as amended (the “Directors

Stock Plan”), authorized the granting of awards in the form of Performance Share awards, non-qualified Stock Options, or a combination of

the foregoing to outside Directors of the Holding Company. Under the MetLife, Inc. 2005 Stock and Incentive Compensation Plan, as

amended (the “2005 Stock Plan”), awards granted may be in the form of Stock Options, Stock Appreciation Rights, Restricted Stock or

Restricted Stock Units, Performance Shares or Performance Share Units, Cash-Based Awards, and Stock-Based Awards (each as defined

in the 2005 Stock Plan). Under the MetLife, Inc. 2005 Non-Management Director Stock Compensation Plan (the “2005 Directors Stock

Plan”), awards granted may be in the form of non-qualified Stock Options, Stock Appreciation Rights, Restricted Stock or Restricted Stock

Units, or Stock-Based Awards (each as defined in the 2005 Directors Stock Plan). The Stock Incentive Plan, Directors Stock Plan, 2005

Stock Plan, the 2005 Directors Stock Plan and the LTPCP, as described below, are hereinafter collectively referred to as the “Incentive

Plans.”

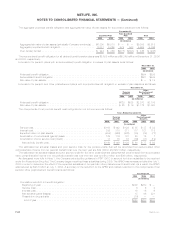

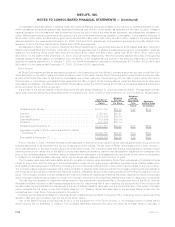

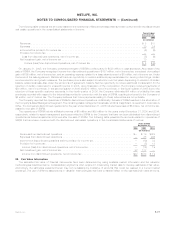

The aggregate number of shares reserved for issuance under the 2005 Stock Plan and the LTPCP is 68,000,000, plus those shares

available but not utilized under the Stock Incentive Plan and those shares utilized under the Stock Incentive Plan that are recovered due to

forfeiture of Stock Options. Additional shares carried forward from the Stock Incentive Plan and available for issuance under the 2005

Stock Plan were 12,423,881 as of December 31, 2006. There were no shares carried forward from the Directors Stock Plan. Each share

issued under the 2005 Stock Plan in connection with a Stock Option or Stock Appreciation Right reduces the number of shares remaining

for issuance under that plan by one, and each share issued under the 2005 Stock Plan in connection with awards other than Stock Options

or Stock Appreciation Rights reduces the number of shares remaining for issuance under that plan by 1.179 shares. The number of shares

reserved for issuance under the 2005 Directors Stock Plan are 2,000,000. As of December 31, 2006, the aggregate number of shares

remaining available for issuance pursuant to the 2005 Stock Plan and the 2005 Directors Stock Plan were 66,712,241 and 1,941,734,

respectively.

Stock Option exercises and other stock-based awards to employees settled in shares are satisfied through the issuance of shares held

in treasury by the Company. Under the current authorized share repurchase program, as described above, sufficient treasury shares exist

to satisfy foreseeable obligations under the Incentive Plans.

F-67MetLife, Inc.

METLIFE, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)